a. SMC recently re-named itself from Silo Manufacturing Corporation to give the impression they were a modern manufacturer. Located in Blacksburg, Virginia, SMC is a

a. SMC recently re-named itself from Silo Manufacturing Corporation to give the impression they were a modern manufacturer. Located in Blacksburg, Virginia, SMC is a regional provider of grain towers/silos for farms as far north as University Park, Pennsylvania, as far west as Knoxville, Tennessee, and as far south as Statesboro, Georgia. In recent years SMC has extended their business to include the latest in agricultural engineering services for elevator design and installation. Their core business still remains the fabrication of the grain elevators.

Vice President of Manufacturing Ferris Martin stopped by the office of SMC’s President Robert Lewin and remarked, “I need your help resolving an issue between ourFinancial Comptroller,Fred Ferguson,and our Purchasing Director,Peter Patrachalski. These two executives continue to argue with each other about our ordering policies.” “How can I help?” asked Lewin, peering over his glasses. “Both Fred and Peter are pretty strong-willed and protective of their areas?”

“It boils down to conflicting goals,” replied Martin. “Ferguson saysthe cost to carry inventory is 32% and is trying to keep inventory costs low. Patrachalski had his intern identify his ordering costs and was shocked to find that every time our employees place an order it costs us $48 regardless of the quantity ordered. Each one would like to dictate how the other operates so they can achieve their own performance goals. I’d like to have them meet somewhere in the middle but I’m not sure if that is the best solution.”

“SMC’s primary performance goals are to reduce cost and increase profitability” exclaimed Lewin, “These guys need to understand SMC comes first. Offer them a test case to propose and defend their ordering policy and we’ll sort this out.”

“I suggest part number 64-1909?” replied Martin. “The unit cost is $112.00 and we order 10,752 units per 365 day year. While we do not have to order by the case, it does come in 15 units per case. The average lead time from when we place the order to the time we receive it at our dock is 8.2 days with a standard variation of 1.7 days.”

Later that week in the conference room, Ferguson and Patrachalski each offered proposals for ordering part number 64-1909. Purchasing Director Patrachalski stated he was trying to keep his purchasing costs down by ordering in larger quantities and suggested buying 32 cases at a time. He has also indicated he would like to avoid ordering in partial cases since doing so may resultin shipments of incorrect quantities and consequent higher costs. Comptroller Ferguson claimed the most important issue was the cost to carry inventory and argued for ordering 4 cases at a time to keep average inventories low. Seeking a compromise, Lewin suggested using economic order quantity(EOQ).

Lewin stated, “economic order quantity can be very complex. The original EOQ, known as ‘Wilson’s EOQ’, was actually developed by F. W. Harris12in 1913, but a consultant named R. H. Wilson, who embraced the model and applied it extensively, was given credit for his early in-depth analysis of it.34It determines the lowest total inventory cost by calculating the optimum order quantity denoted as Q*. Economic order quantity incorporates the trade-off between inventory carrying cost and ordering cost—exactly the trade-off we are facing with Finance and Purchasing.”

You can now find more complicated economic order quantity models extending the concept to consider discount pricing for ordering in larger quantities, backordering costs, differences in transportation rates if you ship by full truckload instead of LTL, including the step function of adding another warehouse as it impacts inventory carrying costs, or bridging into optimal production quantities. Anything that might influence the economic order quantity variables—there is probably an extension. There is probably even one considering the phases of the moon!”

There are a lot of assumptions for economic order quantity including:

5•A continuous, constant, and known rate of demand

•A constant and known replenishment or lead time

•Entire order delivered at same time—no in-transit inventory

•All demand is satisfied

•A constant price or cost that is independent of the order quantity (i.e.,no quantity discount)•No inventory in transit

•One item of inventory or no interaction between items

•Infinite planning horizon

•Unlimited capital“But we should just use the original Harris-Wilson Model and consider tweaking it later. As I recall, the basic formula is:”

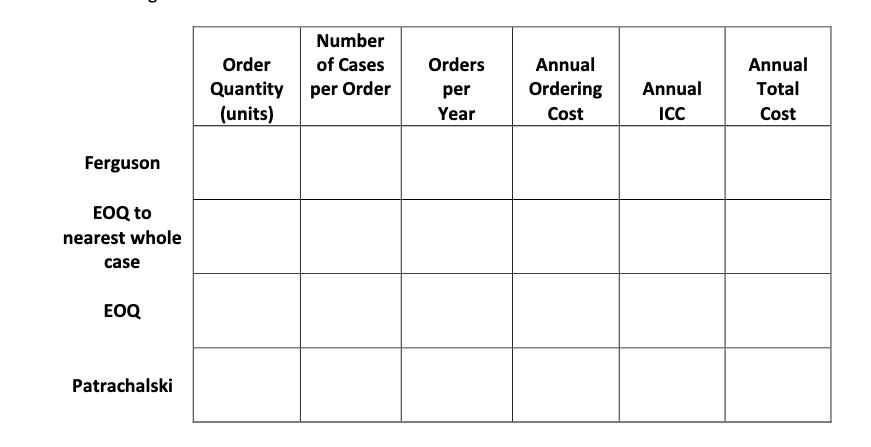

t the end of the meeting, Martin agreed to take the proposals and summarize them in the following chart:

QUESTIONS:1.What is the cost difference between Ferguson's proposal to order 4 cases each time and Patrachalski's proposal to order 32 cases each time?

