The University of

The University of

ManchesterManchester

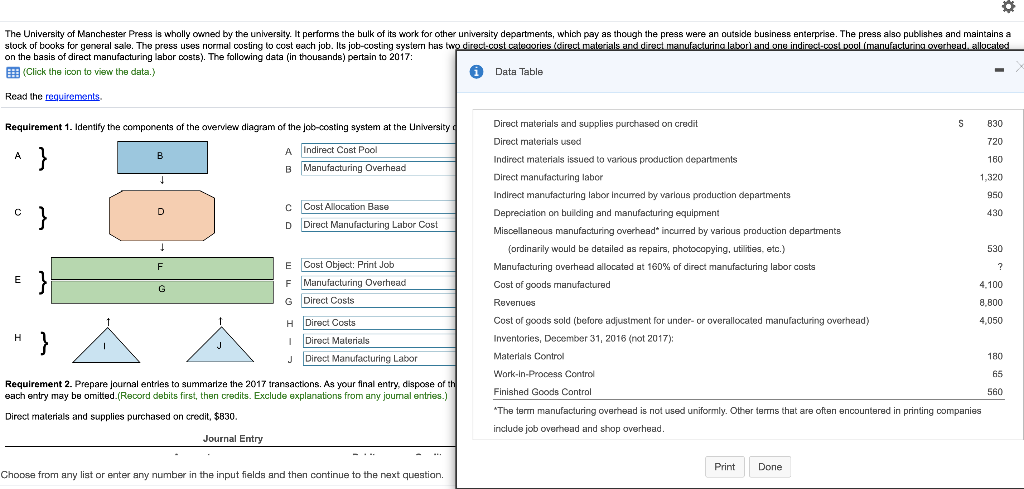

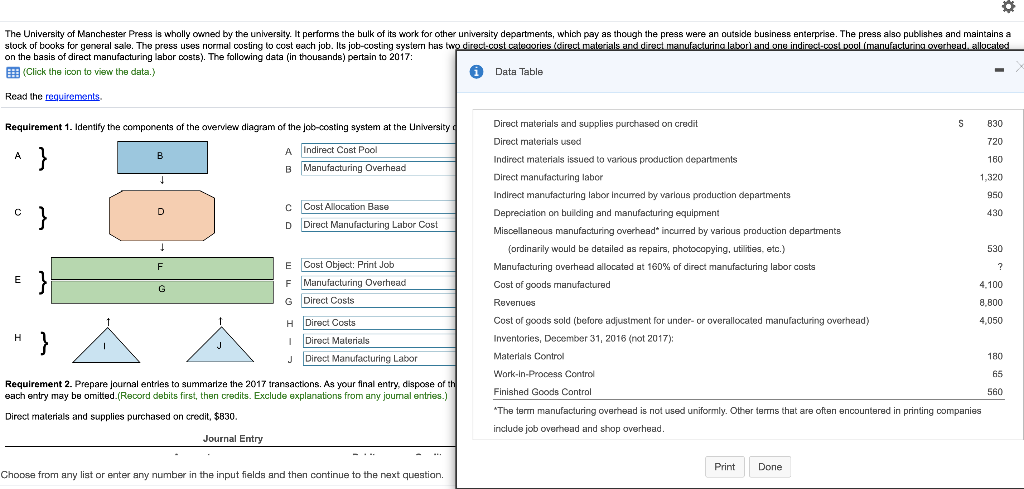

Press is wholly owned by the university. It performs the bulk of its work for other university departments, which pay as though the press were an outside business enterprise. The press also publishes and maintains a stock of books for general sale. The press uses normal costing to cost each job. Its job-costing system has two direct-cost categories (direct materials and direct manufacturing labor) and one indirect-cost pool (manufacturing overhead, allocated on the basis of direct manufacturing labor costs). The following data (in thousands) pertain to 2017:

Direct materials and supplies purchased on credit

$830

Direct materials used

720

Indirect materials issued to various production departments

160

Direct manufacturing labor

1,320

Indirect manufacturing labor incurred by various production departments

950

Depreciation on building and manufacturing equipment

430

Miscellaneous manufacturing overhead* incurred by various production departments

(ordinarily would be detailed as repairs, photocopying, utilities, etc.)

530

Manufacturing overhead allocated at 160% of direct manufacturing labor costs

?

