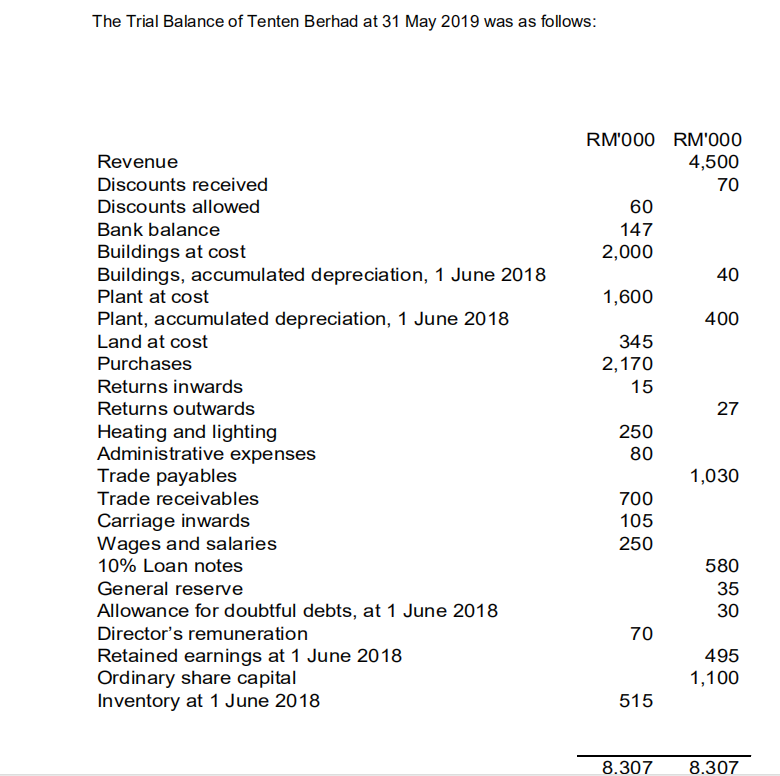

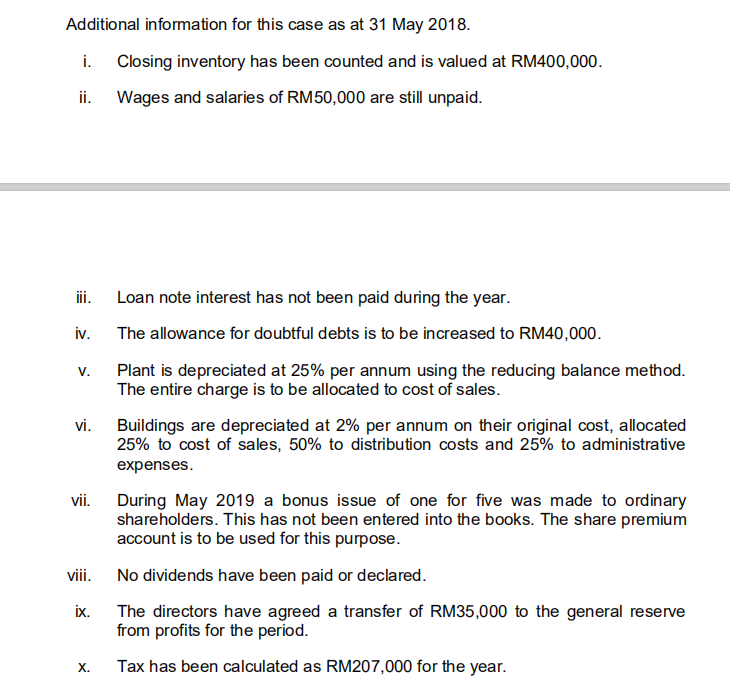

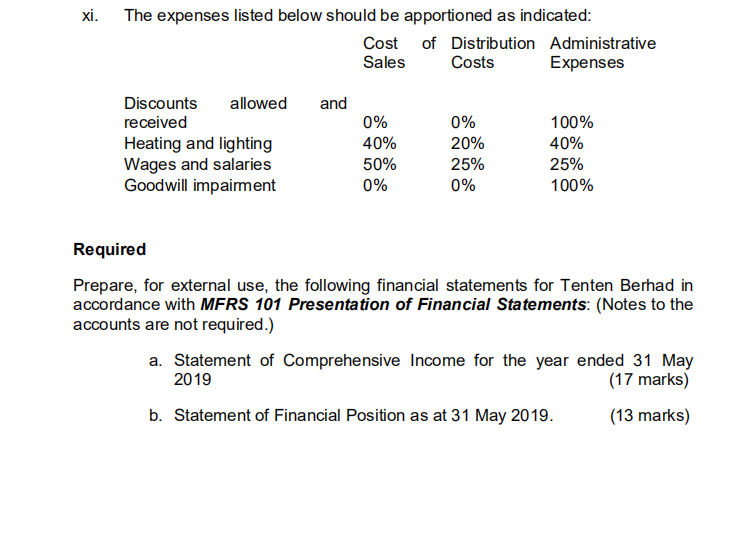

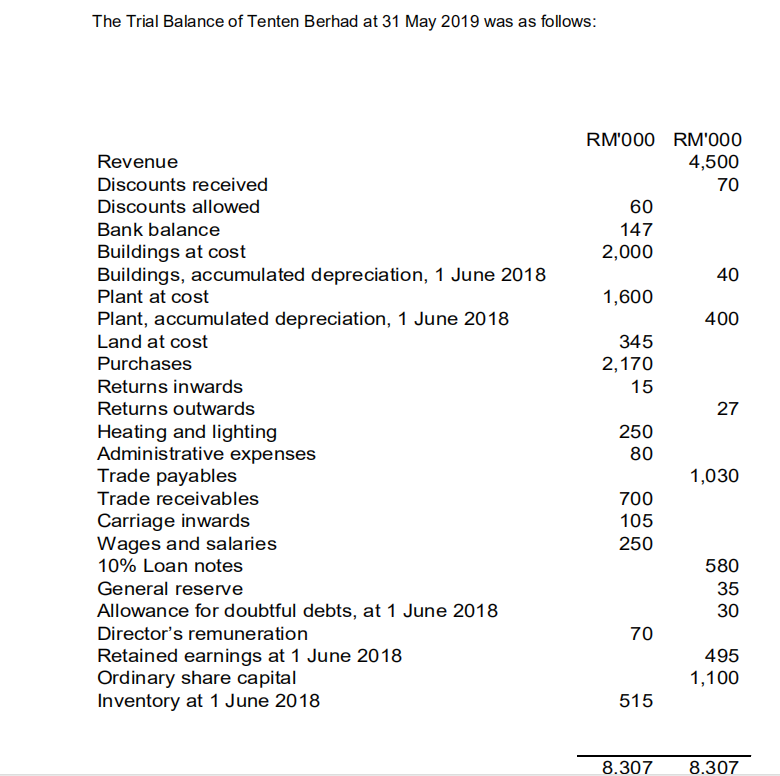

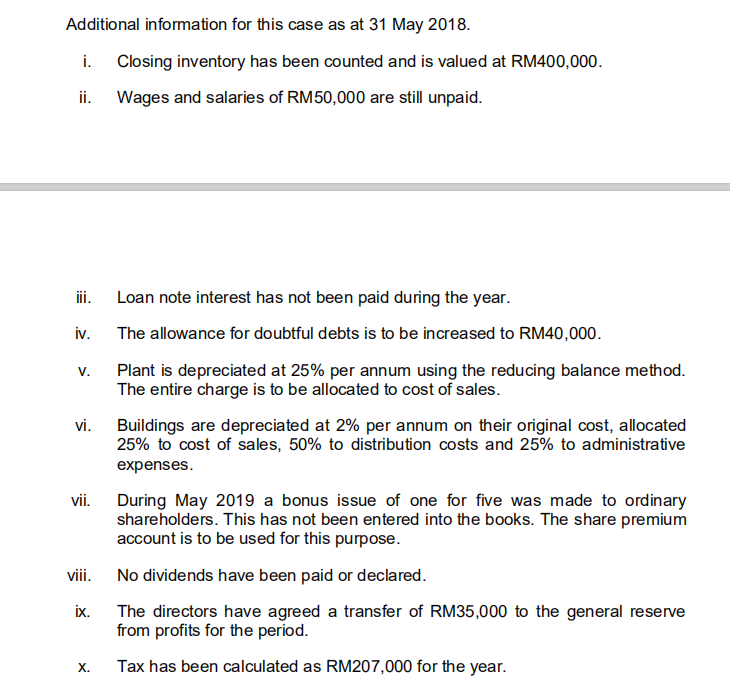

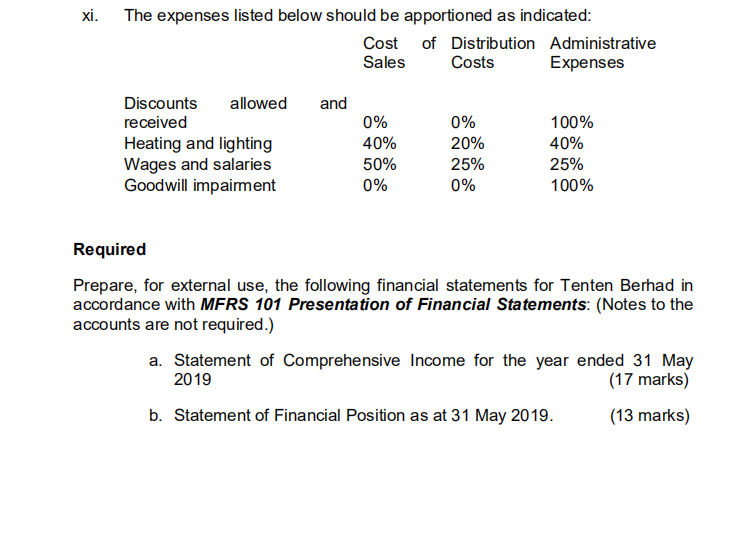

The Trial Balance of Tenten Berhad at 31 May 2019 was as follows: RM'O00 RM'000 4,500 70 60 147 2,000 40 1,600 345 2,170 15 Revenue Discounts received Discounts allowed Bank balance Buildings at cost Buildings, accumulated depreciation, 1 June 2018 Plant at cost Plant, accumulated depreciation, 1 June 2018 Land at cost Purchases Returns inwards Returns outwards Heating and lighting Administrative expenses Trade payables Trade receivables Carriage inwards Wages and salaries 10% Loan notes General reserve Allowance for doubtful debts, at 1 June 2018 Director's remuneration Retained earnings at 1 June 2018 Ordinary share capital Inventory at 1 June 2018 250 80 1,030 700 105 250 580 35 30 495 1,100 515 8.307 8.307 Additional information for this case as at 31 May 2018. i. Closing inventory has been counted and is valued at RM400,000. ii. Wages and salaries of RM50,000 are still unpaid. iii. iv. Loan note interest has not been paid during the year. The allowance for doubtful debts is to be increased to RM40,000. V. Plant is depreciated at 25% per annum using the reducing balance method. The entire charge is to be allocated to cost of sales. Buildings are depreciated at 2% per annum on their original cost, allocated 25% to cost of sales, 50% to distribution costs and 25% to administrative expenses. vii. During May 2019 a bonus issue of one for five