The Unadjusted Trial Balance columns have been completed for you using the unadjusted trial balance you prepared in Requirement 3. Complete the worksheet one section at a time beginning with the Adjustments section. Enter the adjustments along with the adjustment letter

reference(a),(b), (c),into the columns as appropriate. In the following step, complete the Adjusted Trial Balance section of the worksheet. For this section, and for the Income Statement and Balance Sheet sections, enter a "0" on the normal side of the account for any accounts with a zero balance. Lastly, complete the worksheet by preparing the Income Statement and Balance Sheet columns. For the Income Statement and Balance Sheet sections, only enter the "0" for a zero balance if the account

is typically included in that section of the worksheet

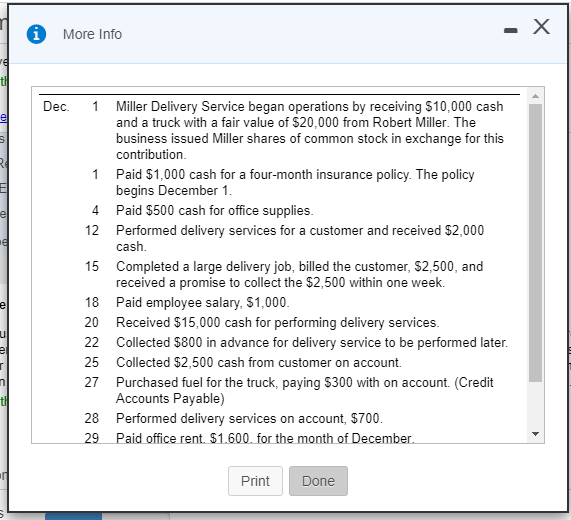

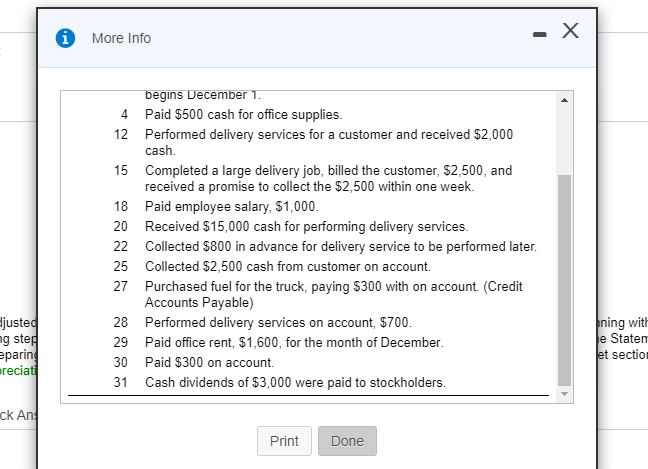

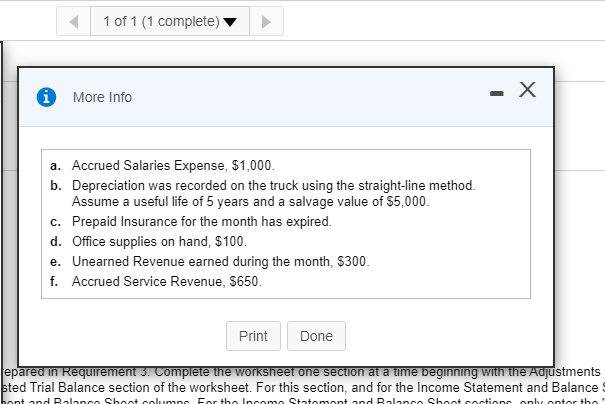

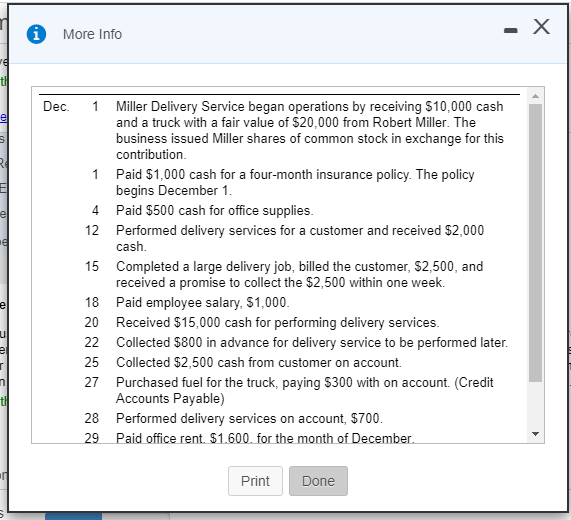

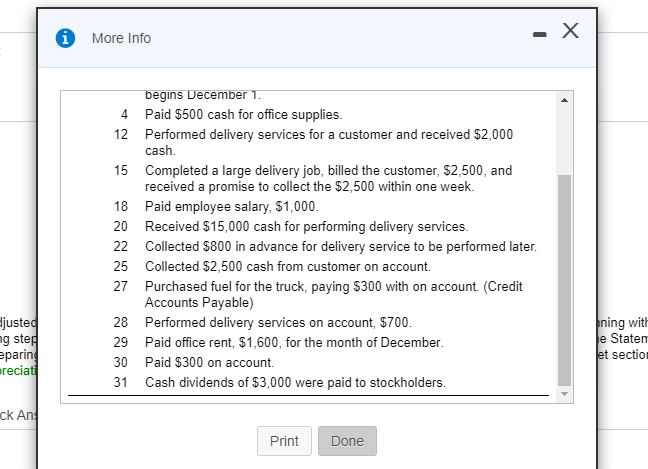

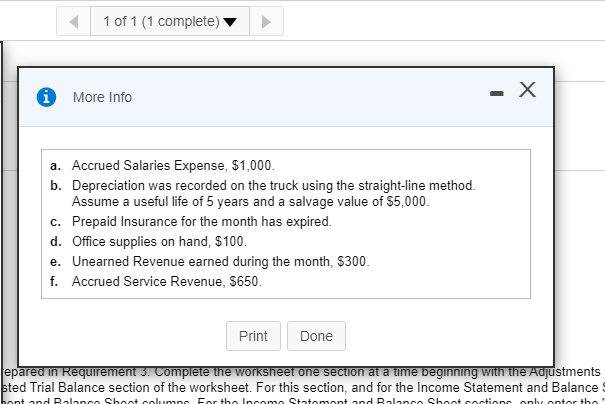

i More Info + Dec. 1 ID U U 1 M D 4 12 M 15 Miller Delivery Service began operations by receiving $10,000 cash and a truck with a fair value of $20,000 from Robert Miller. The business issued Miller shares of common stock in exchange for this contribution. Paid $1,000 cash for a four-month insurance policy. The policy begins December 1. Paid $500 cash for office supplies. Performed delivery services for a customer and received $2,000 cash. Completed a large delivery job, billed the customer, $2,500, and received a promise to collect the $2,500 within one week. Paid employee salary, $1,000. Received $15,000 cash for performing delivery services. Collected $800 in advance for delivery service to be performed later. Collected $2,500 cash from customer on account. Purchased fuel for the truck, paying $300 with on account. (Credit Accounts Payable) Performed delivery services on account, $700. Paid office rent. $1.600. for the month of December D C 18 20 22 25 27 D + 28 29 Print Done i More Info 4 12 15 18 20 22 25 27 begins December 1. Paid $500 cash for office supplies. Performed delivery services for a customer and received $2.000 cash. Completed a large delivery job, billed the customer, $2,500, and received a promise to collect the $2,500 within one week. Paid employee salary, $1,000. Received $15,000 cash for performing delivery services. Collected $800 in advance for delivery service to be performed later Collected $2,500 cash from customer on account. Purchased fuel for the truck, paying $300 with on account. (Credit Accounts Payable) Performed delivery services on account, $700. Paid office rent, $1,600, for the month of December Paid $300 on account. Cash dividends of $3,000 were paid to stockholders. justed ng step eparing reciati 28 29 30 31 ning with e Staten et section ck An Print Done 1 of 1 (1 complete) * More Info a. Accrued Salaries Expense, $1,000 b. Depreciation was recorded on the truck using the