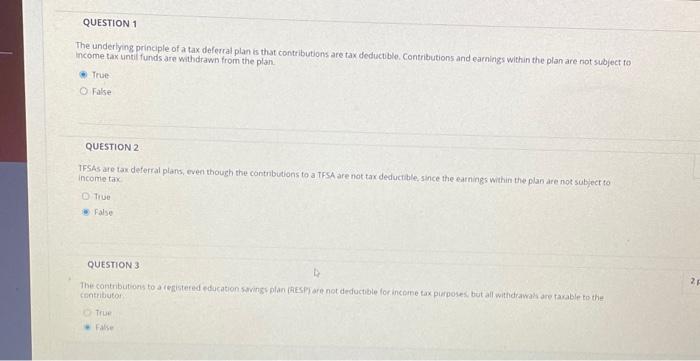

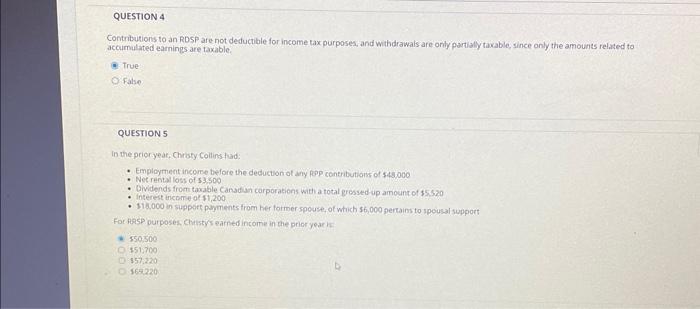

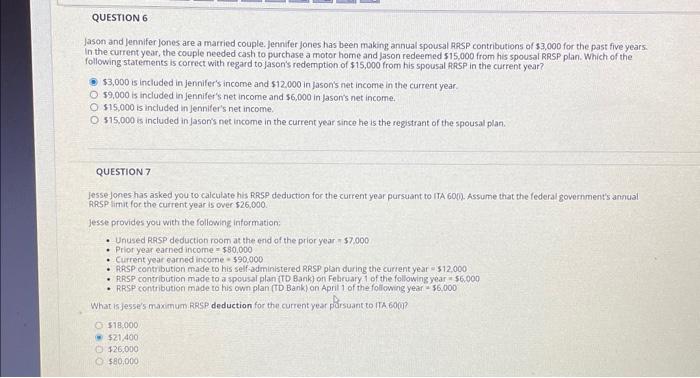

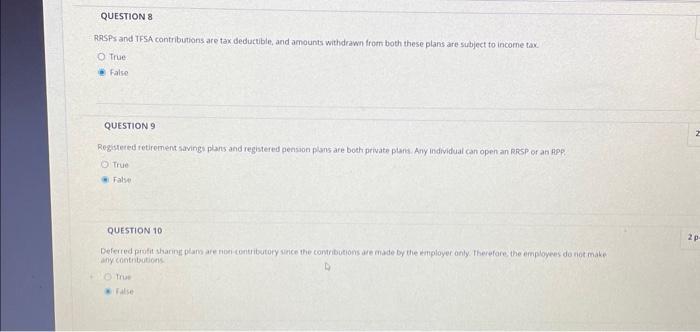

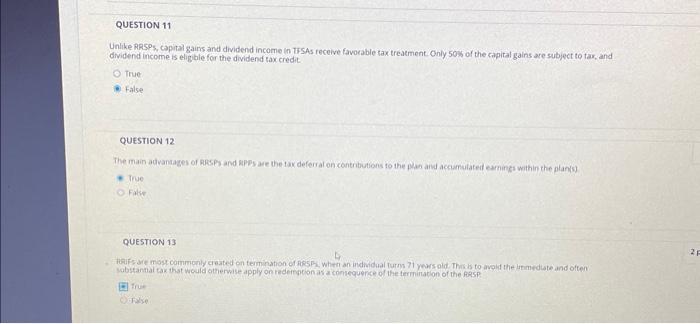

The underlying principle of a tax deferral plan is that contributions are tax deductublo. Contributions and earnings within the plan are not subject fo income tax until funds are withdrawn from the plan. True False QUESTION 2 TFSAs are tax deferral plans, even though the contnbutions to a TFSA are not tax deductible, since the eatnings within the plan are not subject to incomietax True False QUESTION 3 The contributions to a cegistered education somings plan (REsp) are not dedoctible for inceme fax purposes but all withdrawas are taxable to the cantributas True False Unlike RRSP, Capital gains and dividend income in TFSAs receive favorable sax treatment. Only \50 of the capital gains are subject to tax, and dividend income is elighile for the dividend tax credit True False QUESTION 12 True Filse QUESTION 13 true Fise Contritutions to an RDSP are not deductible for income tax purposes, and withdrawals are only partialy taxable, since only the amounts related to accumulated earnings are taxable. True False QUESTION 5 In the prioryeat, Christy Coltins tad: - Empioyment incomse before the deduction of any pap contributions of 543000 - Nec rental loss of 33.500 - Oividends from taxable Canadian carporations with a total grossed up amount of 55.570 - interest incorre or \\( \\$ 1,200 \\) - s18,000 in support payments from her former spouse, of which 56,000 pertains to spousal support For hasp purposes. Chestys earned income in the prior year ha 550.500 151,700 157.220 565220 Jason and Jennifer jones are a married couple. Jerinfer jones has been making annual spousal RpSP contributions of 53.000 for the past five years. In the current year, the couple needed cash to purchase a motor home and jason redeemed 515.000 from his spousal RRSP plan. Which of the following statements is correct with regard to jason's redemption of \\( \\$ 15,000 \\) from his spousal fpesp in the current year? \\( \\$ 3,000 \\) is included in jennifer's income and \\( \\$ 12,000 \\) in fason's net income in the current year. 59,000 is included in jennifer's net income and \\( \\$ 6,000 \\) in jason's net income. \\$15,000 is included in jennifer's net income. \\$15,000 is included in Jason's net income in the current year since he is the registrant of the spousal plan. QUESTION 7 Jessejones has asked you to calculate his RRSP deduction for the current year pursuant to ITA 600 ). Assume that the federal government's annual RRSP limit for the current year is over \\( \\$ 26,000 \\). Jesse provides you with the following information: - Unused RaSP deduction room at the erid of the prior year \\( n \\$ 7,000 \\) - Prior year earned income \\( =\\$ \\$ 0,000 \\) - Current year earned income \\( =\\$ 90,000 \\) - PRSP contribution made to his self-administered RRSP plan during the current year w \\( \\$ 12,000 \\) - RRSP contribution made to a spousal plan (TD Bank) on February 4 of the following year is 56,000 - RRSP contribution made to his own plan (TD Bank) on April 1 of the following year \\( =\\$ 6,000 \\) What is jesse's muxamum RRSP deduction for the current year poursuant to ITh 600 ? 318,000 \\( \\$ 21.400 \\) \\( \\$ 26,000 \\) \\( \\$ 80,000 \\) RASPS and IFSA contributions are tax deductible, and amounts withdrawn from both these plans are subject to income tax. True. False QUESTION 9 Regisered retirement savingi plans and registered pension plans are both private plans. Any individual can open an RRSP of an RPP: True False QUESTION 10 Deferied profit sharnes plam are nonicontributory sice the contributions are made by the employer only therefore the employees do not make any contributions True ralse