Question

The triplets are now entering high school and Jamie Lee and Ross are comfortable with their financial and investment strategies. They budgeted throughout the years

The triplets are now entering high school and Jamie Lee and Ross are comfortable with their financial and investment strategies. They budgeted throughout the years and are on track to reach their long-term investment goals of paying the triplets’ college tuition and accumulating enough to purchase a beach house to enjoy when Jamie and Ross retire. Recently, Ross inherited $50,000 from his uncle’s estate. Ross would like to invest in stocks to supplement their retirement income goals. Jamie Lee and Ross have been watching a technology company that has an upcoming initial public offering and several other stocks for well-established companies, but they are unsure which stocks to invest in and are also wondering if their choices will fit their moderate risk investment strategies. They want to make the best decisions they can to maximize chances they will benefit from positive investment returns.

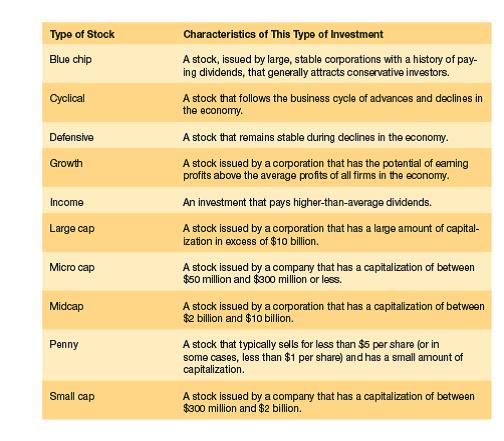

Currently, the economy is in the recovery stage. Referring to Exhibit 12–3 ,

what types of stock would you suggest for Jamie and Ross to invest in considering their life stage and current moderate investment strategies?

What characteristics are associated with the types of investments you suggested?

Reference Exhibit: 12-3

Type of Stock Blue chip Cyclical Defensive Growth Income Large cap Micro cap Midcap Penny Small cap Characteristics of This Type of Investment A stock, issued by large, stable corporations with a history of pay- ing dividends, that generally attracts conservative investors. A stock that follows the business cycle of advances and declines in the economy. A stock that remains stable during declines in the economy. A stock issued by a corporation that has the potential of earning profits above the average profits of all firms in the economy. An investment that pays higher-than-average dividends. A stock issued by a corporation that has a large amount of capital- ization in excess of $10 billion. A stock issued by a company that has a capitalization of between $50 million and $300 million or less. A stock issued by a corporation that has a capitalization of between $2 billion and $10 billion. A stock that typically sells for less than $5 per share (or in some cases, less than $1 per share) and has a small amount of capitalization. A stock issued by a company that has a capitalization of between $300 million and $2 billion.

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

The initial public offering takes place when a corporation sells stock to the overall publi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started