was made to ordinary shareholders. This has not been entered into the books. The share premium account is to be used for this purpose. viii. No dividends have been paid or declared. The directors have agreed a transfer of RM35,000 to the general reserve from profits for the period. X. Tax has been calculated as RM207,000 for the year. xi. The expenses listed below should be apportioned as indicated: Cost of Distribution Administrative Sales Costs Expenses and 0% Discounts allowed received Heating and lighting Wages and salaries Goodwill impairment 0% 40% 20% 100% 40% 25% 100% 50% 25% 0% 0% Required Prepare, for external use, the following financial statements for Tenten Berhad in accordance with MFRS 101 Presentation of Financial Statements: (Notes to the accounts are not required.) a. Statement of Comprehensive Income for the year ended 31 May 2019 (17 marks) b. Statement of Financial Position as at 31 May 2019. (13 marks) The Trial Balance of Tenten Berhad at 31 May 2019 was as follows: RM'O00 RM'000 4,500 70 60 147 2,000 40 1,600 345 2,170 15 Revenue Discounts received Discounts allowed Bank balance Buildings at cost Buildings, accumulated depreciation, 1 June 2018 Plant at cost Plant, accumulated depreciation, 1 June 2018 Land at cost Purchases Returns inwards Returns outwards Heating and lighting Administrative expenses Trade payables Trade receivables Carriage inwards Wages and salaries 10% Loan notes General reserve Allowance for doubtful debts, at 1 June 2018 Director's remuneration Retained earnings at 1 June 2018 Ordinary share capital Inventory at 1 June 2018 250 80 1,030 700 105 250 