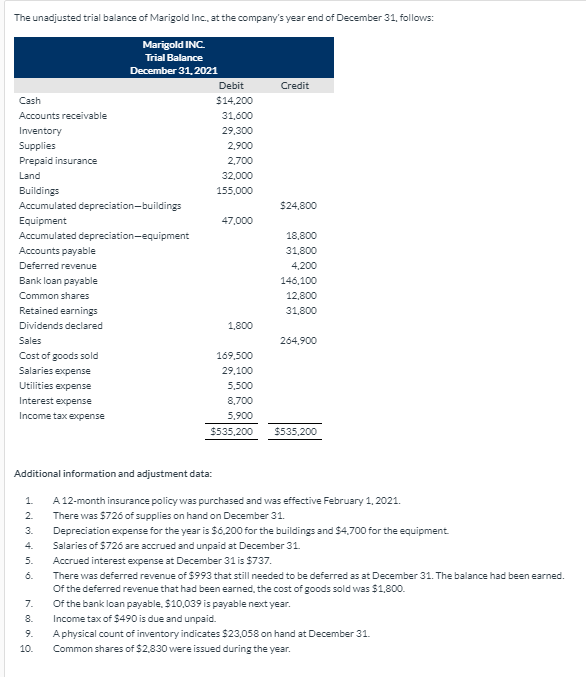

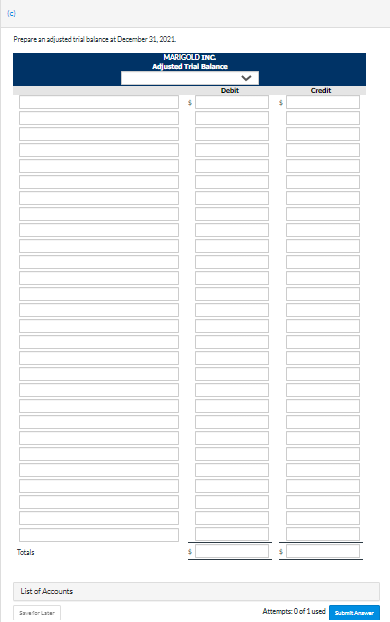

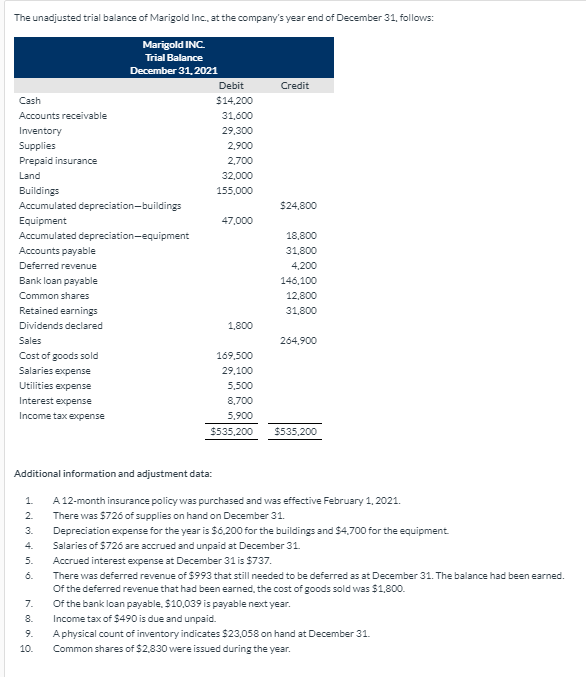

The unadjusted trial balance of Marigold Inc., at the companys year end of December 31, follows:

