Answered step by step

Verified Expert Solution

Question

1 Approved Answer

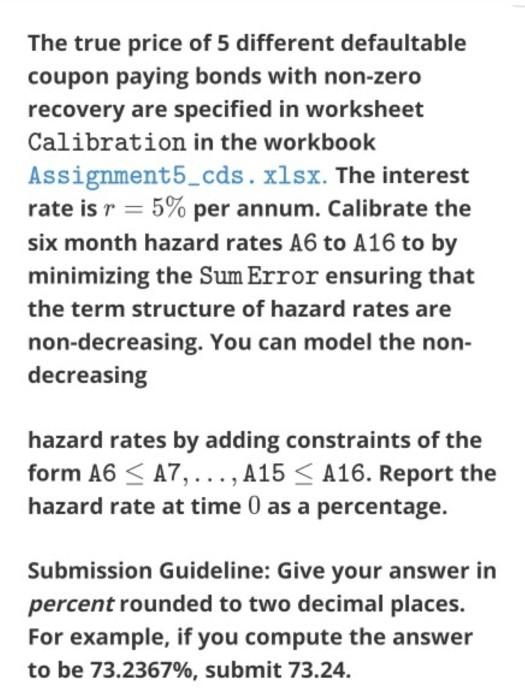

The true price of 5 different defaultable coupon paying bonds with non-zero recovery are specified in worksheet Calibration in the workbook Assignment5_cds.xlsx. The interest

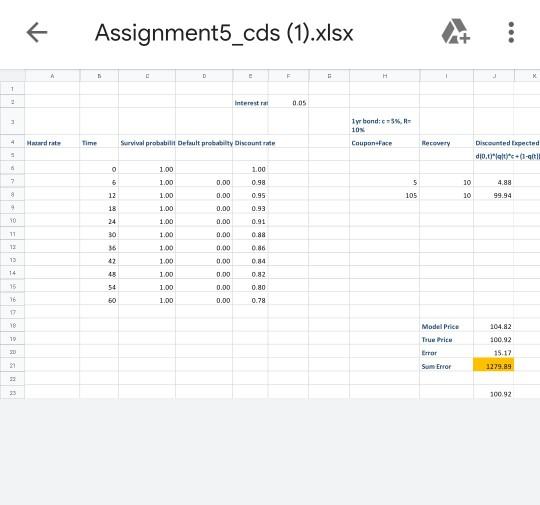

The true price of 5 different defaultable coupon paying bonds with non-zero recovery are specified in worksheet Calibration in the workbook Assignment5_cds.xlsx. The interest rate is r = 5% per annum. Calibrate the six month hazard rates A6 to A16 to by minimizing the Sum Error ensuring that the term structure of hazard rates are non-decreasing. You can model the non- decreasing hazard rates by adding constraints of the form A6 A7,..., A15 A16. Report the hazard rate at time 0 as a percentage. Submission Guideline: Give your answer in percent rounded to two decimal places. For example, if you compute the answer to be 73.2367%, submit 73.24. 1 3 4 5 6 7 8 10 11 12 13 14 15 16 17 18 19 300 21 32 K Hazard rate Assignment5_cds (1).xlsx B Time 8 % 8 % o 12 18 24 30 36 42 48 54 60 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 1.00 D Survival probabilit Default probabilty Discount rate 1.00 1.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 e 0.00 0.00 0.00 Interest rat 1.00 0.98 0.95 0.93 0.91 0.88 0.86 0.84 0.82 0.80 0.78 F 0.05 G H 1yr bond: c=5%, R 10% Coupon Face 5 105 Recovery Model Price True Price Error Sum Error 10 10 3 Discounted Expected di0.tqitjc+(3-qt| 4.88 99.94 104.82 100.92 15.17 1279.89 100.92

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To calibrate the sixmonth hazard rates A6 to A16 by minimizing the sum error while ensuring the term structure of hazard rates is nondecreasing you ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started