Answered step by step

Verified Expert Solution

Question

1 Approved Answer

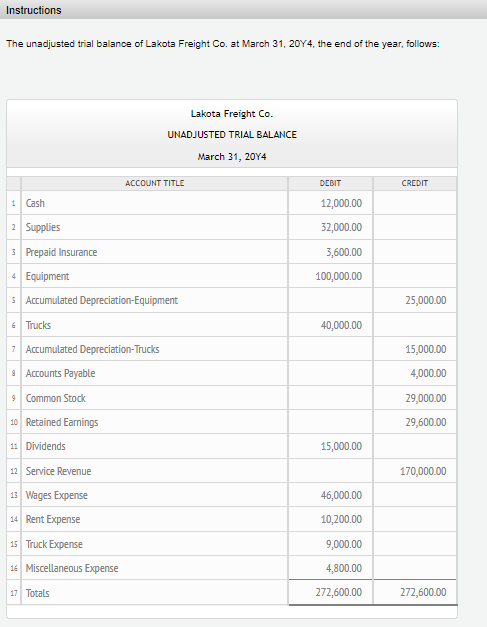

The unadjusted trial balance of Lakota Freight Co. at March 31, 20Y4, the end of the year, follows: Can I please get help on the

The unadjusted trial balance of Lakota Freight Co. at March 31, 20Y4, the end of the year, follows:

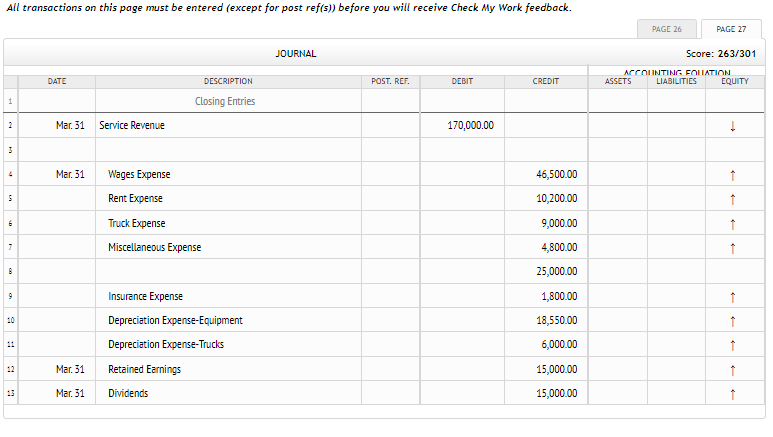

Can I please get help on the general ledger and the general journal for this question? Especially in the general journal, the format is weird, and there are accounts 11-59 to fill in the information. Please help :)

