Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The two accounts affected by the adjustment for insurance are prepaid insurance and insurance expenses The two accounts affected by the adjustment for supplies are

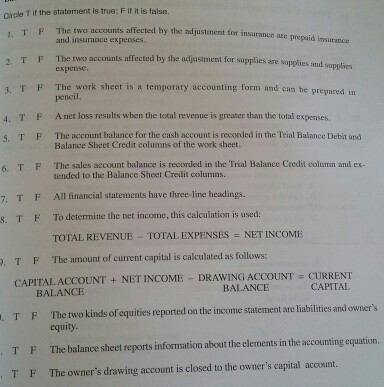

The two accounts affected by the adjustment for insurance are prepaid insurance and insurance expenses The two accounts affected by the adjustment for supplies are supplies and expense. The work sheet is a temporary accounting form and can be prepared in pencil. A net loss results when the local revenue is greater than the total expenses. The account balance for the cash account is recorded in the Trial Balance Debit and Balance Sheet Credit columns of the work sheet. The sales account balance is recorded in the Trial Balance Credit column and extended to the Balance Sheet Credit columns. All financial statements have three line headings. To determine the net income, this calculation is used: TOTAL REVENUE = TOTAL EXPENSES = NET INCOME The amount of current capital is calculated as follows: CAP1TAL ACCOUNT BALANCE + NET INCOME - DRAWING ACCOUNT BALANCE = CURRENT CAPITAL The two kinds of equities reported on the income statement are liabilities and owner's equity. The balance sheet reports information about the elements in the accounting equation. The owner's drawing account is closed to the owner's capital account

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started