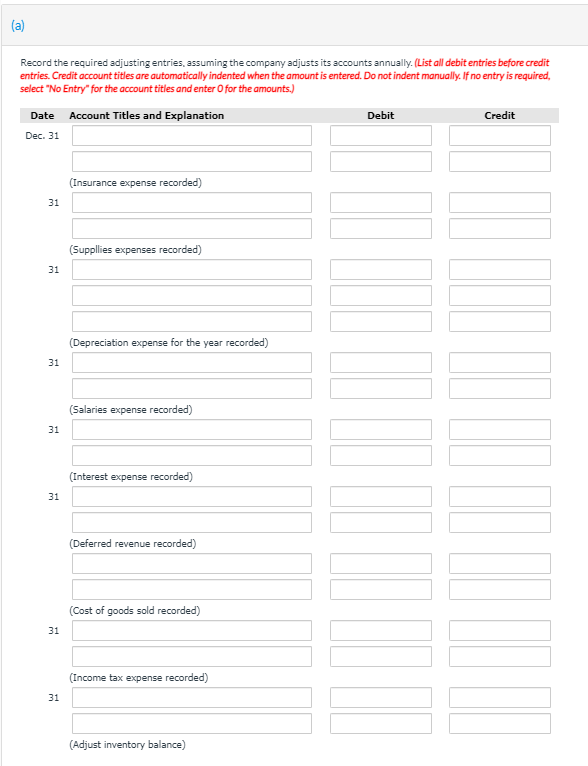

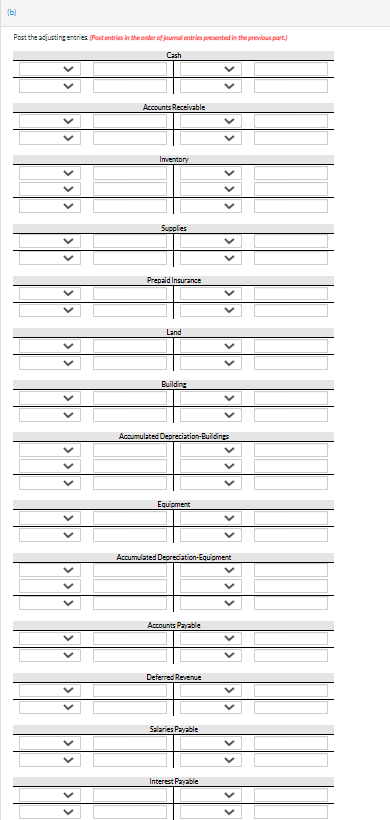

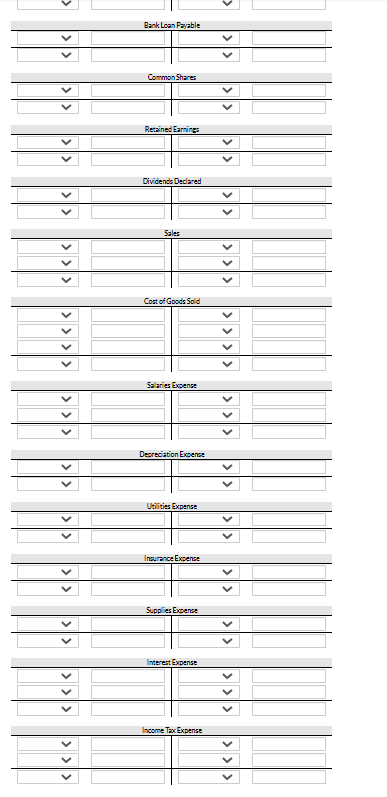

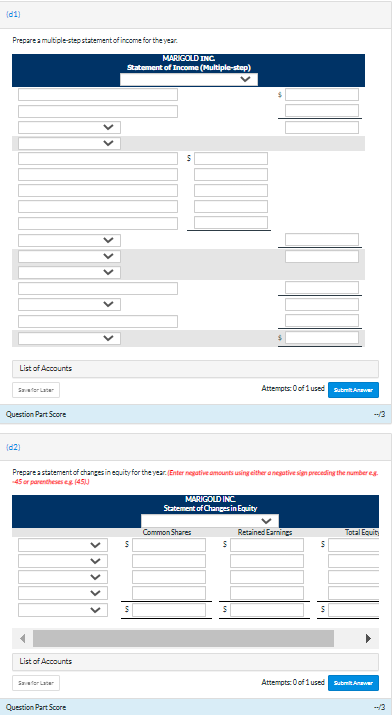

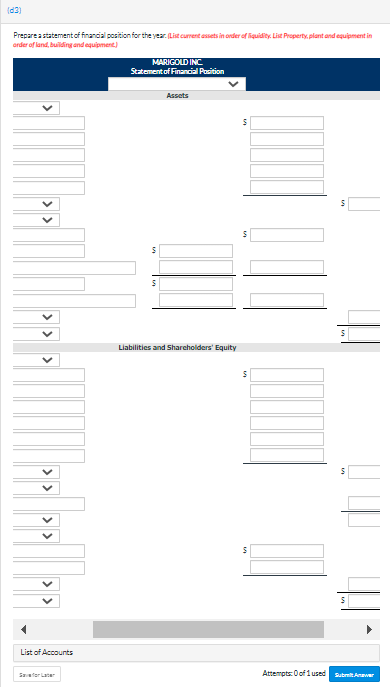

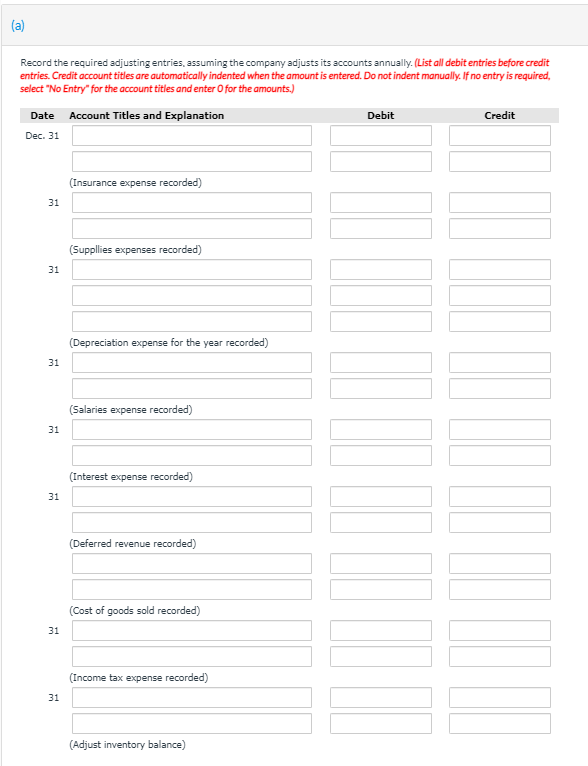

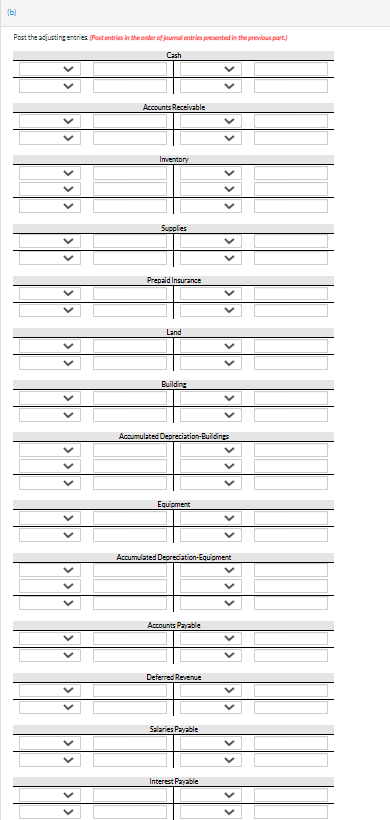

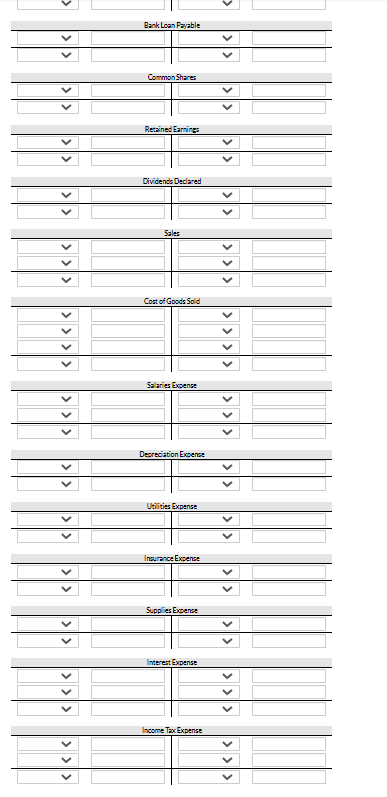

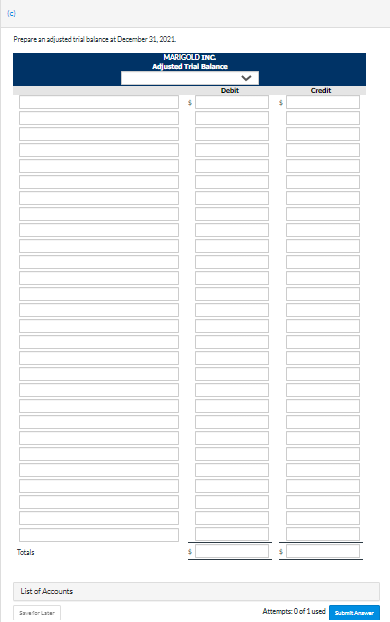

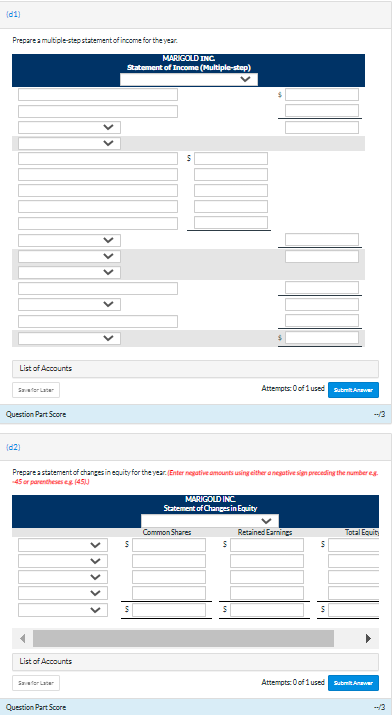

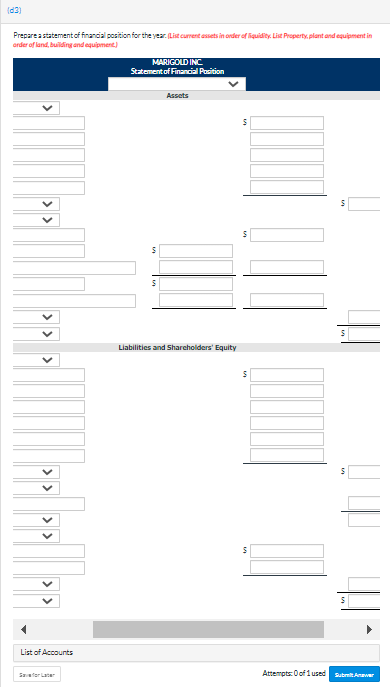

The unadjusted trial balance of Marigold Inc., at the company's year end of December 31, follows: Marigold INC. Trial Balance December 31, 2021 Debit Credit Cash $14,200 Accounts receivable 31,600 Inventory 29,300 Supplies 2.900 Prepaid insurance 2,700 Land 32,000 Buildings 155,000 Accumulated depreciation-buildings $24.800 Equipment 47.000 Accumulated depreciation-equipment 18,800 Accounts payable 31,800 Deferred revenue 4,200 Bank loan payable 146,100 Common shares 