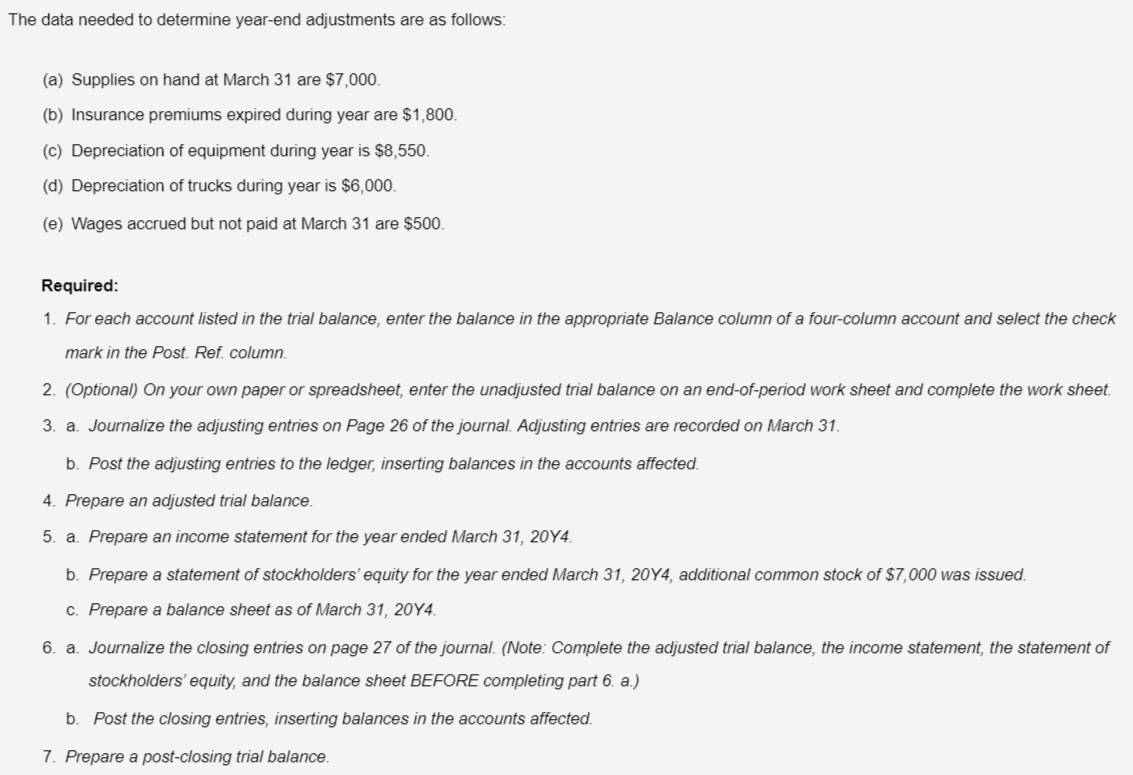

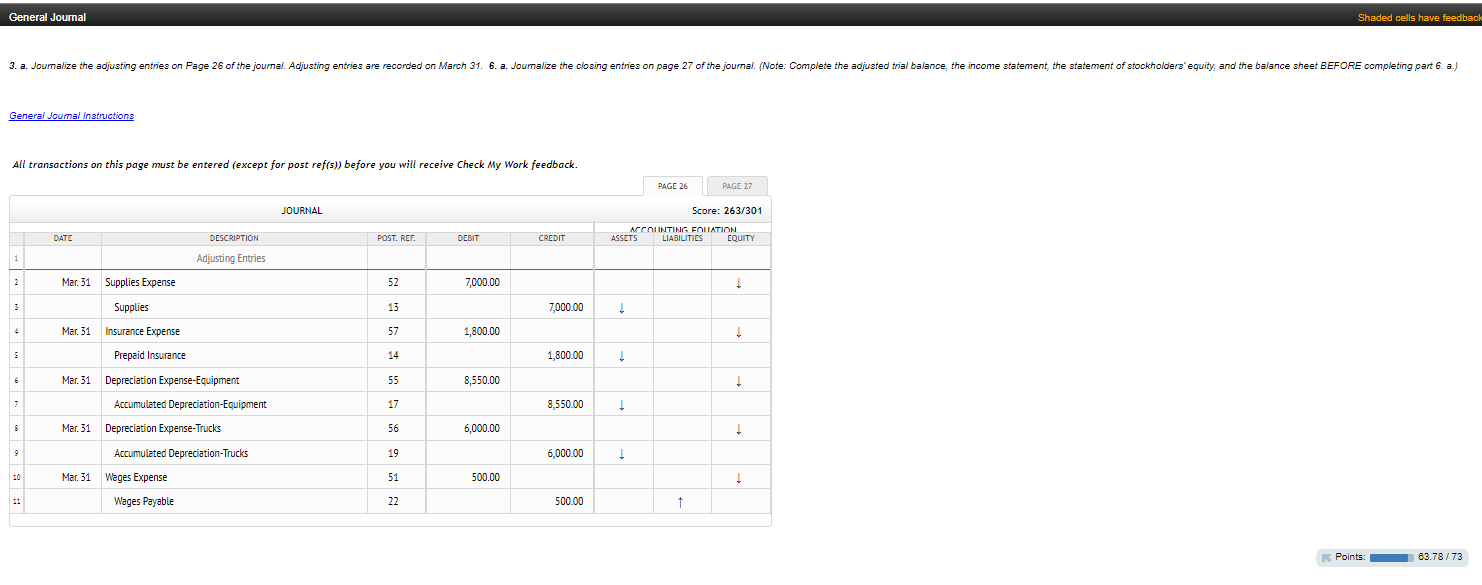

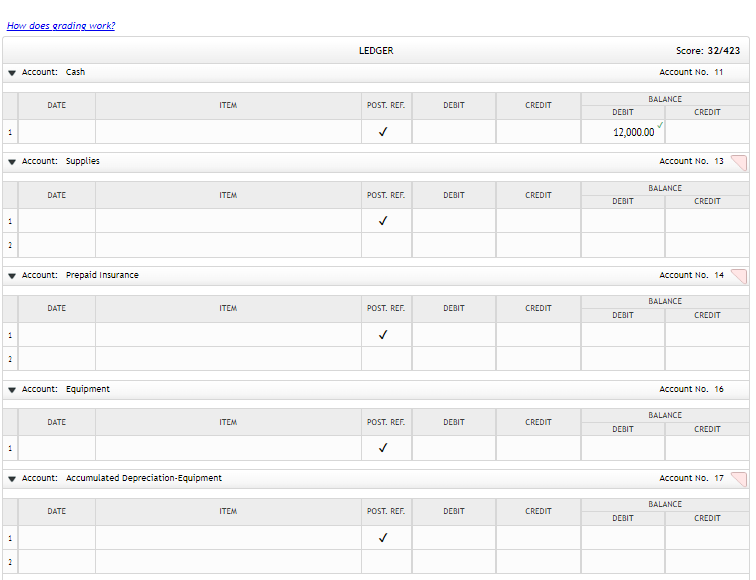

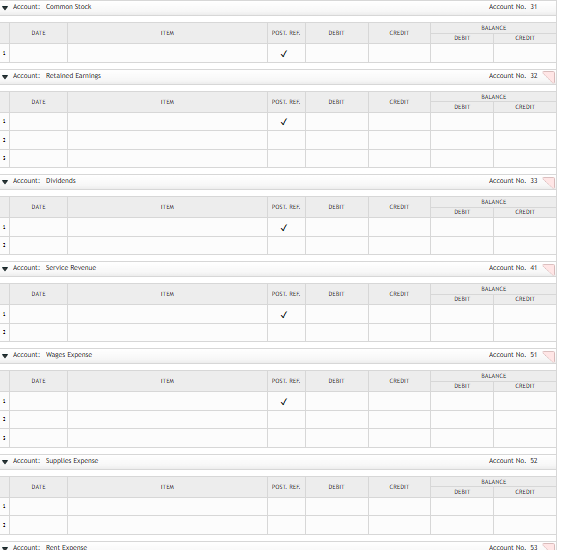

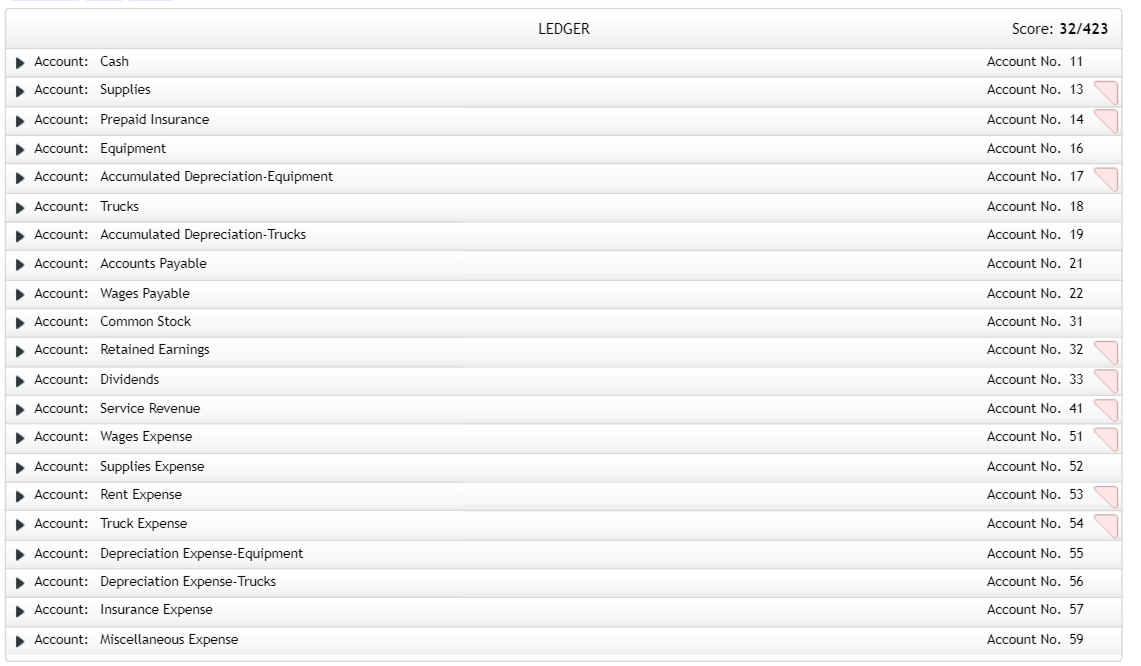

The unadiusted trial halanre of I aknta Freinht Co at March 3120Y4 the end nf the vear follnus: All transactions on this page must be entered (except for post ref(s)) before you will receive Check My Work feedback. Account: Common Stock Account No. 31 Account: Rctalned Eaminge Account No. 32 Account: Dlvidends Account No. 33 Account: Service Pcyenuc Account No. 41 Account: Wages Expense Account No. 5 DaIt IIn \begin{tabular}{|c|} \hline past. ket. \\ \hline \\ \hline \end{tabular} Account: Supplics Expense Account No. 52 All transactions on this page must be entered (except for post ref(s)) before you will receive Check My Work feedback. How does grading work? LEDGER Score: 32/423 Account No. 11 