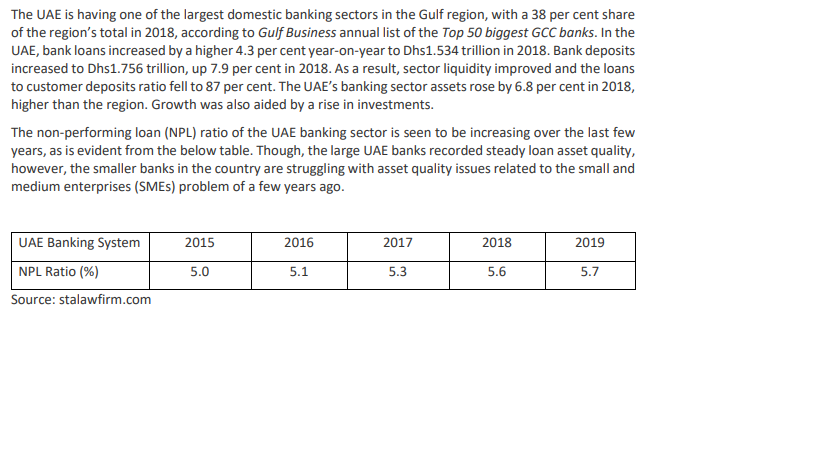

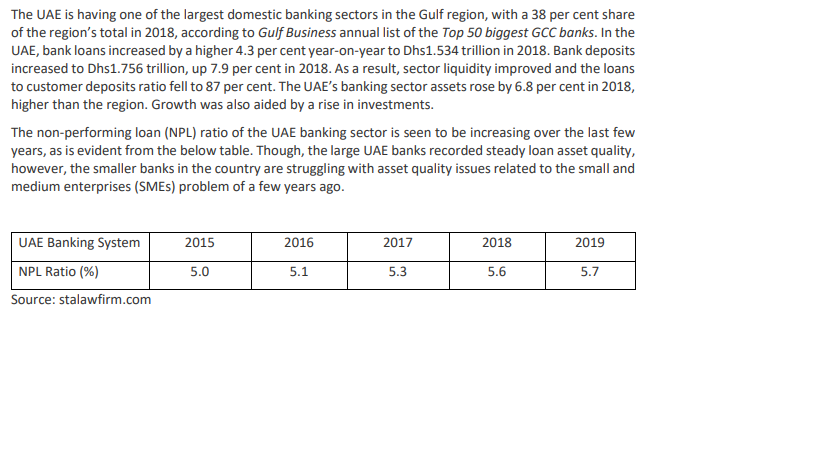

The UAE is having one of the largest domestic banking sectors in the Gulf region, with a 38 per cent share of the region's total in 2018, according to Gulf Business annual list of the Top 50 biggest GCC banks. In the UAE, bank loans increased by a higher 4.3 per cent year-on-year to Dhs1.534 trillion in 2018. Bank deposits increased to Dhs1.756 trillion, up 7.9 per cent in 2018. As a result, sector liquidity improved and the loans to customer deposits ratio fell to 87 per cent. The UAE's banking sector assets rose by 6.8 per cent in 2018, higher than the region. Growth was also aided by a rise in investments. The non-performing loan (NPL) ratio of the UAE banking sector is seen to be increasing over the last few years, as is evident from the below table. Though, the large UAE banks recorded steady loan asset quality, however, the smaller banks in the country are struggling with asset quality issues related to the small and medium enterprises (SMEs) problem of a few years ago. UAE Banking System NPL Ratio (%) | Source: stalawfirm.com 2015 5.0 2016 5.1 2017 5.3 2018 5.6 2019 5.7 A local UAE bank is going through tough times due to several emerging scenarios around the world. The top management of the bank is very much concerned about the increased problem loans. They would like to consult an expert asking to carry out a thorough audit of the situation and what strategy could be adopted in order to effectively overcome this increased problem loan situation. Suppose you are contacted by the bank as subject expert, critically evaluate the situation on the basis of your theoretical understanding of the subject-matter covering the following points: (a) How could the management of the bank have known this situation in advance? Is there an early warning kind of system? Describe. (b) The bank stated that there is a single largest party long-term loan of approximately AED 112 million which was granted to Action Enterprises, a medium-scale enterprise, few years ago. There are still few years left in its maturity but this loan is potentially turning as a problem loan. The bank's management is asking you to recommend a common steps-based strategy that can be exercised in order to deal with this problem loan situation