Cost of goods manufactured

4,100

Revenues

8,800

Cost of goods sold (before adjustment for under- or overallocated manufacturing overhead)

4,050

Inventories, December 31, 2016 (not 2017):

Materials Control

180

Work-in-Process Control

65

Finished Goods Control

560

*The term manufacturing overhead is not used uniformly. Other terms that are often encountered in printing companies

include job overhead and shop overhead.

Requirement 1. Identify the components of the overview diagram of the job-costing system at the University of

ManchesterManchester Press.

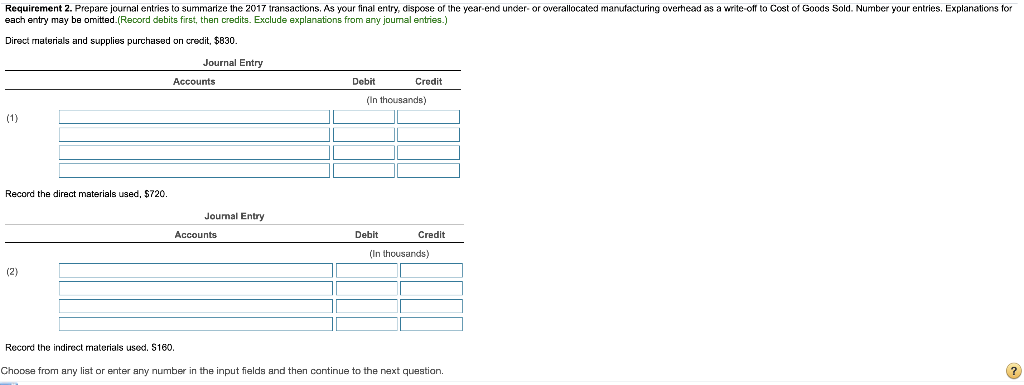

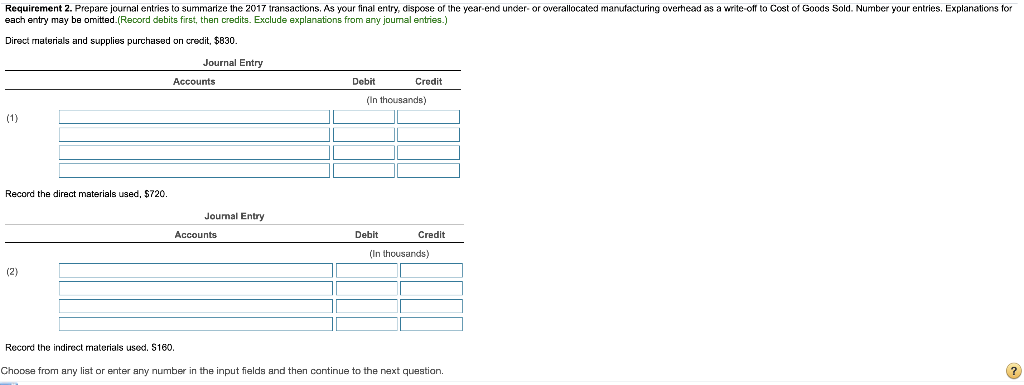

Requirement 2. Prepare journal entries to summarize the 20172017 transactions. As your final entry, dispose of the year-end under- or overallocated manufacturing overhead as a write-off to Cost of Goods Sold. Number your entries. Explanations for each entry may be omitted.(Record debits first, then credits. Exclude explanations from any journal entries.) Direct materials and supplies purchased on credit, $ 830

(1)Direct materials and supplies purchased on credit,$830.

