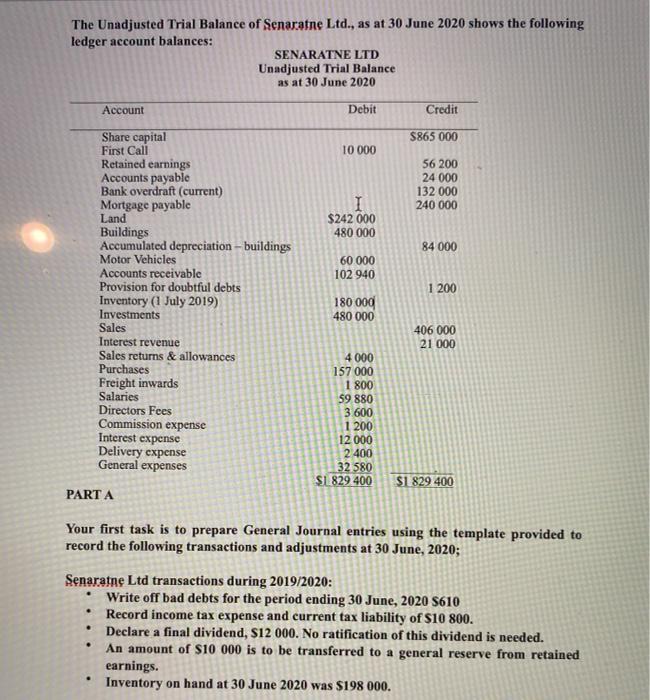

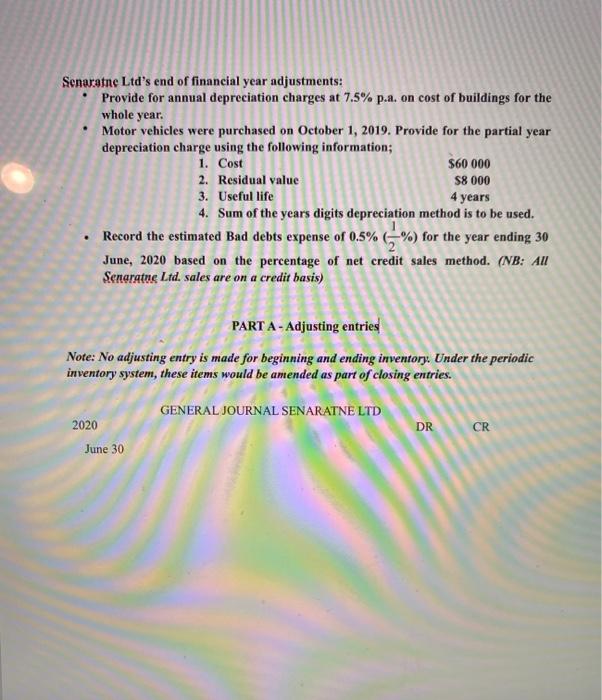

The Unadjusted Trial Balance of Senaratne Ltd., as at 30 June 2020 shows the following ledger account balances: SENARATNE LTD Unadjusted Trial Balance as at 30 June 2020 Account Debit Credit 5865 000 10 000 56 200 24 000 132 000 240 000 $242 000 480 000 84 000 60 000 102 940 1 200 Share capital First Call Retained earnings Accounts payable Bank overdraft (current) Mortgage payable Land Buildings Accumulated depreciation - buildings Motor Vehicles Accounts receivable Provision for doubtful debts Inventory (I July 2019) Investments Sales Interest revenue Sales returns & allowances Purchases Freight inwards Salaries Directors Fees Commission expense Interest expense Delivery expense General expenses 180 000 480 000 406 000 21 000 4000 157 000 1 800 59 880 3 600 1 200 12 000 2400 32 580 $1 829 400 $1 829 400 PARTA Your first task is to prepare General Journal entries using the template provided to record the following transactions and adjustments at 30 June, 2020; Senaratne Ltd transactions during 2019/2020: Write off bad debts for the period ending 30 June, 2020 3610 Record income tax expense and current tax liability of $10 800. Declare a final dividend, S12 000. No ratification of this dividend is needed. An amount of S10 000 is to be transferred to a general reserve from retained earnings. Inventory on hand at 30 June 2020 was $198 000. www is to be true Senaratne Ltd's end of financial year adjustments: Provide for annual depreciation charges at 7.5% p.a. on cost of buildings for the whole year. Motor vehicles were purchased on October 1, 2019. Provide for the partial year depreciation charge using the following information; 1. Cost $60 000 2. Residual value $8 000 3. Useful life 4 years 4. Sum of the years digits depreciation method is to be used. Record the estimated Bad debts expense of 0.5% (%) for the year ending 30 June, 2020 based on the percentage of net credit sales method. (NB: All Senaratne Ltd. sales are on a credit basis) PART A- Adjusting entries Note: No adjusting entry is made for beginning and ending inventory. Under the periodic inventory system, these items would be amended as part of closing entries. GENERAL JOURNAL SENARATNE LTD 2020 DR CR June 30