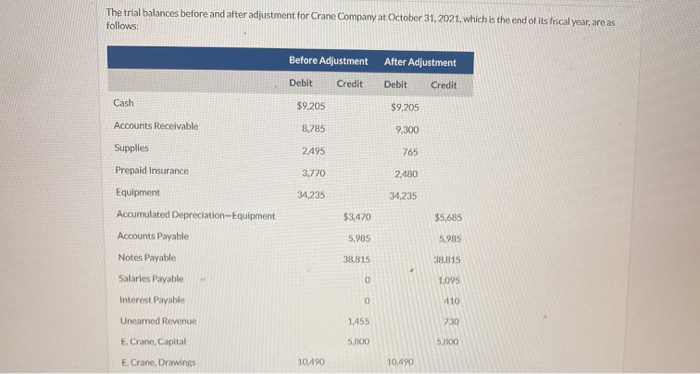

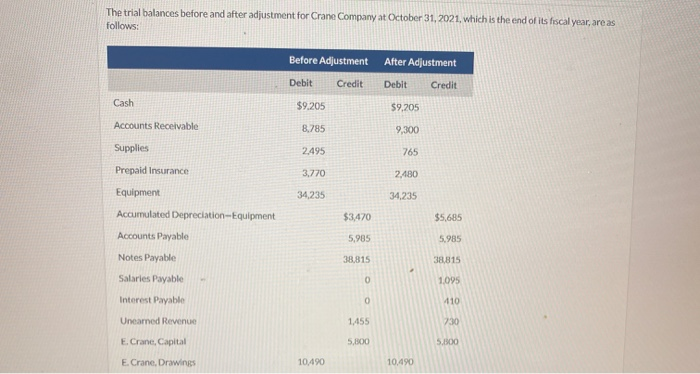

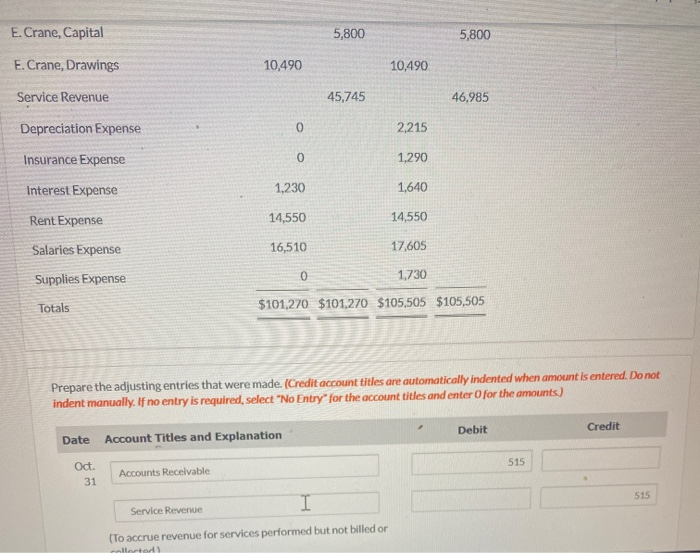

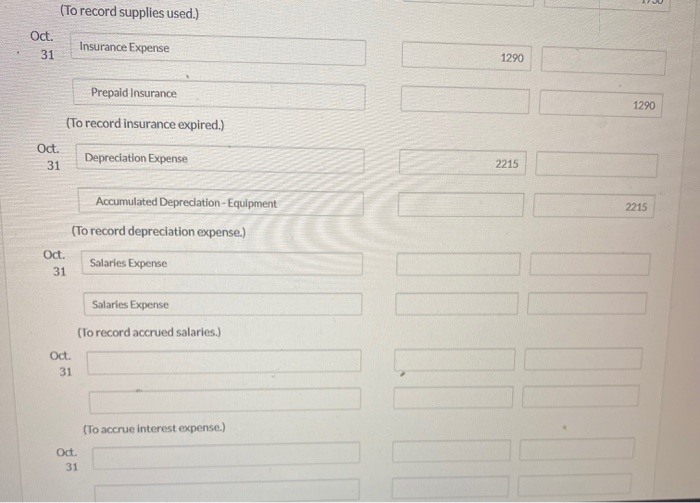

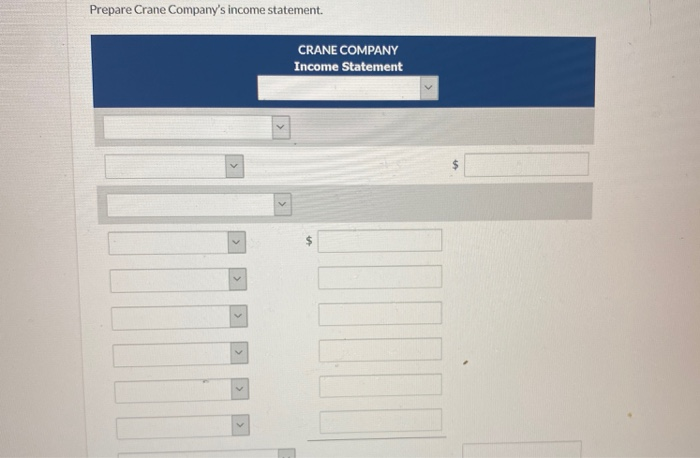

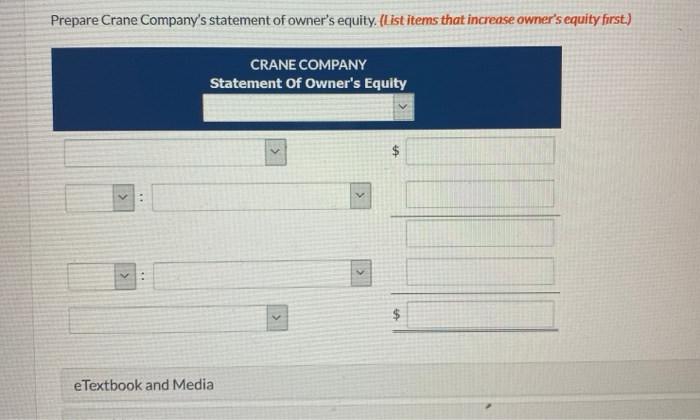

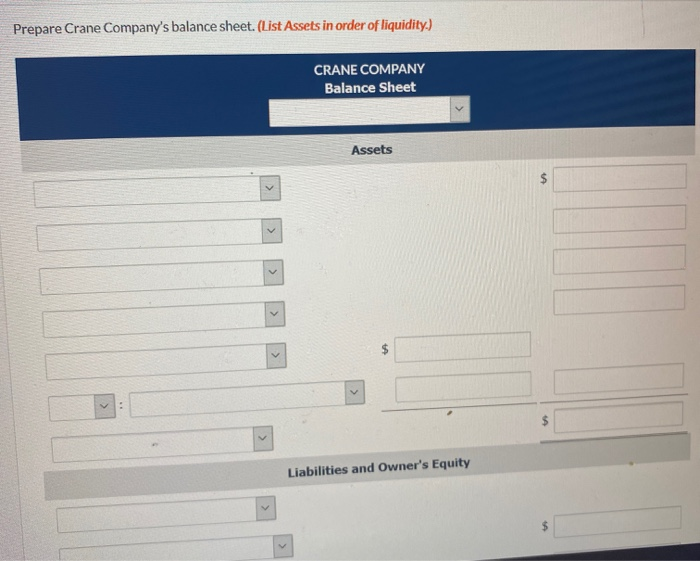

The trial balances before and after adjustment for Crane Company at October 31, 2021, which is the end of its fiscal year, are as follows: Before Adjustment After Adjustment Debit Credit Debit Credit Cash $9.205 $9,205 Accounts Receivable 8.785 9,300 Supplies 2.495 765 Prepaid Insurance 3.770 2.480 Equipment 34,235 34,235 $3,470 $5,685 Accumulated Depreciation-Equipment Accounts Payable 5,985 5,985 38,815 38815 Notes Payable Salaries Payable 0 1.095 Interest Payable 0 410 Unearned Revenue 1.455 730 E. Crane, Capital 5,800 5.800 E. Crane, Drawings 10,490 10,490 The trial balances before and after adjustment for Crane Company at October 31, 2021, which is the end of its fiscal year, are as follows: Before Adjustment After Adjustment Debit Credit Debit Credit Cash $9.205 $9,205 Accounts Receivable 8.785 9,300 Supplies 2.495 765 Prepaid Insurance 3.770 2.480 Equipment 34,235 34,235 Accumulated Depreciation-Equipment $3,470 $5,685 Accounts Payable 5,985 5.985 38,815 38,815 Notes Payable Salaries Payable 0 1.095 Interest Payable 0 410 Unearned