(2)Record the direct materials used, $ 720

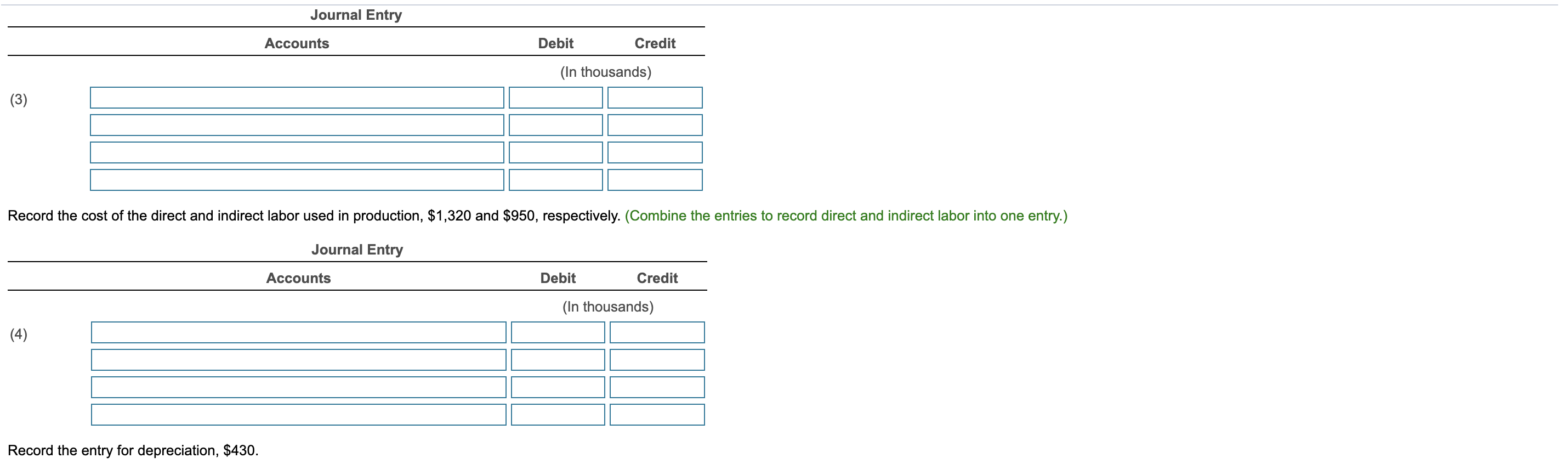

(3)Record the indirect materials used $ 160

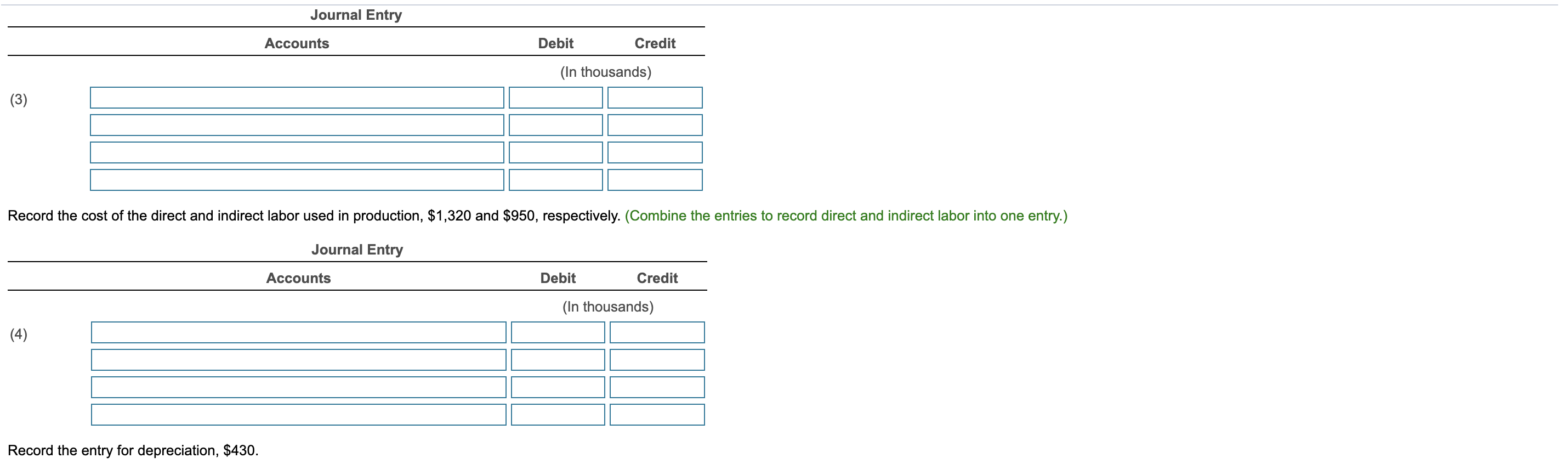

(4)Record the cost of the direct and indirect labor used in production,$1,320 and$ 950, respectively. (Combine the entries to record direct and indirect labor into one entry.)