2.Lewin suggested looking at economic order quantity.Based on the lowest total annual cost, what order quantity should Martin recommend?

3.Let's explore the concept of "robustness." Lewin’s proposal to use economic order quantity may be unrealistic since SMC would like to place orders in whole cases. If the order quantity is decreasedto the nearest whole case (which is a 2.78% reduction) what percent would your total annual cost change? What percent would your annual total cost change if the order quantity is increasedto the nearest whole case? Hint: Use the formula ([New Total Cost / Old Total Cost]–1 )

Silo Manufacturing Corporation–Part B

Vice President of Manufacturing Ferris Martin stopped by the office of SMC’s President Robert Lewin and remarked, “Robert, your suggestion last month to use Economic Order Quantity (EOQ) has already helped us optimize the trade-offs between inventory carrying costs and order costs.

“We are doing a better job of working as a cohesive company,” replied Lewin, “but we are still faced with conflicting management goals. I recently hired Ed Davis as our new Inventory Control Manager and plan to task him with the goal of reducing our corporate inventories by 8.9% at the next executive strategic roundtable. There are still many people in our company that think it is a zero-sum game and Ed will have to manage his operations carefully so he does not step on any toes.”

Two weeks later Ed Davis attended the executive strategic roundtable. The first agenda item was the assignment of annual performance goals. The 8.9% goal to reduce corporate inventories did not come as asurprise. In fact, Ed had already started looking at opportunities to reduce order quantities to meet the goal. Since Lewin supported the implementation of economic order quantity, Davis knew he would have to manage the variables used in EOQ in order to succeed.

During the roundtable meeting many aggressive, yet obtainable, performance goals were proposed. Davis was pleased to see Vice President of Sales Steve Smith, Financial Comptroller Fred Ferguson,and Purchasing Director Peter Patrachalski all agree to goals to improve their areas. Davis left the meeting encouraged at the camaraderie and was delighted that he had joined such a forward-thinking organization. In this organizational culture he might even be ableto implement a just-in-time inventory system!

The next morning after a restful sleep, Davis sat down to his double espresso and orange-cranberry-pistachio biscotti to mull over his new performance goal to reduce corporate inventories by 8.9%. It suddenlydawned on him:Smith, Ferguson, and Patrachalski’s goals all made strategic sense but if Smith increased annual demand, the economic order quantity and corporate inventory levels would increase. Likewise, if Ferguson and Patrachalski were also successful,his inventory levels would further escalate. Their success would exacerbate his failure. The only action he could take to positively counter these “improvements” was to reduce the cost of placing an order. Getting to just-in-time may be another thing all together!

His dilemma reminded him of a quote from Albert Einstein:6“The mere formulation of a problem is far more often essential than its solution, which may be merely a matter of mathematical or experimental skill. To raise new questions, new possibilities, to regard old problems from a new angle requires creative imagination and marks real advances.”

He would utilize the details for part number 64-1909 as a basis todetermine what he needed to do to meet his inventory reduction goal. Last year part number 64-1909 used 10,752 units at an average cost per unit of $112. The cost to place an order was $48 regardless of the quantity ordered and the SMC cost to carry inventory was 32%.

QUESTIONS:

4.What would the cost to place an order need to be forDavis to meet his inventory reduction objective if Vice President of Sales Steve Smith achieves his goal to increase sales by 9.6% (HINT: a 10% increase in sales of 100 units results in sales of 110 units).

5.What would the cost to place an order need to be for Davis to meet his inventory reduction objective if Vice President of Sales Steve Smith achieves his goal to increase sales by 9.6% andFinancial Comptroller Fred Ferguson achieves his goal of reducing the cost to carry inventory from 32.0% to 29.4%.

6.What would the cost to place an order need to be for Davis to meet his inventory reduction objective if Vice President of Sales Steve Smith achieves his goal to increase sales by 9.6% andFinancial Comptroller Fred Ferguson achieves his goal of reducing the cost to carry inventory from 32.0% to 29.4% andPurchasing Director Peter Patrachalski achieves his goal of reducing the average cost per unit by 5.2% (HINT: a 10% reduction in a $10 unit cost results in a $9 unit cost).

7.What would the cost to place anorder need to be if Davis implemented a just-in-time approach so ordering 1 unit at a time is the optimal ordering quantity? Use the original variables for part number 64-1909. Your answer must be accurate to sixdecimal places (e.g. $47.123456)8.Provide three (3) viable recommendations which would result in a lower cost to place an order. Keep in mind that providing a "viable recommendation" means you must move beyond theoretical statements and be immediately actionable. Do not skimp on your details (but don't make anything up either)...you must indicate howto lower the cost in order to receive full points.

Number Order of Cases Orders Annual Annual Quantity (units) per Order per Ordering Annual Total Year Cost ICC Cost Ferguson OQ to nearest whole case EOQ Patrachalski

Step by Step Solution

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

1 112x10752107526048 6023584 121390080 112x107521075248048 48023...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started