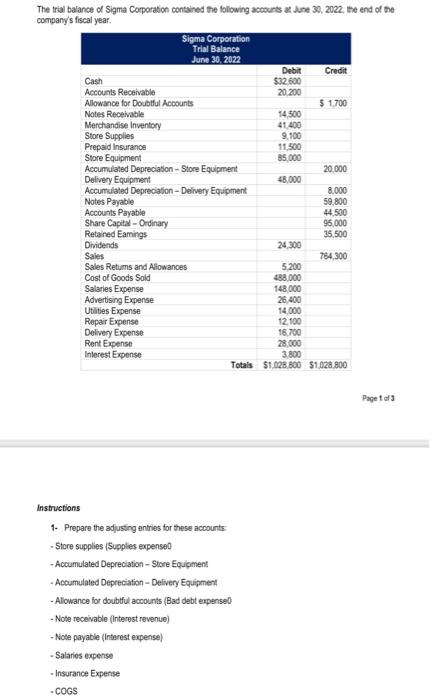

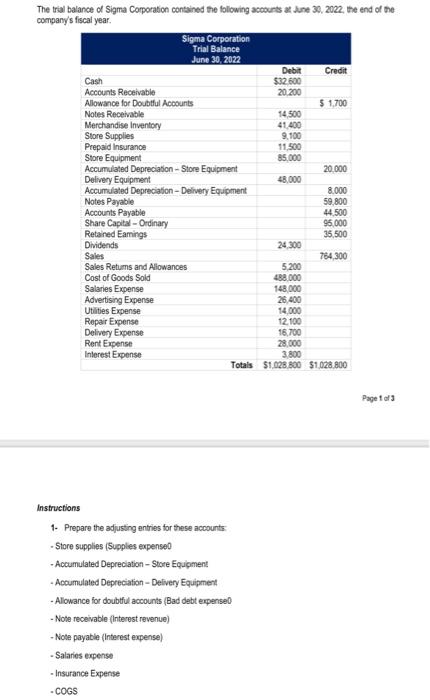

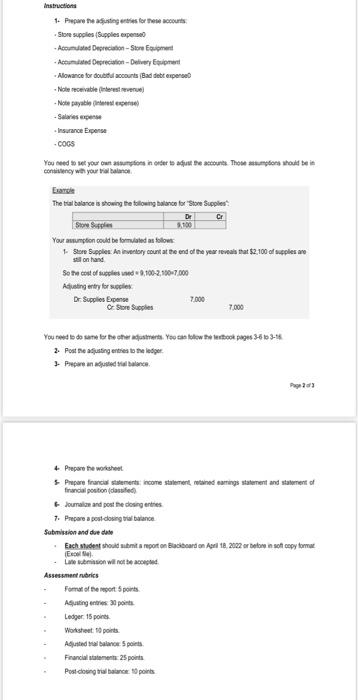

The trial balance of Sigma Corporation contained the following accounts at June 30, 2022, the end of the company's fiscal year Sigma Corporation Trial Balance June 30, 2022 Debit Credit Cash $32.600 Accounts Receivable 20.200 Allowance for Doubtful Accounts $ 1,700 Notes Receivable 14 500 Merchandise Inventory 41.400 Store Supplies 9.100 Prepaid Insurance 11 500 Store Equipment 85.000 Accumulated Depreciation - Store Equipment 20.000 Delivery Equipment 48,000 Accumulated Depreciation - Delivery Equipment 8.000 Notes Payable 59 800 Accounts Payable 44.500 Share Capital - Ordinary 95.000 Retained Eamings 35,500 Dividends 24.300 Sales 784,300 Sales Retums and Allowances 5.200 Cost of Goods Sold 488.000 Salaries Expense 148,000 Advertising Expense 26.400 Utilities Expense 14.000 Repair Expense 12.100 Delivery Expense 16,700 Rent Expense 28.000 Interest Expense 3.800 Totals $1.028 800 $1028 800 Page 1 of 3 Instructions 1. Prepare the adjusting entries for these accounts Store supplies (Supplies expense Accumulated Depreciation - Store Equipment Accumulated Depreciation - Delivery Equipment - Allowance for doubtful accounts (Bad debt expensel - Note receivable Interest revenue) - Note payable (Interest expense) - Salaries expense - Insurance Expense -COGS The trial balance of Sigma Corporation contained the following accounts at June 30, 2022, the end of the company's fiscal year Sigma Corporation Trial Balance June 30, 2022 Debit Credit Cash $32.600 Accounts Receivable 20.200 Allowance for Doubtful Accounts $ 1,700 Notes Receivable 14 500 Merchandise Inventory 41.400 Store Supplies 9.100 Prepaid Insurance 11 500 Store Equipment 85.000 Accumulated Depreciation - Store Equipment 20.000 Delivery Equipment 48,000 Accumulated Depreciation - Delivery Equipment 8.000 Notes Payable 59 800 Accounts Payable 44.500 Share Capital - Ordinary 95.000 Retained Eamings 35,500 Dividends 24.300 Sales 784,300 Sales Retums and Allowances 5.200 Cost of Goods Sold 488.000 Salaries Expense 148,000 Advertising Expense 26.400 Utilities Expense 14.000 Repair Expense 12.100 Delivery Expense 16,700 Rent Expense 28.000 Interest Expense 3.800 Totals $1.028 800 $1028 800 Page 1 of 3 Instructions 1. Prepare the adjusting entries for these accounts Store supplies (Supplies expense Accumulated Depreciation - Store Equipment Accumulated Depreciation - Delivery Equipment - Allowance for doubtful accounts (Bad debt expensel - Note receivable Interest revenue) - Note payable (Interest expense) - Salaries expense - Insurance Expense -COGS Instructions 1. Prepare the streets Store Supplies (Supples expense - Acomod Depreciation - Store Acumstad Depreciation Deliveryone Allowance for counts (Bad debt expense Nole recevable (Interest revenue - Notepayable de Insurance Expense COGS You need to let your count asuntom in order to adjust the secounts Thomsumber thout bein consistency with your belo Earl The total balance is showing the following balance for Store Supplies Sio Splet 100 Youtsumtion could be formed as follows 1-Store Supplies An inventory count at the end of the years that $2.100 suples are son and So the cost of us 100-2.100-7000 Adjusting entry for sale Dr. Supplies Epen 7.000 Or Store Supplies 7.000 You need to do some other users. You can folow the took page 36103-16 2. Post se justing enties to the lodge Page - Prepare the worksheet Prepare financial statements come statement, and a statement and soment of francial position assified Journal and post the doorgentes 7. Prepare a pol doing bande Submission and due date Each student should be a part on Blackboard on April 18, 2002 or before in soft copy forme Erol Late submission will not be cop Assessment bris Format of the sport Sports Austing ettes 3 points Ledger 15 points Worksheet points