12,800 Retained earnings 31,800 Dividends declared 1.800 Sales 264,900 Cost of goods sold 169,500 Salaries expense 29.100 Utilities expense 5,500 Interest expense 8,700 Income tax expense 5.900 $535,200 $535,200 Additional information and adjustment data: 1. 2 3. 4. 5. 6. A 12-month insurance policy was purchased and was effective February 1, 2021. There was 5726 of supplies on hand on December 31. Depreciation expense for the year is $6.200 for the buildings and $4.700 for the equipment Salaries of $726 are accrued and unpaid at December 31 Accrued interest expense at December 31 is $737. There was deferred revenue of $993 that still needed to be deferred as at December 31. The balance had been earned. Of the deferred revenue that had been earned, the cost of goods sold was $1,800. Of the bank loan payable $10.039 is payable next year. Income tax of $490 is due and unpaid. A physical count of inventory indicates $23.058 on hand at December 31. Common shares of $2.830 were issued during the year. 7. 8. 9. 10. (a) Record the required adjusting entries, assuming the company adjusts its accounts annually. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31 (Insurance expense recorded) 31 (Suppllies expenses recorded) 31 (Depreciation expense for the year recorded) 31 (Salaries expense recorded) 31 (Interest expense recorded) 31 (Deferred revenue recorded) (Cost of goods sold recorded) 31 (Income tax expense recorded) 31 (Adjust inventory balance) ( b) Post the adjustingentries. Post entries in the order of journal entries presented in the previous part) Cash Accounts Receivable Inventory Supplies Prepaid Insurance Land Building Accumulated Deprecis Building Equipment Accumulated Depreciation-Equipment Accounts Payable Deferred Revenue Salaries Payable Interes: Payable Bank Loan Payable V Common Shares Retained Earnings Dividends Declared Sales >