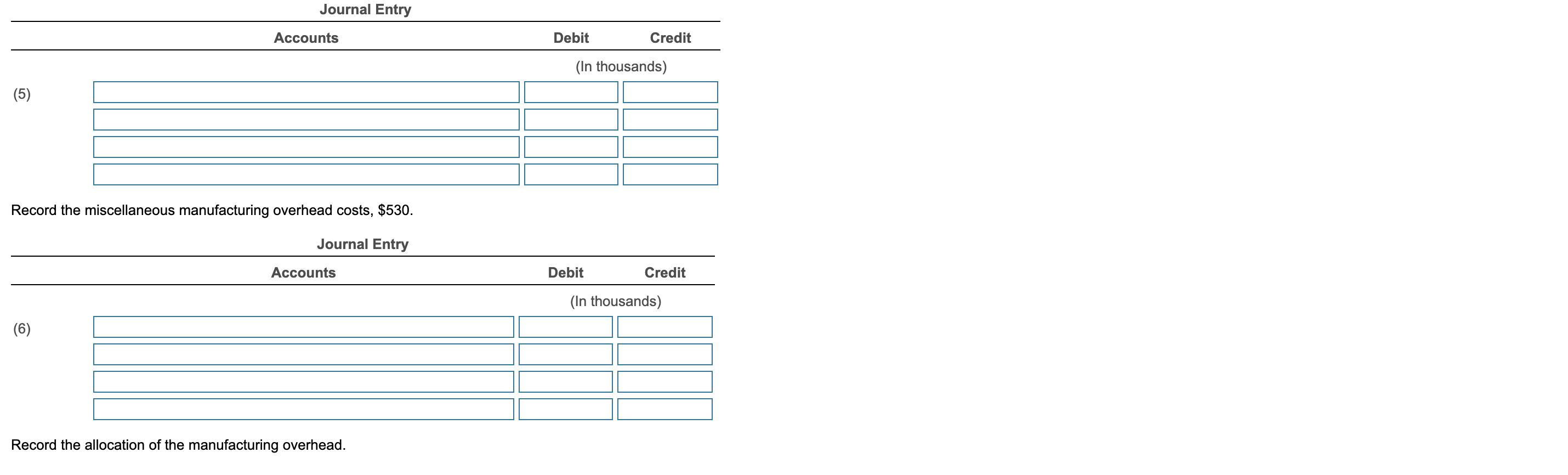

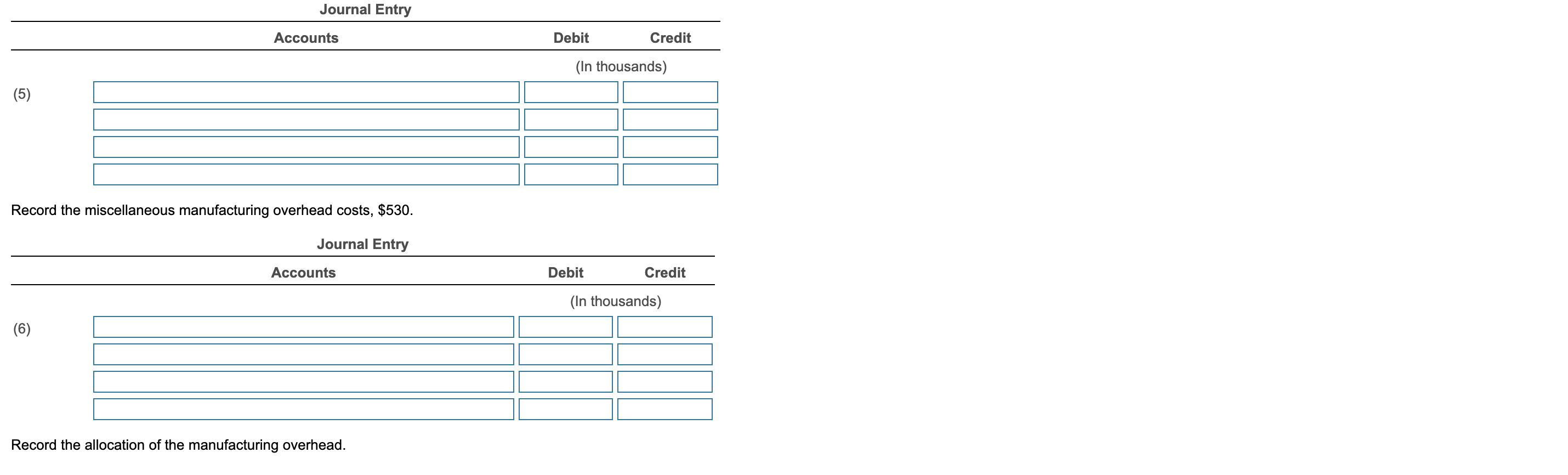

(5)Record the entry for depreciation,$ 430

(6)Record the miscellaneous manufacturing overhead costs,$530.

