Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The United States employs a progressive tax system, under which dollars you earn in higher tax brackets are taxed at a different (and higher)

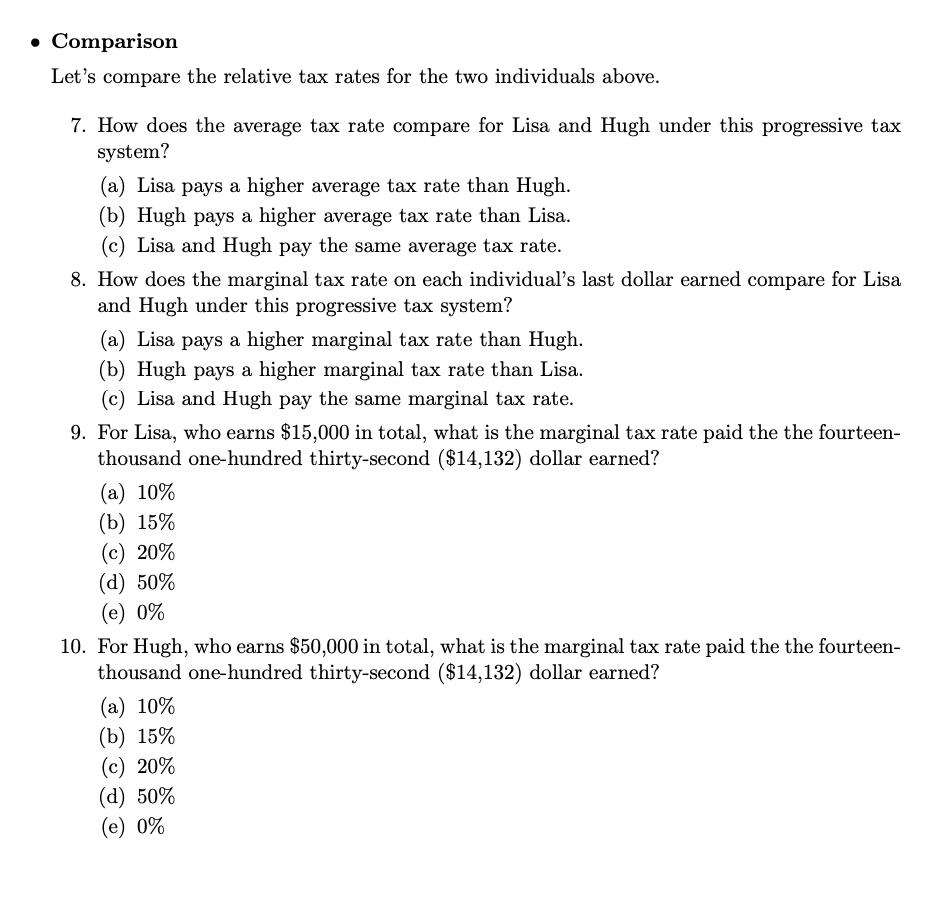

The United States employs a progressive tax system, under which dollars you earn in higher tax brackets are taxed at a different (and higher) rate than the dollars earned in lower tax brackets. Assume you live and work in a country with a similar tax structure, which was broken down for 2019 for a single individual as follows: Tax Bracket $1 - $10,000 $10,001 $40,000 $40,001 - - Tax Rate 10% 20% 50% Determining Taxable Income Use the table above to answer the following questions: 1. What is the marginal tax rate on the last dollar earned by Lisa, a worker with $15,000 in income in 2019? __% 2. How much money in taxes would Lisa, who earned $15,000, owe in total for 2019? $ 3. What is the average income tax rate paid by Lisa, with $15,000 in income in 2019? . _-_-% 4. What is the marginal tax rate on the last dollar earned by Hugh, a worker with $50,000 in income in 2019?. _% 5. How much money in taxes would Hugh, who earned $50,000, owe in total for 2019? $_ 6. What is the average income tax rate paid by Hugh, with $50,000 in income in 2019? .. _-_% Comparison Let's compare the relative tax rates for the two individuals above. 7. How does the average tax rate compare for Lisa and Hugh under this progressive tax system? (a) Lisa pays a higher average tax rate than Hugh. (b) Hugh pays a higher average tax rate than Lisa. (c) Lisa and Hugh pay the same average tax rate. 8. How does the marginal tax rate on each individual's last dollar earned compare for Lisa and Hugh under this progressive tax system? (a) Lisa pays a higher marginal tax rate than Hugh. (b) Hugh pays a higher marginal tax rate than Lisa. (c) Lisa and Hugh pay the same marginal tax rate. 9. For Lisa, who earns $15,000 in total, what is the marginal tax rate paid the the fourteen- thousand one-hundred thirty-second ($14,132) dollar earned? (a) 10% (b) 15% (c) 20% (d) 50% (e) 0% 10. For Hugh, who earns $50,000 in total, what is the marginal tax rate paid the the fourteen- thousand one-hundred thirty-second ($14,132) dollar earned? (a) 10% (b) 15% (c) 20% (d) 50% (e) 0%

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1 The marginal tax rate on the last dollar earned by Lisa a worker with 15000 in income in 2019 is 20 2 Lisa who earned 15000 would owe 2500 in taxes ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started