Adjusted sa balance Sports Francia 25 points Post contracepoints The trial balance of Sigma Corporation contained the following accounts at June 30, 2022, the end of the company's fiscal year Sigma Corporation Trial Balance June 30, 2022 Debit Credit Cash $32.600 Accounts Receivable 20.200 Allowance for Doubtful Accounts $ 1,700 Notes Receivable 14 500 Merchandise Inventory 41.400 Store Supplies 9.100 Prepaid Insurance 11 500 Store Equipment 85.000 Accumulated Depreciation - Store Equipment 20.000 Delivery Equipment 48,000 Accumulated Depreciation - Delivery Equipment 8.000 Notes Payable 59 800 Accounts Payable 44.500 Share Capital - Ordinary 95.000 Retained Eamings 35,500 Dividends 24.300 Sales 784,300 Sales Retums and Allowances 5.200 Cost of Goods Sold 488.000 Salaries Expense 148,000 Advertising Expense 26.400 Utilities Expense 14.000 Repair Expense 12.100 Delivery Expense 16,700 Rent Expense 28.000 Interest Expense 3.800 Totals $1.028 800 $1028 800 Page 1 of 3 Instructions 1. Prepare the adjusting entries for these accounts Store supplies (Supplies expense Accumulated Depreciation - Store Equipment Accumulated Depreciation - Delivery Equipment - Allowance for doubtful accounts (Bad debt expensel - Note receivable Interest revenue) - Note payable (Interest expense) - Salaries expense - Insurance Expense -COGS The trial balance of Sigma Corporation contained the following accounts at June 30, 2022, the end of the company's fiscal year Sigma Corporation Trial Balance June 30, 2022 Debit Credit Cash $32.600 Accounts Receivable 20.200 Allowance for Doubtful Accounts $ 1,700 Notes Receivable 14 500 Merchandise Inventory 41.400 Store Supplies 9.100 Prepaid Insurance 11 500 Store Equipment 85.000 Accumulated Depreciation - Store Equipment 20.000 Delivery Equipment 48,000 Accumulated Depreciation - Delivery Equipment 8.000 Notes Payable 59 800 Accounts Payable 44.500 Share Capital - Ordinary 95.000 Retained Eamings 35,500 Dividends 24.300 Sales 784,300 Sales Retums and Allowances 5.200 Cost of Goods Sold 488.000 Salaries Expense 148,000 Advertising Expense 26.400 Utilities Expense 14.000 Repair Expense 12.100 Delivery Expense 16,700 Rent Expense 28.000 Interest Expense 3.800 Totals $1.028 800 $1028 800 Page 1 of 3 Instructions 1. Prepare the adjusting entries for these accounts Store supplies (Supplies expense Accumulated Depreciation - Store Equipment Accumulated Depreciation - Delivery Equipment - Allowance for doubtful accounts (Bad debt expensel - Note receivable Interest revenue) - Note payable (Interest expense) - Salaries expense - Insurance Expense -COGS Instructions 1. Prepare the streets Store Supplies (Supples expense - Acomod Depreciation - Store Acumstad Depreciation Deliveryone Allowance for counts (Bad debt expense Nole recevable (Interest revenue - Notepayable de Insurance Expense COGS You need to let your count asuntom in order to adjust the secounts Thomsumber thout bein consistency with your belo Earl The total balance is showing the following balance for Store Supplies Sio Splet 100 Youtsumtion could be formed as follows 1-Store Supplies An inventory count at the end of the years that $2.100 suples are son and So the cost of us 100-2.100-7000 Adjusting entry for sale Dr. Supplies Epen 7.000 Or Store Supplies 7.000 You need to do some other users. You can folow the took page 36103-16 2. Post se justing enties to the lodge Page - Prepare the worksheet Prepare financial statements come statement, and a statement and soment of francial position assified Journal and post the doorgentes 7. Prepare a pol doing bande Submission and due date Each student should be a part on Blackboard on April 18, 2002 or before in soft copy forme Erol Late submission will not be cop Assessment bris Format of the sport Sports Austing ettes 3 points Ledger 15 points Worksheet points Adjusted sa balance Sports Francia 25 points Post contracepoints