Question

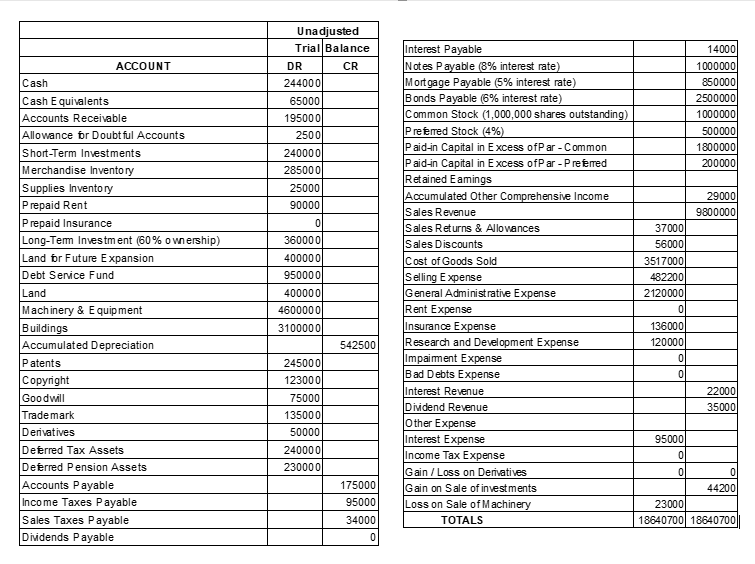

The unadjusted trial balance for Lulus firm as of December 31, 2018 (below, it is big to see). Use this trial balance and the data

The unadjusted trial balance for Lulus firm as of December 31, 2018 (below, it is big to see). Use this trial balance and the data given for necessary year-end adjustments in order to create a corrected, adjusted trial balance and financial statements for Echo firms bank.

Required:

1. Complete the adjusting entries, based on the data that you have been given. Record then in the general ledger and on the worksheet. Write the journal entries by hand in the general journal.

2. Determine net income before computing income tax expense in Part 14. Then create the journal entry for income tax expense, record the entry in the general journal and on the worksheet, extend the amount, and recompute net income.

3. Prepare the combined statement of income and other comprehensive income. Assume that the number of common shares outstanding has not changed from the beginning to the end of the year. Prepare this statement by hand.

4. Prepare the balance sheet.

Data for Adjusting Entries:

- The bank statement as of December 31, 2018 shows service charges of $240 and NSF checks for items recorded as sales in the amount of $3,400. Interest was shown earned in December is $2,420.

- An aging schedule shows that $25,000 of the Accounts Receivable balance is likely to be uncollected.

- The end-of-year inventory counts show a final balance of $245,000 in Merchandise Inventory and $14,000 in Supplies Inventory.

- Rent for one year for the building was prepaid on September 1, 2018. No adjustments have been made since that time. 20% of the space is used by the Selling area, and 30% is used for production space. The rest is all used for administrative space.

- The liability insurance policies were paid for two years coverage on July 1, 2018.

- The investment trustee reports that $20,000 in dividends and $35,000 in interest were earned in the Debt Service Fund during 2018.

- Unfortunately, there was a fire in part of the production area and some of the equipment was harmed. The nondiscounted future cash flows related to this machinery (Cost $150,000 and Accum. Deprec. $25,000) is estimated to be $100,000, and the fair value of the machinery is $105,000.

- Depreciation is done using straight-line depreciation with no salvage. None has been taken for the year. Machinery and equipment is estimated to last for 10 years, and buildings are estimated to last for 20 years. 20% of the space is used by the Selling area, and 30% is used for production space. The rest is all used for administrative space. The machinery is 70% for production, 15% for administrative, and 15% for sales.

- Finite-lived intangible assets are amortized over their legal lives with no salvage. Assume that they are all new in 2018 and that all legal years are remaining (years beyond the life of the author for the copyright). The patents are used in production. The copyright is used by the administrative area, and the trademark is used by the sales area to promote product.

- Goodwill must be tested for impairment each year. It was first recorded when your firm purchased 60% of another firm. The Fair value of the entire subsidiary with goodwill is $700,000. The fair value of the entire subsidiary without goodwill is $600,000.

- The derivatives are options purchased to protect the firm from loss. The derivatives served their purpose but no longer have any remaining value.

- Only part of the interest expense on the note payable, mortgage payable, and bonds payable has been expensed for the entire year. Determine the correct amount of total interest expense for the year and accrue what is necessary.

- The Board of Directors declared dividends for the common shareholders of $50,000 plus the amount due for the preferred shareholders. No dividends have been paid for the year 2018.

- The income tax rate is 20%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started