Account: Cash POST. REF. Account: Supplies Account No. 13 Account No. 14 Account: Prepaid Insurance Account: Equipment Account: Accumulated Depreciation-Equipment Account No. 16 \begin{tabular}{|c|c|} \hline POST. REF. & DEBIT \\ \hline & \\ \hline \end{tabular} BALANCE CREDIT 1 2 DATE ITEM POST. REF. POST. REF. Account No. 17 BALANCE DERIT CREDIT The data needed to determine year-end adjustments are as follows: (a) Supplies on hand at March 31 are $7,000. (b) Insurance premiums expired during year are $1,800. (c) Depreciation of equipment during year is $8,550. (d) Depreciation of trucks during year is $6,000. (e) Wages accrued but not paid at March 31 are $500. Required: 1. For each account listed in the trial balance, enter the balance in the appropriate Balance column of a four-column account and select the check mark in the Post. Ref. column. 2. (Optional) On your own paper or spreadsheet, enter the unadjusted trial balance on an end-of-period work sheet and complete the work sheet. 3. a. Journalize the adjusting entries on Page 26 of the journal. Adjusting entries are recorded on March 31. b. Post the adjusting entries to the ledger, inserting balances in the accounts affected. 4. Prepare an adjusted trial balance. 5. a. Prepare an income statement for the year ended March 31, 20Y4. b. Prepare a statement of stockholders' equity for the year ended March 31,20Y4, additional common stock of \$7,000 was issued. C. Prepare a balance sheet as of March 31, 20 Y. 6. a. Journalize the closing entries on page 27 of the journal. (Note: Complete the adjusted trial balance, the income statement, the statement of stockholders' equity, and the balance sheet BEFORE completing part 6. a.) b. Post the closing entries, inserting balances in the accounts affectedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started