Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The UK Treasurer of Suits plc expects to receive a payment for wool exports to a customer in Munich in three months' time. Her

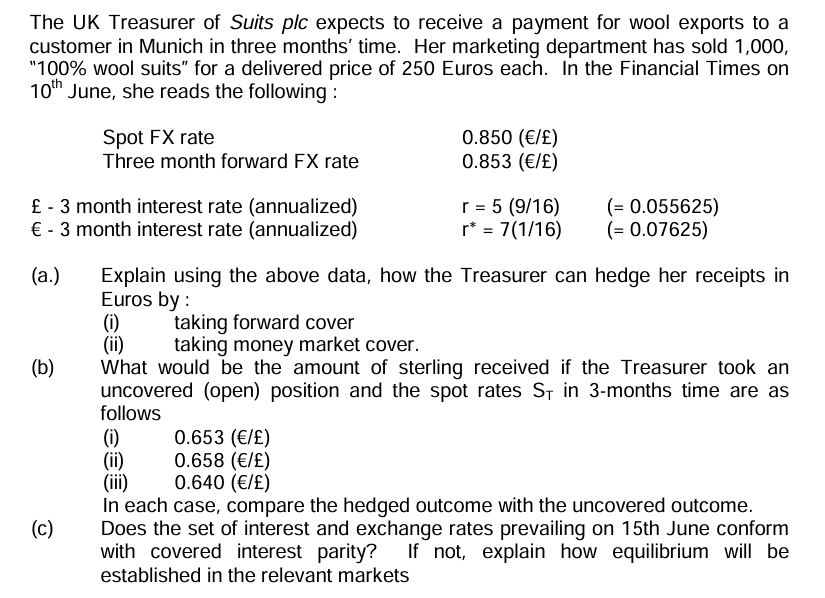

The UK Treasurer of Suits plc expects to receive a payment for wool exports to a customer in Munich in three months' time. Her marketing department has sold 1,000, "100% wool suits" for a delivered price of 250 Euros each. In the Financial Times on 10th June, she reads the following: Spot FX rate Three month forward FX rate - 3 month interest rate (annualized) 3 month interest rate (annualized) - 0.850 (/) 0.853 (/) r = 5 (9/16) r* = 7(1/16) (= 0.055625) (= 0.07625) Explain using the above data, how the Treasurer can hedge her receipts in Euros by: (a.) (i) (b) (c) (ii) taking forward cover taking money market cover. What would be the amount of sterling received if the Treasurer took an uncovered (open) position and the spot rates S in 3-months time are as follows (i) (ii) (iii) 0.653 (/) 0.658 (/) 0.640 (/) In each case, compare the hedged outcome with the uncovered outcome. Does the set of interest and exchange rates prevailing on 15th June conform with covered interest parity? If not, explain how equilibrium will be established in the relevant markets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a i Taking Forward Cover The Treasurer can hedge her receipts in Euros by entering into a forward contract The threemonth forward FX rate is given as ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started