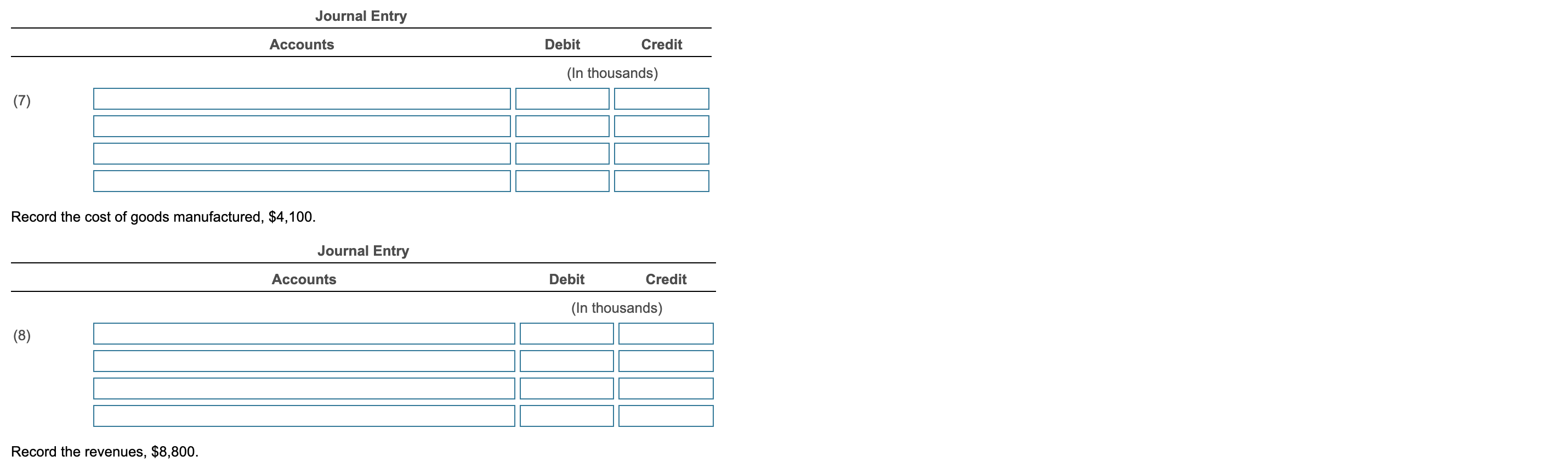

(7)Record the allocation of the manufacturing overhead.

(8)Record the cost of goods manufactured,$4,100.

