Answered step by step

Verified Expert Solution

Question

1 Approved Answer

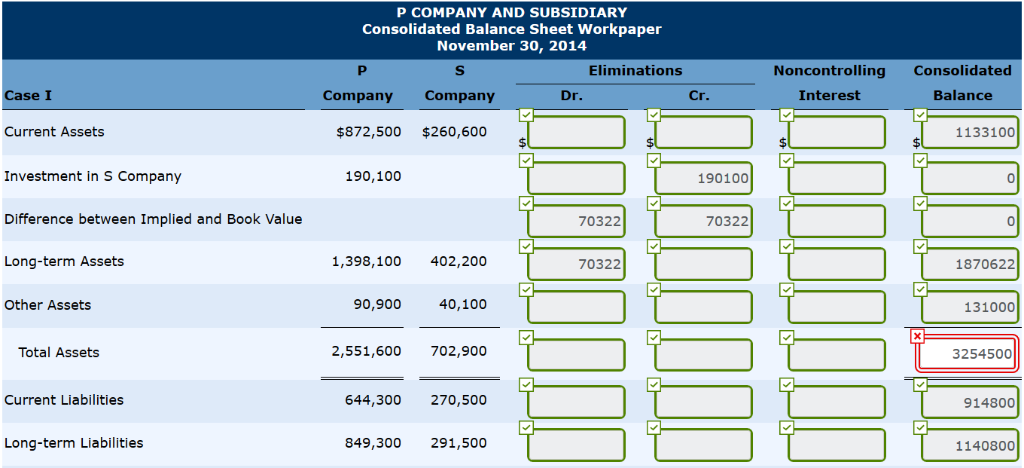

The two following separate cases show the financial position of a parent company and its subsidiary company on November 30, 2014, just after the parent

The two following separate cases show the financial position of a parent company and its subsidiary company on November 30, 2014, just after the parent had purchased 90% of the subsidiarys stock: PART A OF PROBLEM

| Case I | Case II | ||||||||

| P Company | S Company | P Company | S Company | ||||||

| Current assets | $ 872,500 | $260,600 | $ 779,600 | $281,000 | |||||

| Investment in S Company | 190,100 | 190,100 | |||||||

| Long-term assets | 1,398,100 | 402,200 | 1,205,100 | 402,200 | |||||

| Other assets | 90,900 | 40,100 | 69,500 | 69,400 | |||||

| Total | $2,551,600 | $702,900 | $2,244,300 | $752,600 | |||||

| Current liabilities | $ 644,300 | $270,500 | $ 704,500 | $260,500 | |||||

| Long-term liabilities | 849,300 | 291,500 | 928,400 | 270,400 | |||||

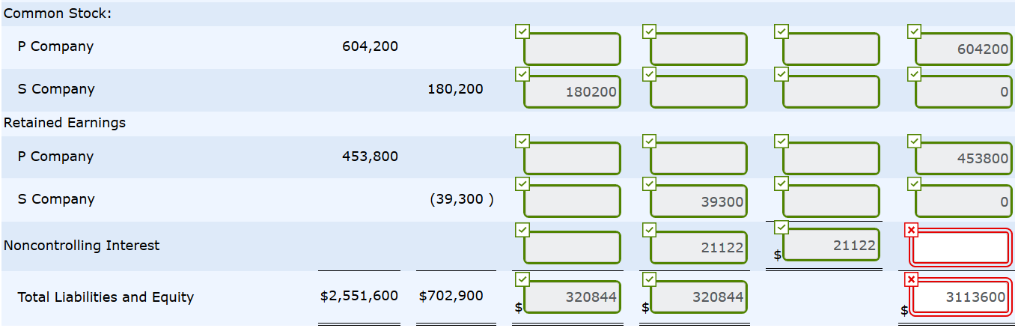

| Common stock | 604,200 | 180,200 | 604,200 | 180,200 | |||||

| Retained earnings | 453,800 | (39,300 | ) | 7,200 | 41,500 | ||||

| Total | $2,551,600 | $702,900 | $2,244,300 | $752,600 | |||||

Case I: Prepare a November 30, 2014, consolidated balance sheet workpaper. Any difference between book value of equity and the value implied by the purchase price relates to subsidiary long-term assets. THIS IS PART A

Please explain how you got to the answer in addition to the answer so I know how to do this next time.

P COMPANY AND SUBSIDIARY Consolidated Balance Sheet Workpaper November 30, 2014 Eliminations Noncon trolling Consolidated Case I Company Company Dr. Cr. Interest Balance Current Assets $872,500 $260,600 1133100 Investment in S Company Difference between Implied and Book Value Long-term Asset:s 190,100 190100 0 70322 70322 0 1,398,100 402,200 70322 1870622 Other Assets 90,900 40,100 131000 Total Assets 2,551,600 702,900 3254500 Current Liabilities 644,300 270,500 914800 Long-term Liabilities 849,300 291,500 1140800 Common Stock: P Company 604,200 604200 S Company 180,200 180200 0 Retained Earnings P Company 453,800 453800 S Company (39,300) 39300 0 Noncontrolling Interest 21122 $ 21122 Total Liabilities and Equity $2,551,600 $702,900 320844 320844 3113600Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started