580 35 30 495 1,100 515 8.307 8.307 Additional information for this case as at 31 May 2018. i. Closing inventory has been counted and is valued at RM400,000. ii. Wages and salaries of RM50,000 are still unpaid. iii. iv. Loan note interest has not been paid during the year. The allowance for doubtful debts is to be increased to RM40,000. V. Plant is depreciated at 25% per annum using the reducing balance method. The entire charge is to be allocated to cost of sales. Buildings are depreciated at 2% per annum on their original cost, allocated 25% to cost of sales, 50% to distribution costs and 25% to administrative expenses. vii. During May 2019 a bonus issue of one for five was made to ordinary shareholders. This has not been entered into the books. The share premium account is to be used for this purpose. viii. No dividends have been paid or declared. The directors have agreed a transfer of RM35,000 to the general reserve from profits for the period. X. Tax has been calculated as RM207,000 for the year. xi. The expenses listed below should be apportioned as indicated: Cost of Distribution Administrative Sales Costs Expenses and 0% Discounts allowed received Heating and lighting Wages and salaries Goodwill impairment 0% 40% 20% 100% 40% 25% 100% 50% 25% 0% 0% Required Prepare, for external use, the following financial statements for Tenten Berhad in accordance with MFRS 101 Presentation of Financial Statements: (Notes to the accounts are not required.) a. Statement of Comprehensive Income for the year ended 31 May 2019 (17 marks) b. Statement of Financial Position as at 31 May 2019. (13 marks)