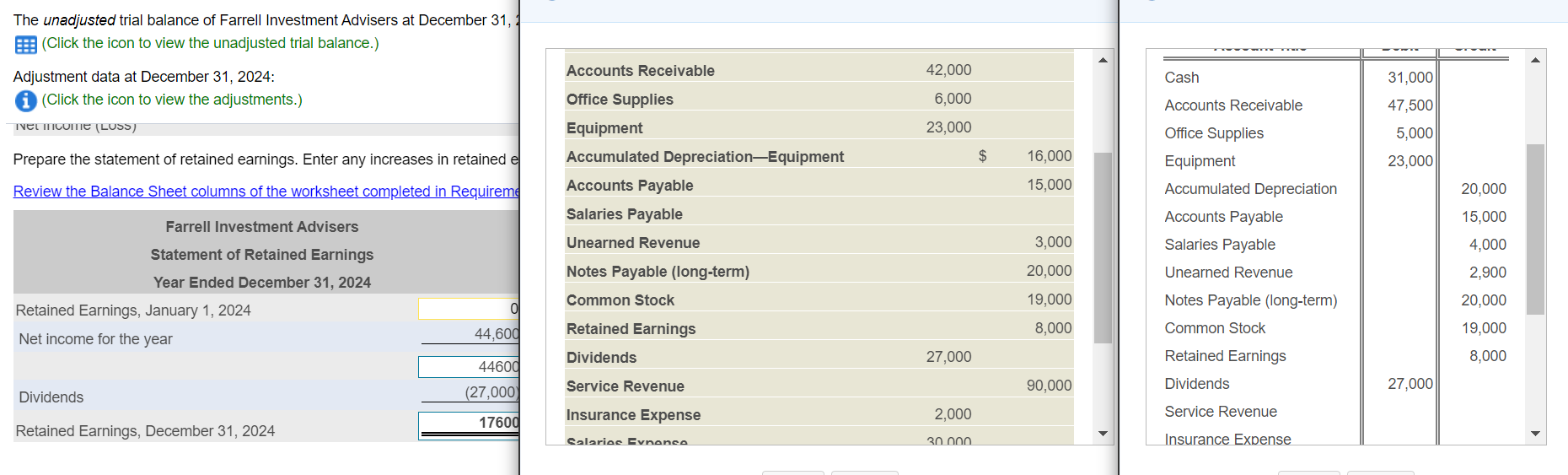

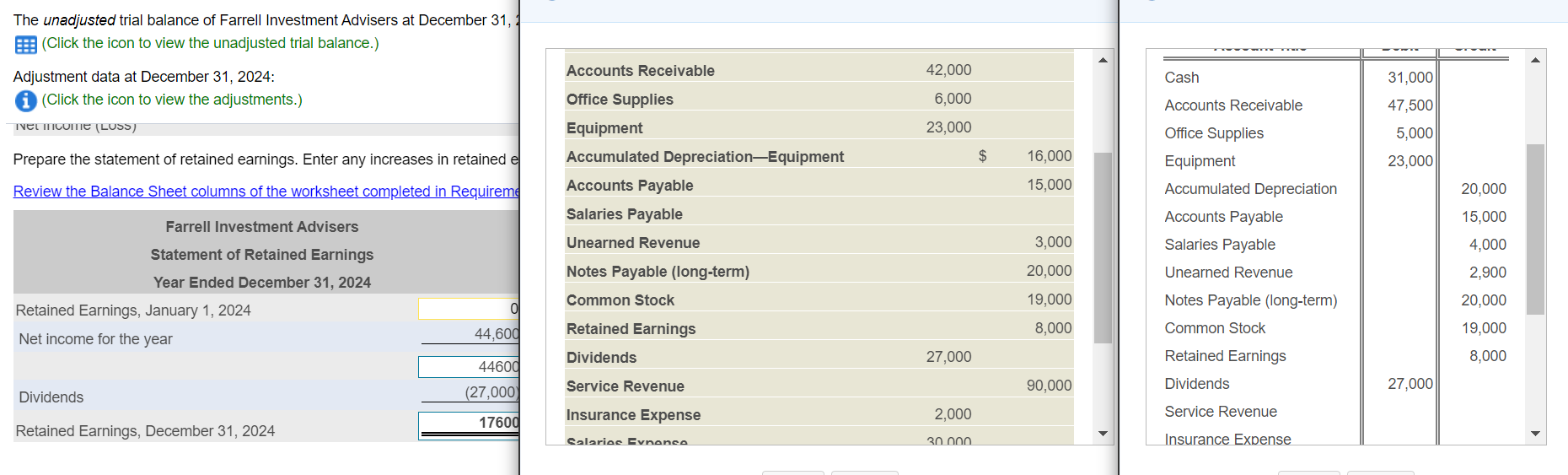

The unadjusted trial balance of Farrell Investment Advisers at December 31, 1 E (Click the icon to view the unadjusted trial balance.) Accounts Receivable 42,000 Cash 31,000 Adjustment data at December 31, 2024: (Click the icon to view the adjustments.) 6,000 Accounts Receivable 47,500 NEL INICITIE (LUSS) 23,000 5,000 Prepare the statement of retained earnings. Enter any increases in retained e $ 16,000 23,000 Review the Balance Sheet columns of the worksheet completed in Requireme Office Supplies Equipment Accumulated Depreciation-Equipment Accounts Payable Salaries Payable Unearned Revenue Notes Payable (long-term) 15,000 Office Supplies Equipment Accumulated Depreciation Accounts Payable Salaries Payable 20,000 15,000 Farrell Investment Advisers 3,000 4,000 20,000 Unearned Revenue 2,900 Statement of Retained Earnings Year Ended December 31, 2024 Retained Earnings, January 1, 2024 Net income for the year Common Stock 19,000 20,000 Notes Payable (long-term) Common Stock 44,600 Retained Earnings 8,000 19,000 Dividends 27,000 Retained Earnings 8,000 44600 Service Revenue 90,000 Dividends (27,000 27,000 Dividends Insurance Expense 2,000 Service Revenue 17600 Retained Earnings, December 31, 2024 Salaries Cynanca 30 non Insurance Expense The unadjusted trial balance of Farrell Investment Advisers at December 31, 1 E (Click the icon to view the unadjusted trial balance.) Accounts Receivable 42,000 Cash 31,000 Adjustment data at December 31, 2024: (Click the icon to view the adjustments.) 6,000 Accounts Receivable 47,500 NEL INICITIE (LUSS) 23,000 5,000 Prepare the statement of retained earnings. Enter any increases in retained e $ 16,000 23,000 Review the Balance Sheet columns of the worksheet completed in Requireme Office Supplies Equipment Accumulated Depreciation-Equipment Accounts Payable Salaries Payable Unearned Revenue Notes Payable (long-term) 15,000 Office Supplies Equipment Accumulated Depreciation Accounts Payable Salaries Payable 20,000 15,000 Farrell Investment Advisers 3,000 4,000 20,000 Unearned Revenue 2,900 Statement of Retained Earnings Year Ended December 31, 2024 Retained Earnings, January 1, 2024 Net income for the year Common Stock 19,000 20,000 Notes Payable (long-term) Common Stock 44,600 Retained Earnings 8,000 19,000 Dividends 27,000 Retained Earnings 8,000 44600 Service Revenue 90,000 Dividends (27,000 27,000 Dividends Insurance Expense 2,000 Service Revenue 17600 Retained Earnings, December 31, 2024 Salaries Cynanca 30 non Insurance Expense