straight-line method. Assume a useful life of 5 years and a salvage value of $5,000. c. Prepaid Insurance for the month has expired. d. Office supplies on hand, $100. e. Unearned Revenue earned during the month, $300. f. Accrued Service Revenue, $650. Print Done nent 3. Complete the worksheet one section at a time beginning with the Adjustments sted Trial Balance section of the worksheet. For this section, and for the Income Statement and Balance bont and Balance Shoot columne For the Income Statement and Balance sheet catione anbantartha" i More Info + Dec. 1 ID U U 1 M D 4 12 M 15 Miller Delivery Service began operations by receiving $10,000 cash and a truck with a fair value of $20,000 from Robert Miller. The business issued Miller shares of common stock in exchange for this contribution. Paid $1,000 cash for a four-month insurance policy. The policy begins December 1. Paid $500 cash for office supplies. Performed delivery services for a customer and received $2,000 cash. Completed a large delivery job, billed the customer, $2,500, and received a promise to collect the $2,500 within one week. Paid employee salary, $1,000. Received $15,000 cash for performing delivery services. Collected $800 in advance for delivery service to be performed later. Collected $2,500 cash from customer on account. Purchased fuel for the truck, paying $300 with on account. (Credit Accounts Payable) Performed delivery services on account, $700. Paid office rent. $1.600. for the month of December D C 18 20 22 25 27 D + 28 29 Print Done i More Info 4 12 15 18 20 22 25 27 begins December 1. Paid $500 cash for office supplies. Performed delivery services for a customer and received $2.000 cash. Completed a large delivery job, billed the customer, $2,500, and received a promise to collect the $2,500 within one week. Paid employee salary, $1,000. Received $15,000 cash for performing delivery services. Collected $800 in advance for delivery service to be performed later Collected $2,500 cash from customer on account. Purchased fuel for the truck, paying $300 with on account. (Credit Accounts Payable) Performed delivery services on account, $700. Paid office rent, $1,600, for the month of December Paid $300 on account. Cash dividends of $3,000 were paid to stockholders. justed ng step eparing reciati 28 29 30 31 ning with e Staten et section ck An Print Done 1 of 1 (1 complete) * More Info a. Accrued Salaries Expense, $1,000 b. Depreciation was recorded on the truck using the straight-line method. Assume a useful life of 5 years and a salvage value of $5,000. c. Prepaid Insurance for the month has expired. d. Office supplies on hand, $100. e. Unearned Revenue earned during the month, $300. f. Accrued Service Revenue, $650. Print Done nent 3. Complete the worksheet one section at a time beginning with the Adjustments sted Trial Balance section of the worksheet. For this section, and for the Income Statement and Balance bont and Balance Shoot columne For the Income Statement and Balance sheet catione anbantartha