Answered step by step

Verified Expert Solution

Question

1 Approved Answer

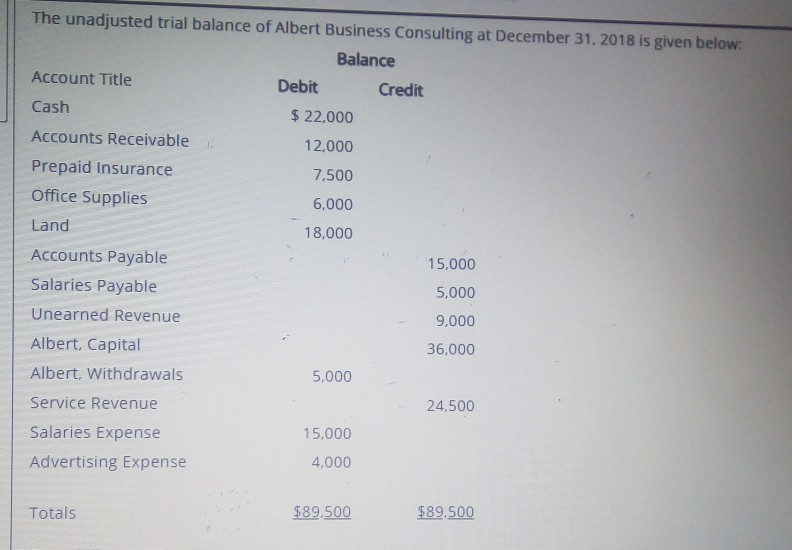

The unadjusted trial balance of Albert Business Consulting at December 31, 2018 is given below: Balance Account Title Debit Credit Cash $ 22.000 Accounts Receivable

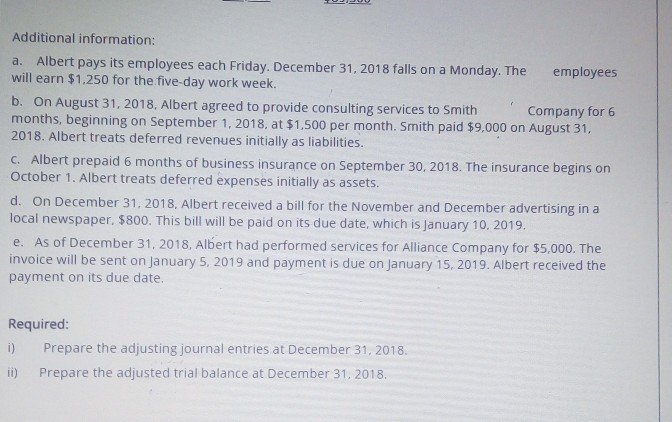

The unadjusted trial balance of Albert Business Consulting at December 31, 2018 is given below: Balance Account Title Debit Credit Cash $ 22.000 Accounts Receivable 12.000 7,500 6,000 18,000 15,000 5,000 Prepaid Insurance Office Supplies Land Accounts Payable Salaries Payable Unearned Revenue Albert, Capital Albert, Withdrawals Service Revenue Salaries Expense Advertising Expense 9,000 36,000 5,000 24,500 15,000 4,000 Totals $89.500 $89.500 Additional information: a. Albert pays its employees each Friday, December 31, 2018 falls on a Monday. The employees will earn $1.250 for the five-day work week. b. On August 31, 2018. Albert agreed to provide consulting services to Smith Company for 6 months, beginning on September 1, 2018, at $1.500 per month. Smith paid $9,000 on August 31, 2018. Albert treats deferred revenues initially as liabilities. C. Albert prepaid 6 months of business insurance on September 30, 2018. The insurance begins on October 1. Albert treats deferred expenses initially as assets. d. On December 31, 2018, Albert received a bill for the November and December advertising in a local newspaper, $800. This bill will be paid on its due date, which is January 10, 2019. e. As of December 31, 2018, Albert had performed services for Alliance Company for $5,000. The invoice will be sent on January 5, 2019 and payment is due on January 15, 2019. Albert received the payment on its due date. Required: i) Prepare the adjusting journal entries at December 31, 2018. ii) Prepare the adjusted trial balance at December 31, 2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started