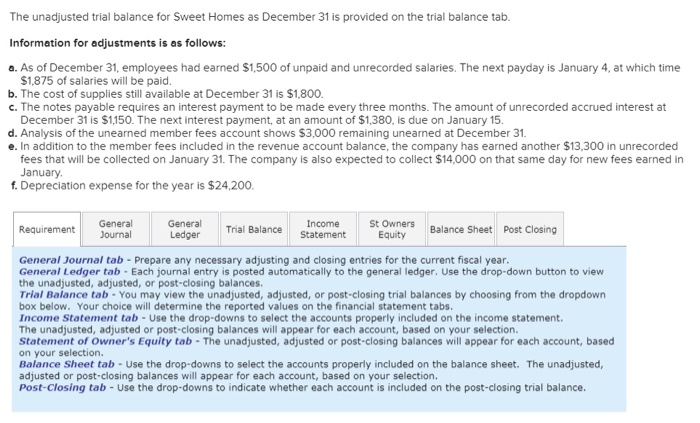

The unadjusted trial balance for Sweet Homes as December 31 is provided on the trial balance tab. Information for adjustments is as follows: a. As of December 31, employees had earned $1,500 of unpaid and unrecorded salaries. The next payday is January 4, at which time $1,875 of salaries will be paid. b. The cost of supplies still available at December 31 is $1,800. c. The notes payable requires an interest payment to be made every three months. The amount of unrecorded accrued interest at December 31 is $1,150. The next interest payment, at an amount of $1,380, is due on January 15. d. Analysis of the unearned member fees account shows $3,000 remaining unearned at December 31. e. In addition to the member fees included in the revenue account balance, the company has earned another $13,300 in unrecorded fees that will be collected on January 31. The company is also expected to collect $14,000 on that same day for new fees earned in January f. Depreciation expense for the year is $24,200. Requirement General Journal General Ledger Trial Balance Income Statement St Owners Equity Balance Sheet Post Closing General Journal tab - Prepare any necessary adjusting and closing entries for the current fiscal year. General Ledger tab - Each journal entry is posted automatically to the general ledger. Use the drop-down button to view the unadjusted, adjusted, or post-closing balances. Trial Balance tab - You may view the unadjusted, adjusted, or post-closing trial balances by choosing from the dropdown box below. Your choice will determine the reported values on the financial statement tabs. Income Statement tab - Use the drop-downs to select the accounts properly included on the income statement. The unadjusted, adjusted or post.closing balances will appear for each account, based on your selection. Statement of Owner's Equity tab - The unadjusted, adjusted or post-closing balances will appear for each account, based on your selection. Balance Sheet tab - Use the drop-downs to select the accounts properly included on the balance sheet. The unadjusted, adjusted or post-closing balances will appear for each account, based on your selection. Post-Closing tab - Use the drop-downs to indicate whether each account is included on the post-closing trial balance. The unadjusted trial balance for Sweet Homes as December 31 is provided on the trial balance tab. Information for adjustments is as follows: a. As of December 31, employees had earned $1,500 of unpaid and unrecorded salaries. The next payday is January 4, at which time $1,875 of salaries will be paid. b. The cost of supplies still available at December 31 is $1,800. c. The notes payable requires an interest payment to be made every three months. The amount of unrecorded accrued interest at December 31 is $1,150. The next interest payment, at an amount of $1,380, is due on January 15. d. Analysis of the unearned member fees account shows $3,000 remaining unearned at December 31. e. In addition to the member fees included in the revenue account balance, the company has earned another $13,300 in unrecorded fees that will be collected on January 31. The company is also expected to collect $14,000 on that same day for new fees earned in January f. Depreciation expense for the year is $24,200. Requirement General Journal General Ledger Trial Balance Income Statement St Owners Equity Balance Sheet Post Closing General Journal tab - Prepare any necessary adjusting and closing entries for the current fiscal year. General Ledger tab - Each journal entry is posted automatically to the general ledger. Use the drop-down button to view the unadjusted, adjusted, or post-closing balances. Trial Balance tab - You may view the unadjusted, adjusted, or post-closing trial balances by choosing from the dropdown box below. Your choice will determine the reported values on the financial statement tabs. Income Statement tab - Use the drop-downs to select the accounts properly included on the income statement. The unadjusted, adjusted or post.closing balances will appear for each account, based on your selection. Statement of Owner's Equity tab - The unadjusted, adjusted or post-closing balances will appear for each account, based on your selection. Balance Sheet tab - Use the drop-downs to select the accounts properly included on the balance sheet. The unadjusted, adjusted or post-closing balances will appear for each account, based on your selection. Post-Closing tab - Use the drop-downs to indicate whether each account is included on the post-closing trial balance