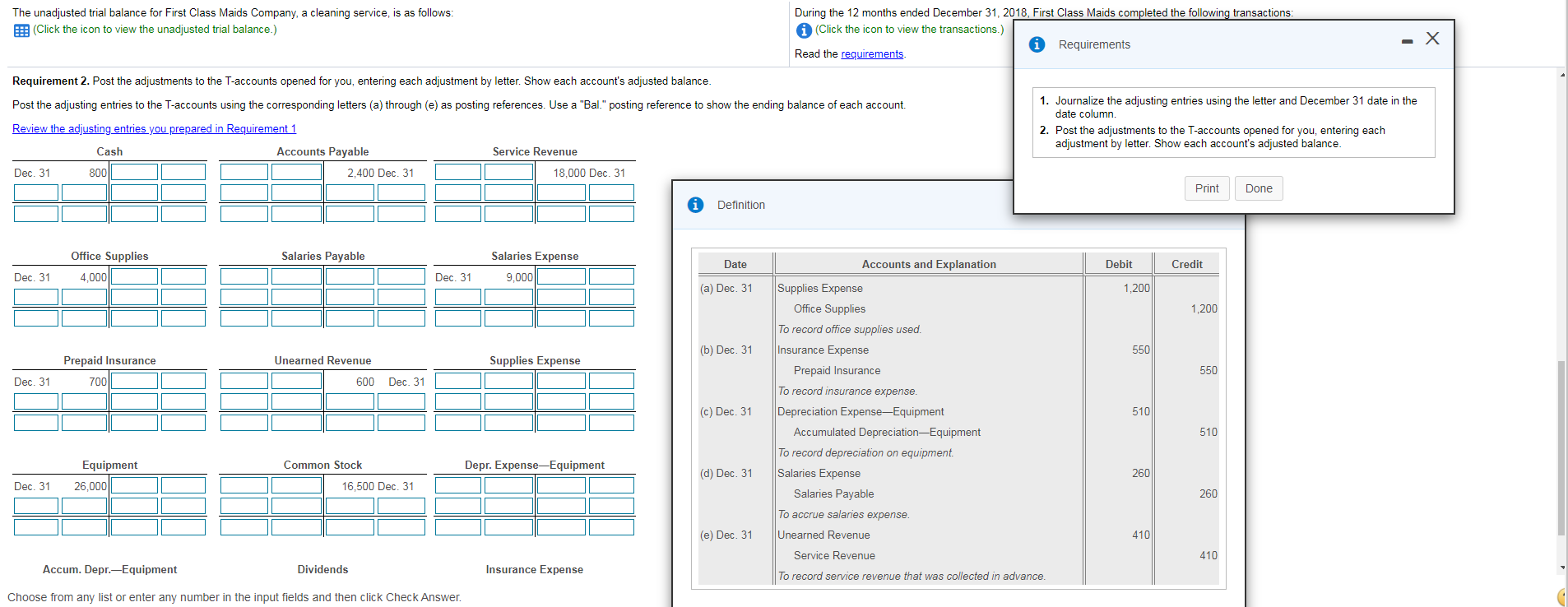

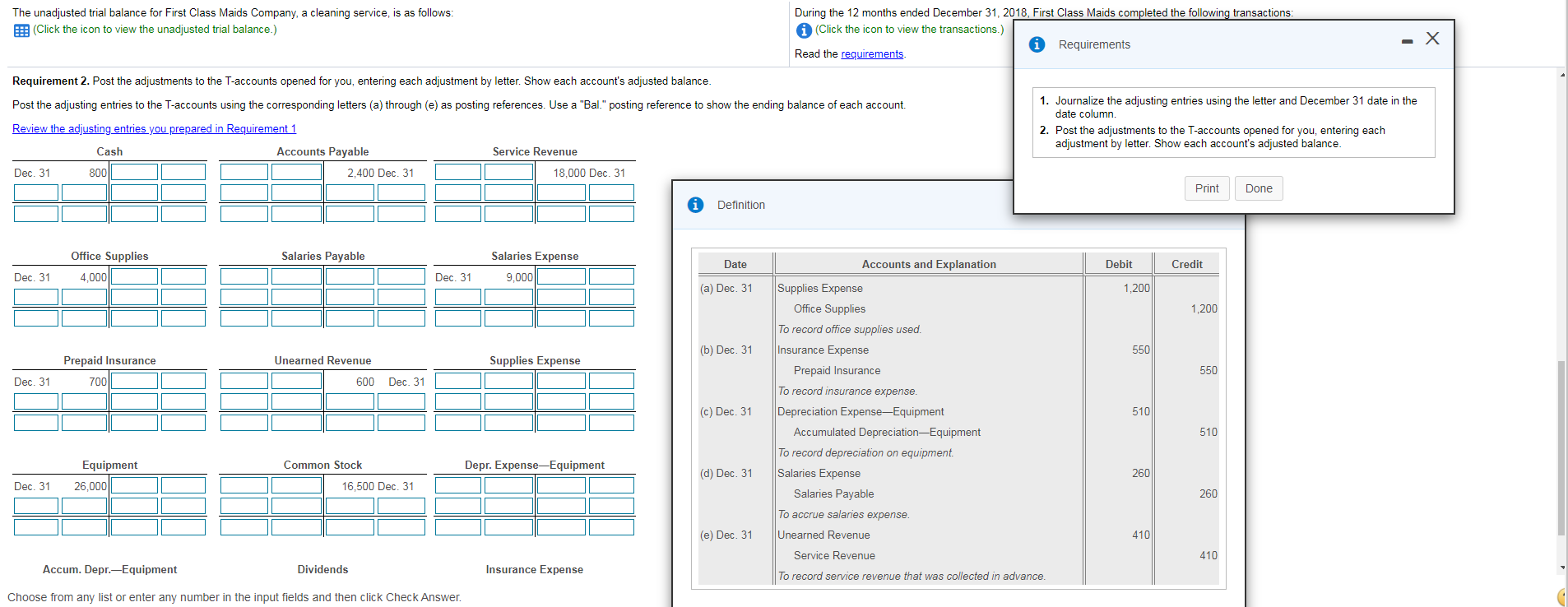

The unadjusted trial balance for First Class Maids Company, a cleaning service, is as follows: (Click the icon to view the unadjusted trial balance.) During the 12 months ended December 31, 2018, First Class Maids completed the following transactions: (Click the icon to view the transactions.) Requirements Read the requirements Requirement 2. Post the adjustments to the T-accounts opened for you, entering each adjustment by letter. Show each account's adjusted balance. Post the adjusting entries to the T-accounts using the corresponding letters (a) through (e) as posting references. Use a "Bal" posting reference to show the ending balance of each account. Review the adjusting entries you prepared in Requirement 1 Cash Accounts Payable Service Revenue Dec. 31 800 2,400 Dec. 31 18,000 Dec. 31 1. Journalize the adjusting entries using the letter and December 31 date in the date column 2. Post the adjustments to the T-accounts opened for you, entering each adjustment by letter. Show each account's adjusted balance. Print Done Definition Salaries Payable Office Supplies 4,000 Salaries Expense 9,000 Date Accounts and Explanation Debit Credit Dec. 31 Dec. 31 (a) Dec. 31 1.200 1,200 (b) Dec. 31 550 Unearned Revenue Supplies Expense Prepaid Insurance 700 550 Dec. 31 600 Dec. 31 (c) Dec. 31 Supplies Expense Office Supplies To record office supplies used. Insurance Expense Prepaid Insurance To record insurance expense. Depreciation Expense-Equipment Accumulated Depreciation-Equipment To record depreciation on equipment Salaries Expense Salaries Payable To accrue salaries expense. Unearned Revenue 510 510 Common Stock Depr. Expense-Equipment Equipment 26,000 (d) Dec. 31 260 Dec. 31 16,500 Dec. 31 260 (e) Dec. 31 410 Service Revenue 410 Accum. Depr.