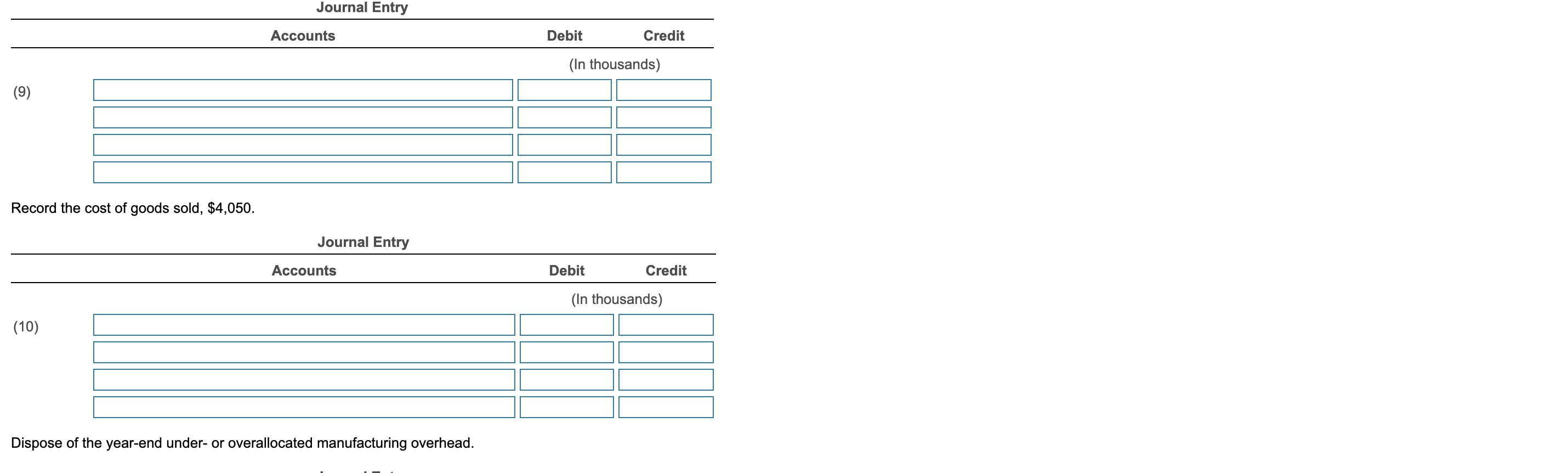

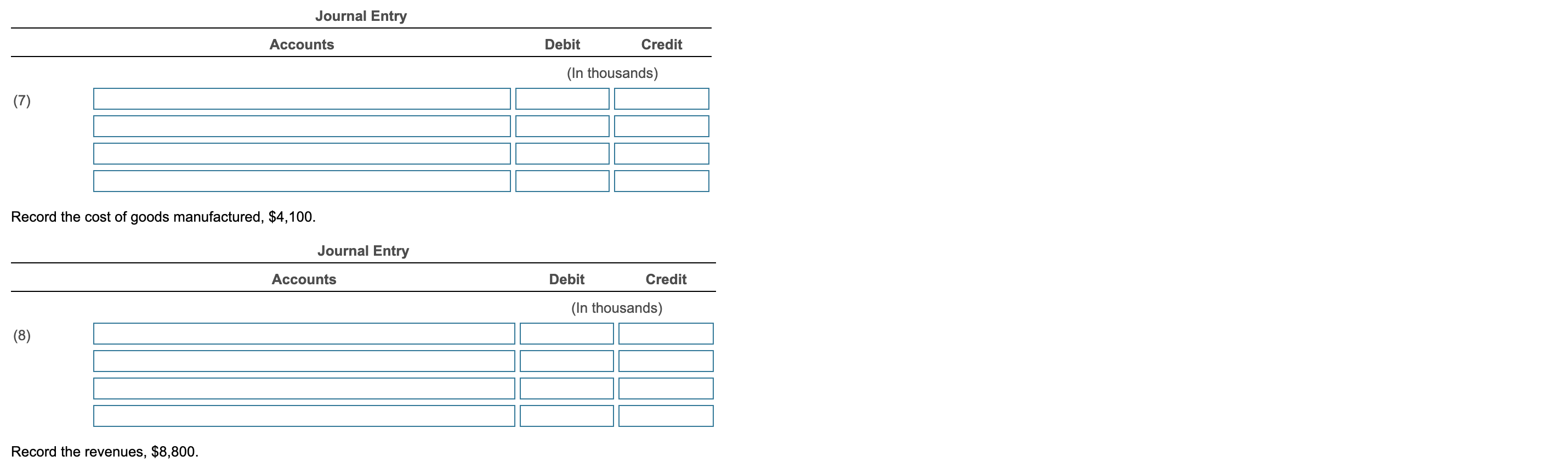

(9)Record the revenues,$8,800.

(10)Record the cost of goods sold,$4,050.

