Question

The United States Multinational subsidiary company located in Malaysia could borrow 1-year short-term financing in Malaysia at 6% or in United States at 7%.

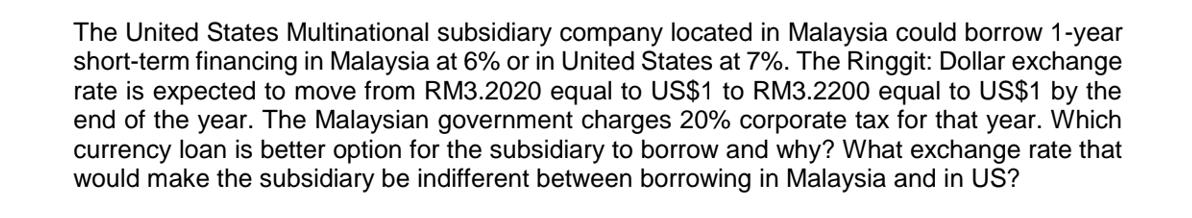

The United States Multinational subsidiary company located in Malaysia could borrow 1-year short-term financing in Malaysia at 6% or in United States at 7%. The Ringgit: Dollar exchange rate is expected to move from RM3.2020 equal to US$1 to RM3.2200 equal to US$1 by the end of the year. The Malaysian government charges 20% corporate tax for that year. Which currency loan is better option for the subsidiary to borrow and why? What exchange rate that would make the subsidiary be indifferent between borrowing in Malaysia and in US?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine which currency loan is the better option for the subsidiary we need to compare the effective costs of borrowing in Malaysia and the Unite...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost management a strategic approach

Authors: Edward J. Blocher, David E. Stout, Gary Cokins

5th edition

73526940, 978-0073526942

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App