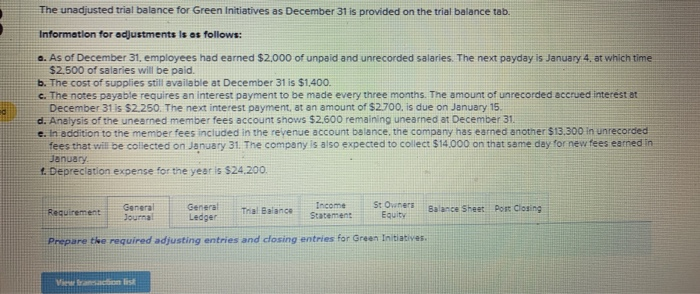

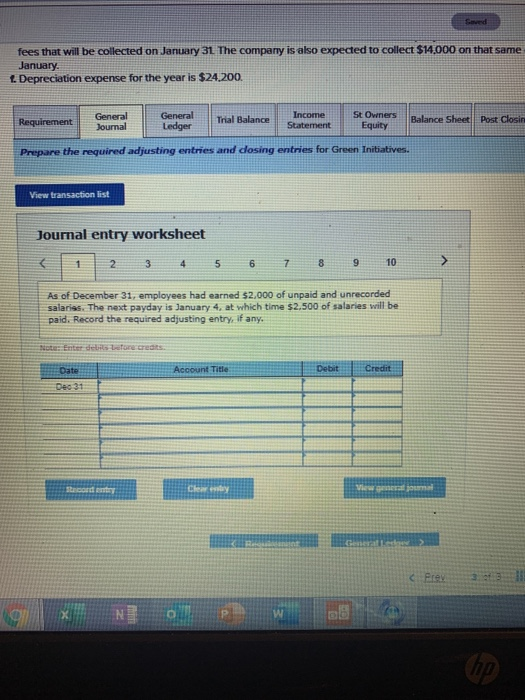

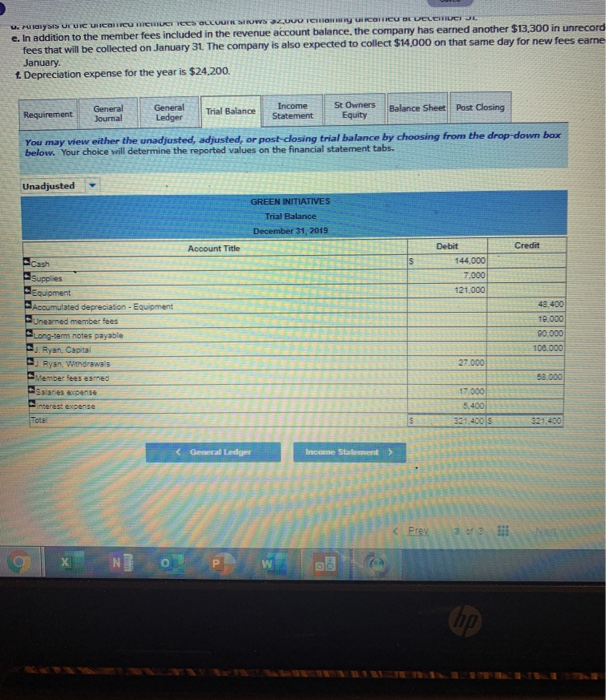

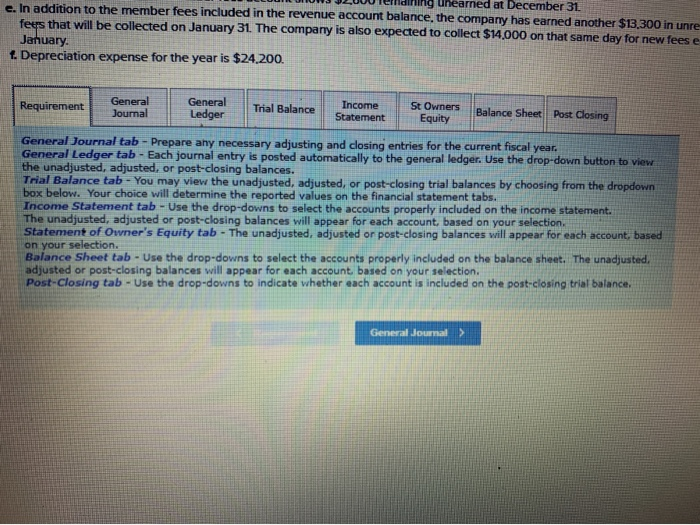

The unadjusted trial balance for Green Initiatives as December 31 is provided on the trial balance tab. Information for adjustments is os follows: o. As of December 31, employees had earned $2.000 of unpaid and unrecorded salaries. The next payday is January 4, at which time $2,500 of salaries will be paid. b. The cost of supplies still available at December 31 is $1.400. c. The notes payable requires an interest payment to be made every three months. The amount of unrecorded accrued interest at December 31 is $2.250. The next interest payment, at an amount of $2700. is due on January 15. d. Analysis of the unearned member fees account shows $2,600 remaining unearned at December 31 e. in addition to the member fees included in the revenue account balance, the company has earned another $13.300 In unrecorded fees that will be collected on January 31. The company is also expected to collect $14.000 on that same day for new fees earned in January Depreclation expense for the year is $24.200 St Owners General Journal Income Statement General Ledger Post Closing Balance Sheet Requirement Tral Balance Equity Prepare the required adjusting entries and closing entries for Green Initiatives. Saved fees that will be collected on January 31 The company is also expected to collect $14.000 on that same January Depreciation expense for the year is $24,200. General Ledger Income General Journal St Oviners Balance Sheet Post Closin Trial Balance Requirement Equity Statement Prepare the required adjusting entries and closing entries for Green Initiatives. View transaction list Journal entry worksheet 10 8 1 2 4 5 6 7 As of December 31, employees had earned $2,000 of unpaid and unrecorded salariss. The next payday is January 4, at which time $2.500 of salaries will be paid. Record the required adjusting entry, if any. reets Debit Credit Account Title: Date Dec 31 Clew Vicw a jomal Staod nty Generat Ledo Prev P UVO TCHO ucoicu OLUCLEEIDCI J e. In addition to the member fees included in the revenue account balance, the company has earned another $13,300 in unrecord- fees that will be collected on January 31. The company is also expected to collect $14,000 on that same day for new fees earne January. t Depreciation expense for the year is $24,200 u. AIyas Ur uIC uIcaucu nICmLCI EEs oLLUurn sROWS St Owners Equity Balance Sheet Income Post Closing General General Journal Trial Balance Requirement Ledger Statement You may view either the unadjusted, adjusted, or post-closing trial balance by choosing from the drop-down box below. Your choice will determine the reported values on the financial statement tabs Unadjusted GREEN INITIATIVES Trial Balance December 31, 2019 Credit Debit Account Title 144,000 Cash 7,000 Supplies Equipment 121.000 48,400 Accumulated depreciation-Equipment Unearned member fees 19.000 90,000 Long-sem notes payable 108.000 Ryan, Capital 27.000 J Ryan Wthdrawals 58.000 Member fees eamed 17.000 5.400 321.400 5 Salares expense interest expense Total 321.400