-Equipment Dividends Insurance Expense To record service revenue that was collected in advance. Choose from any list or enter any number in the input fields and then click Check Answer. The unadjusted trial balance for First Class Maids Company, a cleaning service, is as follows: (Click the icon to view the unadjusted trial balance.) During the 12 months ended December 31, 2018, First Class Maids completed the following transactions: (Click the icon to view the transactions.) Requirements Read the requirements Requirement 2. Post the adjustments to the T-accounts opened for you, entering each adjustment by letter. Show each account's adjusted balance. Post the adjusting entries to the T-accounts using the corresponding letters (a) through (e) as posting references. Use a "Bal" posting reference to show the ending balance of each account. Review the adjusting entries you prepared in Requirement 1 Cash Accounts Payable Service Revenue Dec. 31 800 2,400 Dec. 31 18,000 Dec. 31 1. Journalize the adjusting entries using the letter and December 31 date in the date column 2. Post the adjustments to the T-accounts opened for you, entering each adjustment by letter. Show each account's adjusted balance. Print Done Definition Salaries Payable Office Supplies 4,000 Salaries Expense 9,000 Date Accounts and Explanation Debit Credit Dec. 31 Dec. 31 (a) Dec. 31 1.200 1,200 (b) Dec. 31 550 Unearned Revenue Supplies Expense Prepaid Insurance 700 550 Dec. 31 600 Dec. 31 (c) Dec. 31 Supplies Expense Office Supplies To record office supplies used. Insurance Expense Prepaid Insurance To record insurance expense. Depreciation Expense-Equipment Accumulated Depreciation-Equipment To record depreciation on equipment Salaries Expense Salaries Payable To accrue salaries expense. Unearned Revenue 510 510 Common Stock Depr. Expense-Equipment Equipment 26,000 (d) Dec. 31 260 Dec. 31 16,500 Dec. 31 260 (e) Dec. 31 410 Service Revenue 410 Accum. Depr.-Equipment Dividends Insurance Expense To record service revenue that was collected in advance. Choose from any list or enter any number in the input fields and then click Check