Answered step by step

Verified Expert Solution

Question

1 Approved Answer

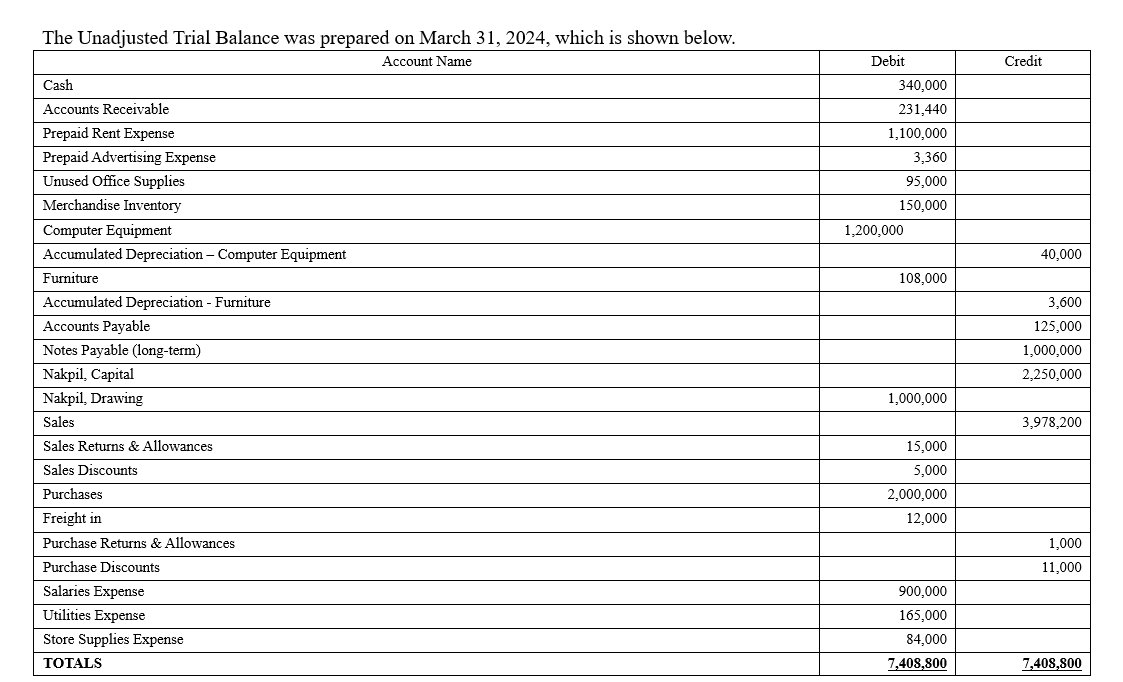

The Unadjusted Trial Balance was prepared on March 3 1 , 2 0 2 4 , which is shown below. table [ [ Account

The Unadjusted Trial Balance was prepared on March which is shown below.

tableAccount Name,Debit,CreditCashAccounts Receivable,Prepaid Rent Expense,Prepaid Advertising Expense,Unused Office Supplies,Merchandise Inventory,Computer Equipment,Accumulated Depreciation Computer Equipment,,FurnitureAccumulated Depreciation Furniture,,Accounts Payable,,Notes Payable longterm

Complete the adjustments section of the worksheet WS Use the following information as basis for adjustments for the month ended March

a Based on a physical count, ending inventory was determined to be

b Office supplies that were used for the month amounted to

c All computers and furniture were acquired in January and have an estimated useful life of years with no residual value. FDN Trading recognizes fullmonth depreciation in the month of acquisition.

d The notes payable pertains to a bank loan taken on February The principal on the loan is due after five years.

e Unpaid utilities for the month of March amount to

f Prepaid Rent was paid at the beginning of March which covers months of rent.

g Two sales staff are paid on a weekly basis for a daily rate of each. The workweek covers Monday to Saturday and the last payment was made on March March falls on a Sunday.

h Prepaid Advertising was paid to Instagram Ads on March for boosting a product post for days. The contract price was day The boost was approved and applied the next day.

i It is estimated that of the Accounts Receivable is doubtful of collection. It is the companys first adjustment for doubtful accounts.

Determine the net income or net loss for the month ended March and complete the worksheet WS

Journalize and post the adjusting entries on March using the general journal and the general ledger GJ and GL

Prepare a functional form Statement of Profit or Loss for the month ended March SPL Include any supporting notes to financial statements NOTES

Prepare a Statement of Owners Equity for the month ended March SOE

Prepare a report form Statement of Financial Position as of March SFP Include any supporting notes to financial statements NOTES

Journalize and post the closing entries on March using the general journal and the general ledger GJ and GL

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started