The two portfolios are on the MVF of the four risky assets. What is the percentage weight on asset 1 in a third MV portfolio

- The two portfolios are on the MVF of the four risky assets. What is the percentage weight on asset 1 in a third MV portfolio of the same four risky assets if this portfolio is to have an expected return of 1% p.a.?

What is the percentage weight on asset 1 in a third MV portfolio of the same four risky assets considered in the previous question (each with the same expected return as given in the table in that question) if this portfolio is to have an expected return of 5% p.a.?

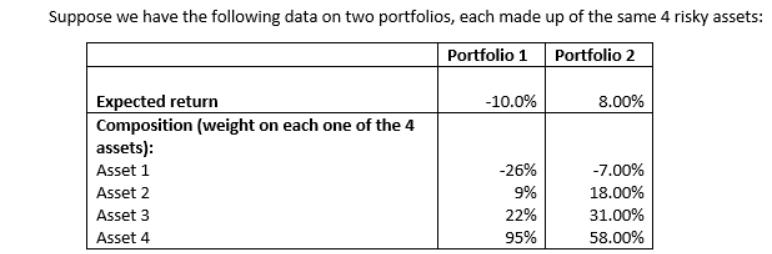

Suppose we have the following data on two portfolios, each made up of the same 4 risky assets: Portfolio 1 Portfolio 2 Expected return Composition (weight on each one of the 4 assets): Asset 1 Asset 2 Asset 3 Asset 4 -10.0% -26% 9% 22% 95% 8.00% -7.00% 18.00% 31.00% 58.00%

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The third MV portfolio will lie on the line connecting Portfolio 1 and Portfolio 2 in the graph The ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started