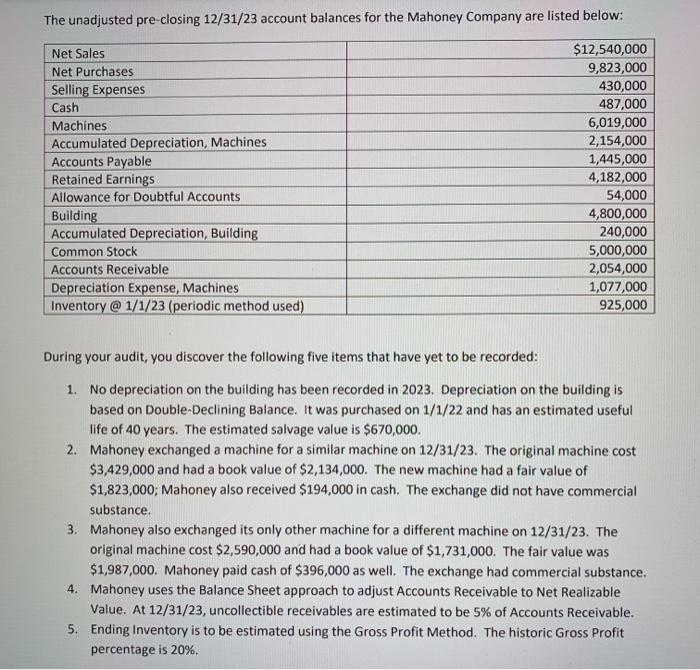

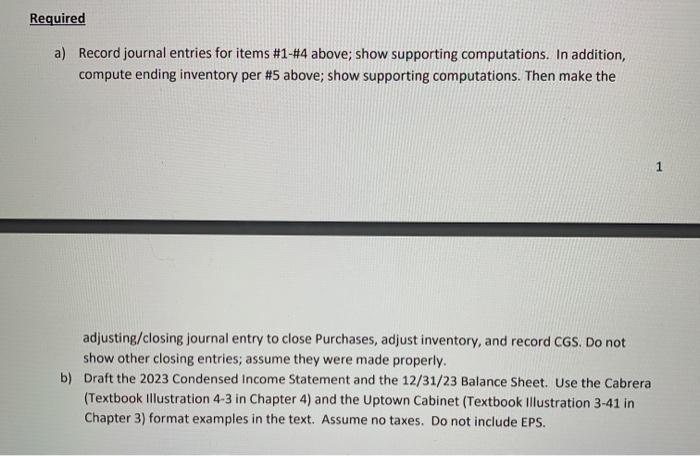

The unadjusted pre-closing 12/31/23 account balances for the Mahoney Company are listed below: Net Sales Net Purchases Selling Expenses Cash Machines Accumulated Depreciation, Machines Accounts Payable Retained Earnings Allowance for Doubtful Accounts Building Accumulated Depreciation, Building Common Stock Accounts Receivable Depreciation Expense, Machines Inventory @ 1/1/23 (periodic method used) $12,540,000 9,823,000 430,000 487,000 6,019,000 2,154,000 1,445,000 4,182,000 54,000 4,800,000 240,000 5,000,000 2,054,000 1,077,000 925,000 During your audit, you discover the following five items that have yet to be recorded: 1. No depreciation on the building has been recorded in 2023. Depreciation on the building is based on Double-Declining Balance. It was purchased on 1/1/22 and has an estimated useful life of 40 years. The estimated salvage value is $670,000. 2. Mahoney exchanged a machine for a similar machine on 12/31/23. The original machine cost $3,429,000 and had a book value of $2,134,000. The new machine had a fair value of $1,823,000; Mahoney also received $194,000 in cash. The exchange did not have commercial substance, 3. Mahoney also exchanged its only other machine for a different machine on 12/31/23. The original machine cost $2,590,000 and had a book value of $1,731,000. The fair value was $1,987,000. Mahoney paid cash of $396,000 as well. The exchange had commercial substance. 4. Mahoney uses the Balance Sheet approach to adjust Accounts Receivable to Net Realizable Value. At 12/31/23, uncollectible receivables are estimated to be 5% of Accounts Receivable. 5. Ending Inventory is to be estimated using the Gross Profit Method. The historic Gross Profit percentage is 20%. Required a) Record journal entries for items #1-#4 above; show supporting computations. In addition, compute ending inventory per #5 above; show supporting computations. Then make the adjusting/closing journal entry to close Purchases, adjust inventory, and record CGS. Do not show other closing entries; assume they were made properly. b) Draft the 2023 Condensed Income Statement and the 12/31/23 Balance Sheet. Use the Cabrera (Textbook illustration 4-3 in Chapter 4) and the Uptown Cabinet (Textbook Illustration 3-41 in Chapter 3) format examples in the text. Assume no taxes. Do not include EPS