Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The two stocks (ACC & Yes Bank) and the market index (Nifty) performances in National Stock Exchange (NSE) of India over the last 5 years

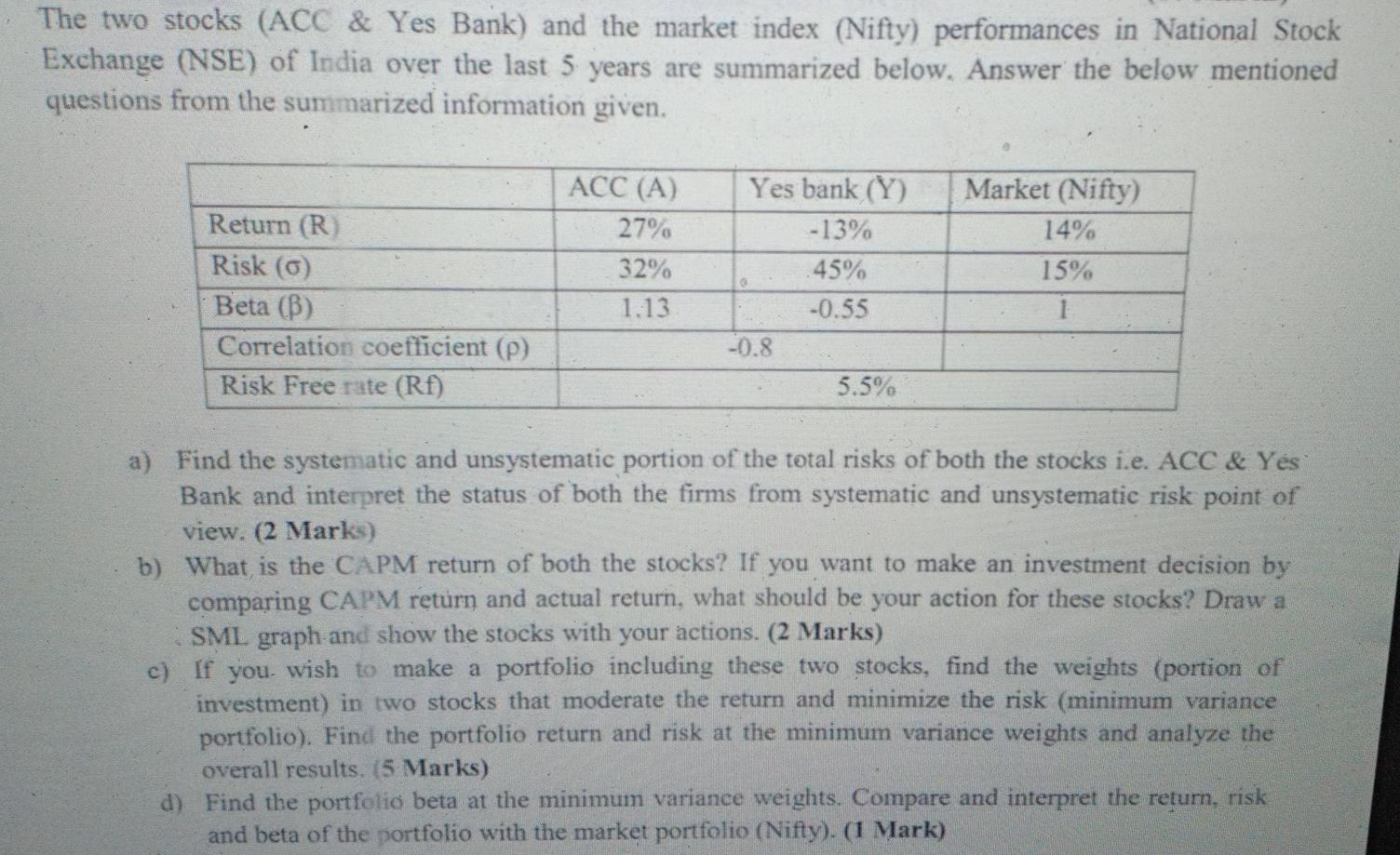

The two stocks (ACC & Yes Bank) and the market index (Nifty) performances in National Stock Exchange (NSE) of India over the last 5 years are summarized below. Answer the below mentioned questions from the summarized information given. Return (R) Risk (0) Beta (B) Correlation coefficient (P) Risk Free rate (Rf) ACC (A) 27% 32% 1.13 Yes bank (Y) -13% 45% -0.55 Market (Nifty) 14% 15% 1 -0.8 5.5% a) Find the systematic and unsystematic portion of the total risks of both the stocks i.e. ACC & Yes Bank and interpret the status of both the firms from systematic and unsystematic risk point of view. (2 Marks) b) What is the CAPM return of both the stocks? If you want to make an investment decision by comparing CAPM return and actual return, what should be your action for these stocks? Draw a SML graph and show the stocks with your actions. (2 Marks) c) If you wish to make a portfolio including these two stocks, find the weights (portion of investment) in two stocks that moderate the return and minimize the risk (minimum variance portfolio). Find the portfolio return and risk at the minimum variance weights and analyze the overall results. (5 Marks) d) Find the portfolio beta at the minimum variance weights. Compare and interpret the return, risk and beta of the portfolio with the market portfolio (Nifty). (1 Mark) The two stocks (ACC & Yes Bank) and the market index (Nifty) performances in National Stock Exchange (NSE) of India over the last 5 years are summarized below. Answer the below mentioned questions from the summarized information given. Return (R) Risk (0) Beta (B) Correlation coefficient (P) Risk Free rate (Rf) ACC (A) 27% 32% 1.13 Yes bank (Y) -13% 45% -0.55 Market (Nifty) 14% 15% 1 -0.8 5.5% a) Find the systematic and unsystematic portion of the total risks of both the stocks i.e. ACC & Yes Bank and interpret the status of both the firms from systematic and unsystematic risk point of view. (2 Marks) b) What is the CAPM return of both the stocks? If you want to make an investment decision by comparing CAPM return and actual return, what should be your action for these stocks? Draw a SML graph and show the stocks with your actions. (2 Marks) c) If you wish to make a portfolio including these two stocks, find the weights (portion of investment) in two stocks that moderate the return and minimize the risk (minimum variance portfolio). Find the portfolio return and risk at the minimum variance weights and analyze the overall results. (5 Marks) d) Find the portfolio beta at the minimum variance weights. Compare and interpret the return, risk and beta of the portfolio with the market portfolio (Nifty). (1 Mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started