Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The unadjusted trial balance of No Sigmund LLC at March 31, 2021, the end of the year, follows: No Sigmund LLC Unadjusted Trial Balance As

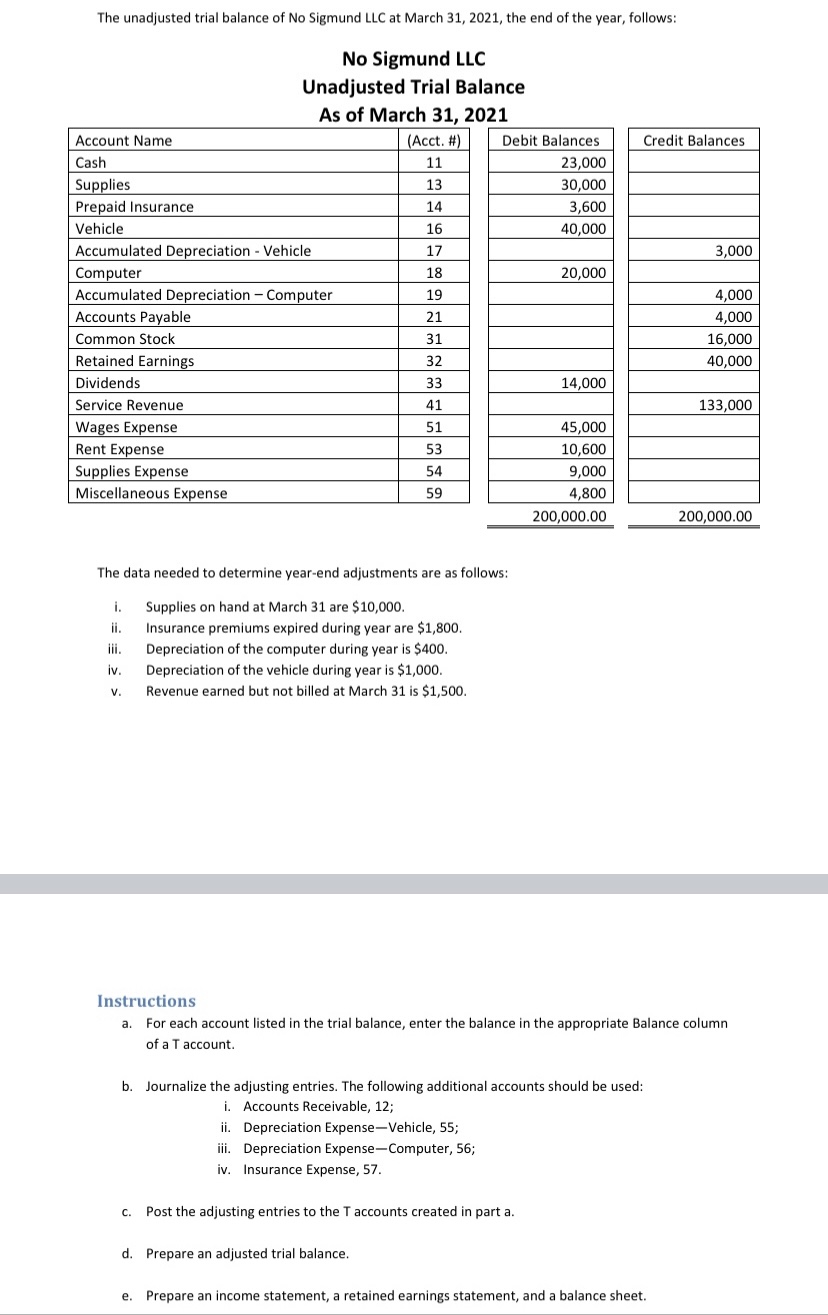

The unadjusted trial balance of No Sigmund LLC at March 31, 2021, the end of the year, follows: No Sigmund LLC Unadjusted Trial Balance As of March 31. 2021 \begin{tabular}{|r|} \hline Debit Balances \\ \hline 23,000 \\ \hline 30,000 \\ \hline 3,600 \\ \hline 40,000 \\ \hline 20,000 \\ \hline \\ \hline \\ \hline 14,000 \\ \hline 45,000 \\ \hline 10,600 \\ \hline 9,000 \\ \hline 4,800 \\ \hline 200,000.00 \\ \hline \end{tabular} The data needed to determine year-end adjustments are as follows: i. Supplies on hand at March 31 are $10,000. ii. Insurance premiums expired during year are $1,800. iii. Depreciation of the computer during year is $400. iv. Depreciation of the vehicle during year is $1,000. v. Revenue earned but not billed at March 31 is $1,500. Instructions a. For each account listed in the trial balance, enter the balance in the appropriate Balance column of a T account. b. Journalize the adjusting entries. The following additional accounts should be used: i. Accounts Receivable, 12; ii. Depreciation Expense-Vehicle, 55; iii. Depreciation Expense-Computer, 56; iv. Insurance Expense, 57. c. Post the adjusting entries to the T accounts created in part a. d. Prepare an adjusted trial balance. e. Prepare an income statement, a retained earnings statement, and a balance sheet

The unadjusted trial balance of No Sigmund LLC at March 31, 2021, the end of the year, follows: No Sigmund LLC Unadjusted Trial Balance As of March 31. 2021 \begin{tabular}{|r|} \hline Debit Balances \\ \hline 23,000 \\ \hline 30,000 \\ \hline 3,600 \\ \hline 40,000 \\ \hline 20,000 \\ \hline \\ \hline \\ \hline 14,000 \\ \hline 45,000 \\ \hline 10,600 \\ \hline 9,000 \\ \hline 4,800 \\ \hline 200,000.00 \\ \hline \end{tabular} The data needed to determine year-end adjustments are as follows: i. Supplies on hand at March 31 are $10,000. ii. Insurance premiums expired during year are $1,800. iii. Depreciation of the computer during year is $400. iv. Depreciation of the vehicle during year is $1,000. v. Revenue earned but not billed at March 31 is $1,500. Instructions a. For each account listed in the trial balance, enter the balance in the appropriate Balance column of a T account. b. Journalize the adjusting entries. The following additional accounts should be used: i. Accounts Receivable, 12; ii. Depreciation Expense-Vehicle, 55; iii. Depreciation Expense-Computer, 56; iv. Insurance Expense, 57. c. Post the adjusting entries to the T accounts created in part a. d. Prepare an adjusted trial balance. e. Prepare an income statement, a retained earnings statement, and a balance sheet Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started