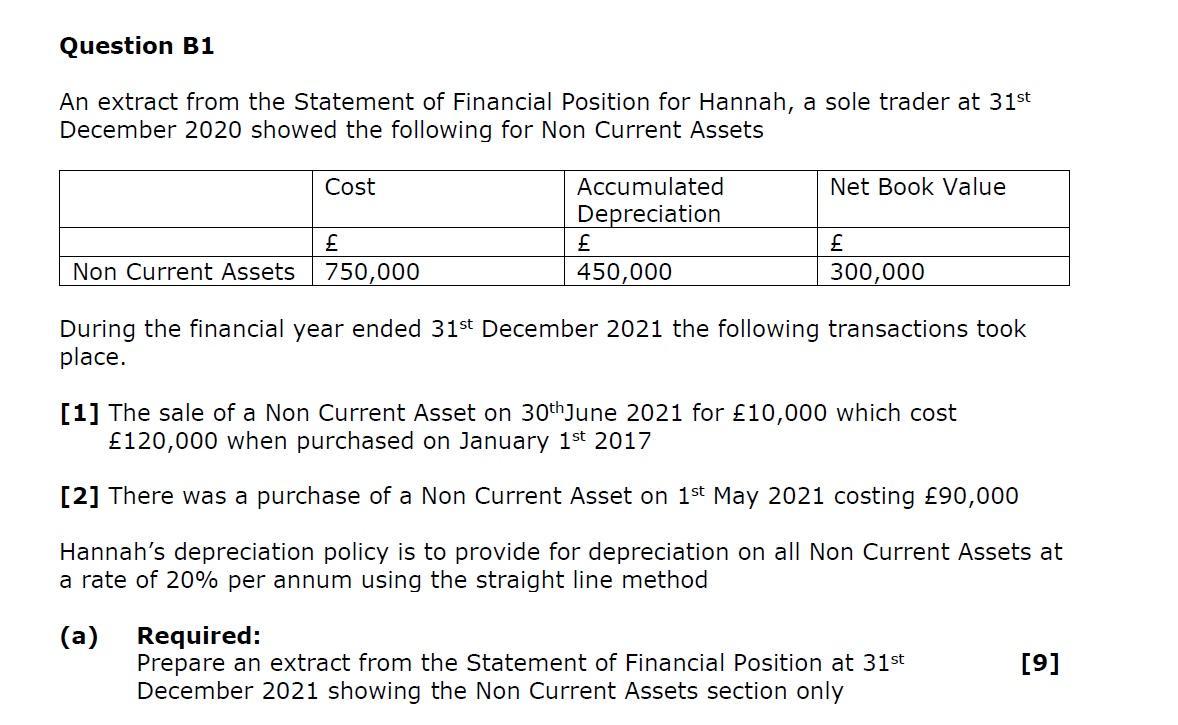

Question B1 An extract from the Statement of Financial Position for Hannah, a sole trader at 31st December 2020 showed the following for Non

Question B1 An extract from the Statement of Financial Position for Hannah, a sole trader at 31st December 2020 showed the following for Non Current Assets Cost Non Current Assets 750,000 Accumulated Depreciation Net Book Value 450,000 During the financial year ended 31st December 2021 the following transactions took place. 300,000 [1] The sale of a Non Current Asset on 30th June 2021 for 10,000 which cost 120,000 when purchased on January 1st 2017 [2] There was a purchase of a Non Current Asset on 1st May 2021 costing 90,000 Hannah's depreciation policy is to provide for depreciation on all Non Current Assets at a rate of 20% per annum using the straight line method (a) Required: Prepare an extract from the Statement of Financial Position at 31st December 2021 showing the Non Current Assets section only [9]

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Cost Accumulated Net Book Value Depreciation NonCurrent Assets 750000 630000 120000 Explanat...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started