Revenue 1.455 730 E. Crane, Capital 5,800 5.900 E. Crane, Drawings 10,490 10,490 E. Crane, Capital 5,800 5,800 E. Crane, Drawings 10,490 10,490 Service Revenue 45,745 46,985 Depreciation Expense 0 2,215 Insurance Expense 0 1,290 Interest Expense 1,230 1,640 Rent Expense 14,550 14,550 Salaries Expense 16,510 17,605 Supplies Expense 0 1,730 Totals $101,270 $101,270 $105,505 $105,505 Prepare the adjusting entries that were made. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Debit Credit Date Account Titles and Explanation 515 Oct. 31 Accounts Recevable 515 I Service Revenue (To accrue revenue for services performed but not billed or collected (To record supplies used.) Oct. Insurance Expense 31 1290 Prepaid Insurance (To record insurance expired.) 1290 Oct. 31 Depreciation Expense 2215 2215 Accumulated Depreciation - Equipment (To record depreciation expense.) Oct. Salaries Expense 31 Salaries Expense (To record accrued salaries.) Oct. 31 (To accrue interest expense.) Oct. 31 Prepare Crane Company's income statement. CRANE COMPANY Income Statement Prepare Crane Company's statement of owner's equity (List items that increase owner's equity first.) CRANE COMPANY Statement of Owner's Equity $ > $ > e Textbook and Media Prepare Crane Company's balance sheet. (List Assets in order of liquidity.) CRANE COMPANY Balance Sheet Assets $