Question

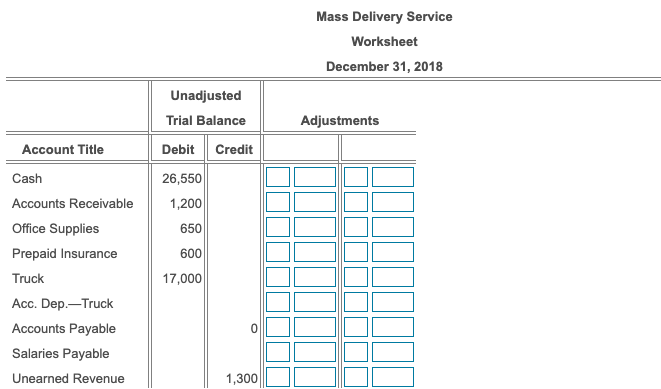

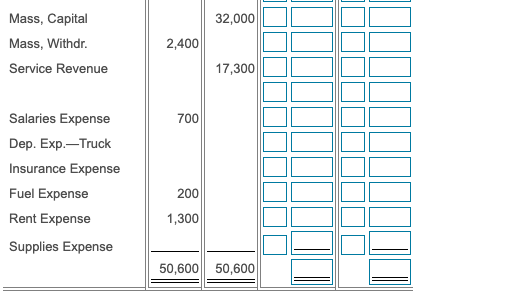

The Unadjusted Trial Balance columns have been completed for you using the unadjusted trial balance you prepared in Requirement 3. Complete the worksheet one section

The Unadjusted Trial Balance columns have been completed for you using the unadjusted trial balance you prepared in Requirement 3. Complete the worksheet one section at a time beginning with the Adjustments section. Enter the adjustments along with the adjustment letter

referenceslong dash(a),

(b), (c),

etc.long dashinto

the columns as appropriate. In the following step, complete the Adjusted Trial Balance section of the worksheet. For this section, and for the Income Statement and Balance Sheet sections, enter a "0" on the normal side of the account for any accounts with a zero balance. Lastly, complete the worksheet by preparing the Income Statement and Balance Sheet columns.

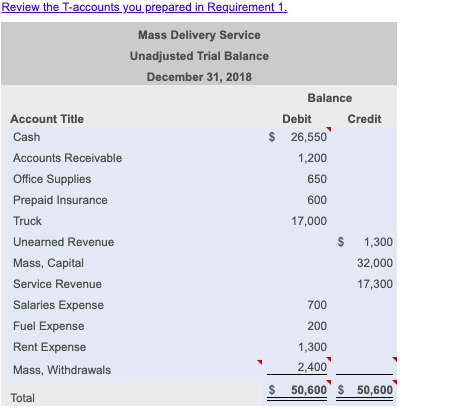

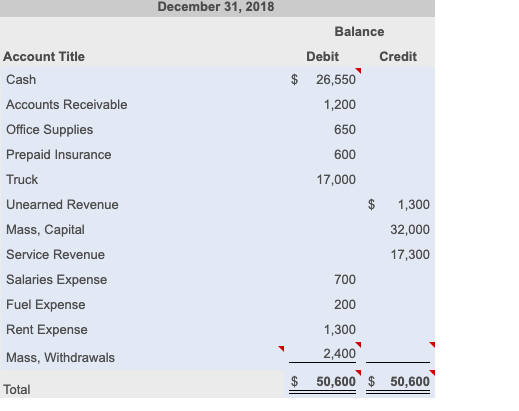

Review the T-accounts you prepared in Requirement 1. Mass Delivery Service Unadjusted Trial Balance December 31, 2018 Account Title Cash $ Accounts Receivable Office Supplies Prepaid Insurance Truck Unearned Revenue Mass, Capital Service Revenue Salaries Expense Fuel Expense Balance Debit Credit 26,550 1,200 650 600 17,000 $ 1,300 32,000 17,300 700 200 1,300 Rent Expense Mass, Withdrawals 2,400 $ 50,600 $ 50,600 Total December 31, 2018 Balance Debit Credit Account Title Cash $ 26,550 Accounts Receivable 1,200 650 Office Supplies Prepaid Insurance Truck 600 17,000 $ Unearned Revenue Mass, Capital Service Revenue Salaries Expense Fuel Expense 1,300 32,000 17,300 700 200 Rent Expense 1,300 Mass, Withdrawals 2,400 $ 50,600 $ 50,600 Total Mass Delivery Service Worksheet December 31, 2018 Adjustments Account Title Unadjusted Trial Balance Debit Credit 26,550 1,200 650 600 Cash Accounts Receivable Office Supplies Prepaid Insurance Truck Acc. Dep.-Truck Accounts Payable Salaries Payable Unearned Revenue 17,000 OODUDDDDD Mass, Capital 32,000 Mass, Withdr. 2,400 Service Revenue 17,300 JOINDD 700 Salaries Expense Dep. Exp.-Truck Insurance Expense Fuel Expense 0000000000 200 Rent Expense 1,300 Supplies Expense 50.600 | 50.600 Review the T-accounts you prepared in Requirement 1. Mass Delivery Service Unadjusted Trial Balance December 31, 2018 Account Title Cash $ Accounts Receivable Office Supplies Prepaid Insurance Truck Unearned Revenue Mass, Capital Service Revenue Salaries Expense Fuel Expense Balance Debit Credit 26,550 1,200 650 600 17,000 $ 1,300 32,000 17,300 700 200 1,300 Rent Expense Mass, Withdrawals 2,400 $ 50,600 $ 50,600 Total December 31, 2018 Balance Debit Credit Account Title Cash $ 26,550 Accounts Receivable 1,200 650 Office Supplies Prepaid Insurance Truck 600 17,000 $ Unearned Revenue Mass, Capital Service Revenue Salaries Expense Fuel Expense 1,300 32,000 17,300 700 200 Rent Expense 1,300 Mass, Withdrawals 2,400 $ 50,600 $ 50,600 Total Mass Delivery Service Worksheet December 31, 2018 Adjustments Account Title Unadjusted Trial Balance Debit Credit 26,550 1,200 650 600 Cash Accounts Receivable Office Supplies Prepaid Insurance Truck Acc. Dep.-Truck Accounts Payable Salaries Payable Unearned Revenue 17,000 OODUDDDDD Mass, Capital 32,000 Mass, Withdr. 2,400 Service Revenue 17,300 JOINDD 700 Salaries Expense Dep. Exp.-Truck Insurance Expense Fuel Expense 0000000000 200 Rent Expense 1,300 Supplies Expense 50.600 | 50.600Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started