Question

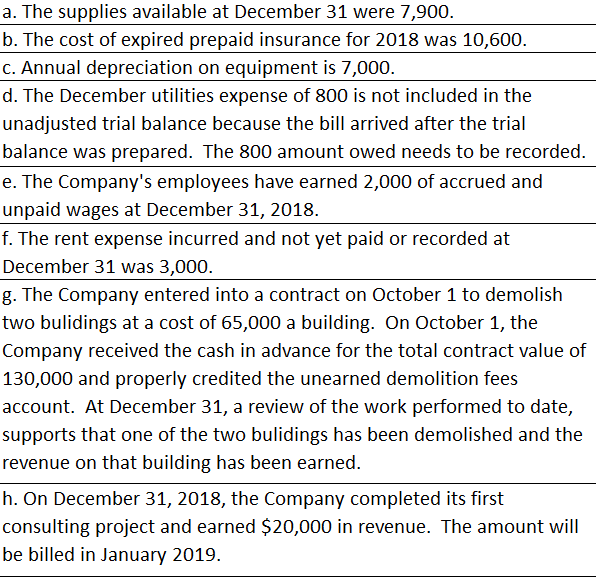

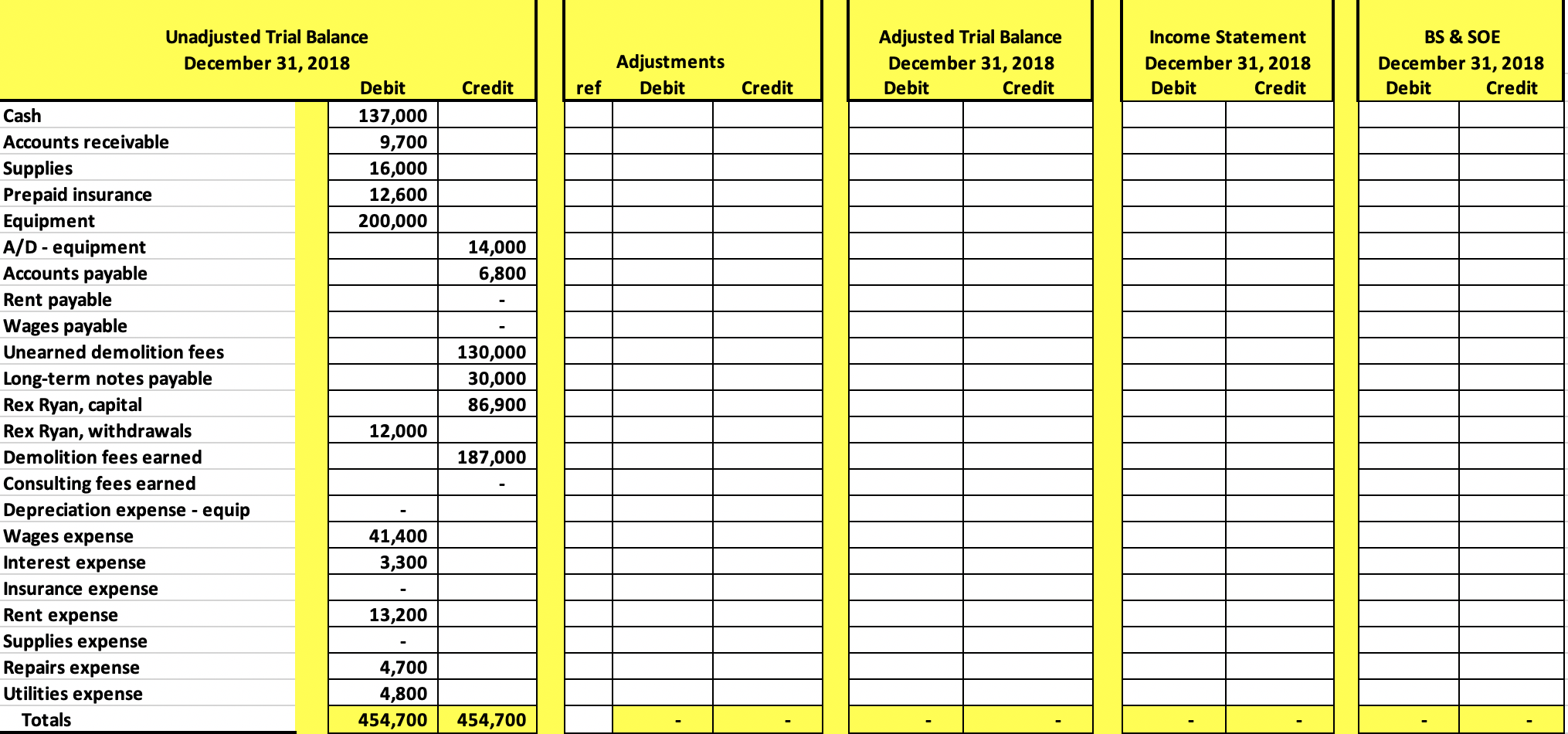

The unadjusted trial balance (TB tab) is for Rex Ryan Construction Company as of December 31, 2018. The January 1, 2018 credit balance for the

The unadjusted trial balance (TB tab) is for Rex Ryan Construction Company as of December 31, 2018. The January 1, 2018 credit balance for the Owner's Capital account was 46,900; and the owner invested $40,000 cash in the Company during the 2018 year.

REQUIRED:

1. Prepare and complete a 10 column work sheet for 2018, starting with the unadjusted trial balance and including adjustments based on these additional facts.

2. Using information from the completed 10-column work sheet in Part 1 (TB Tab), journalize the adjusting entries (AJE Tab) and the closing entries (CE Tab).

3. Prepare the income statement (IS Tab) and the statement of owner's equity (SOE Tab) for the year ended December 31, 2018 and the classified balance sheet (BS Tab) at December 31, 2018.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started