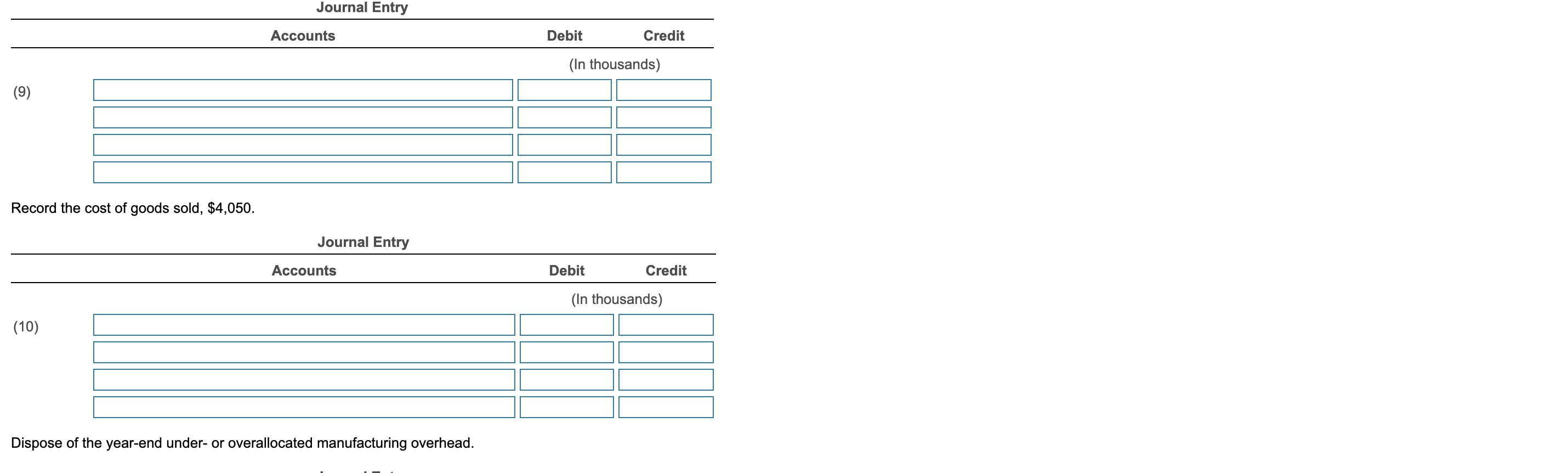

(11)Dispose of the year-end under- or overallocated manufacturing overhead.

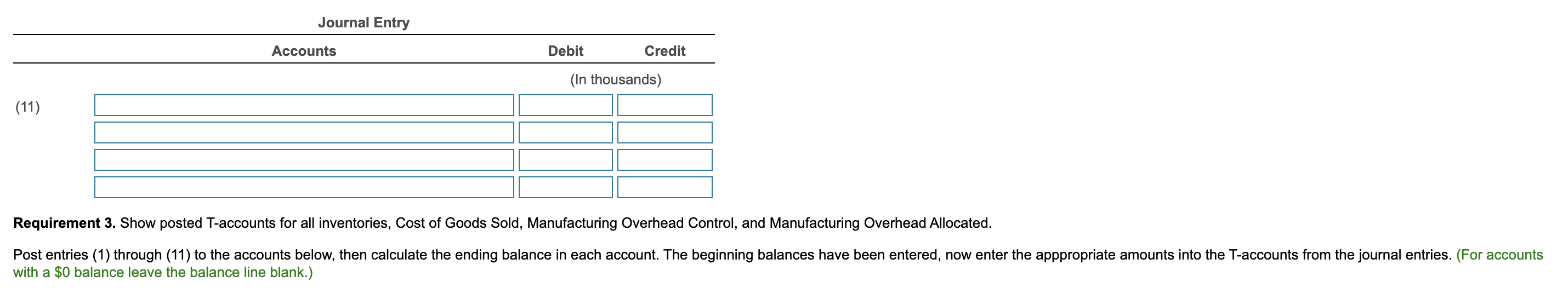

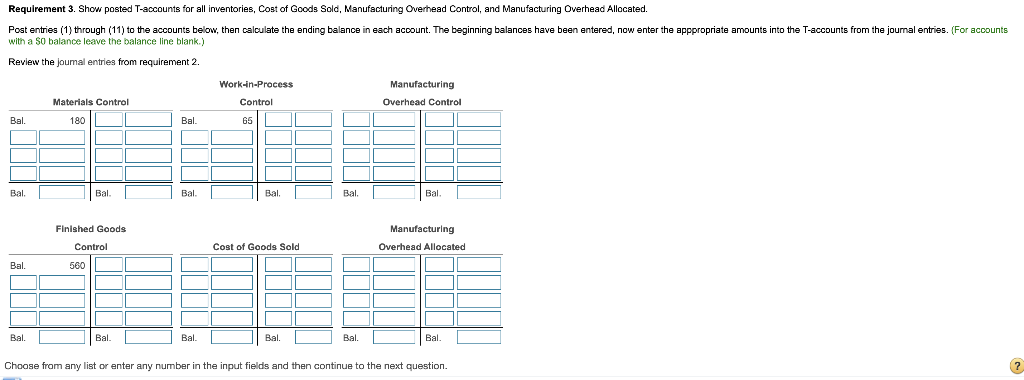

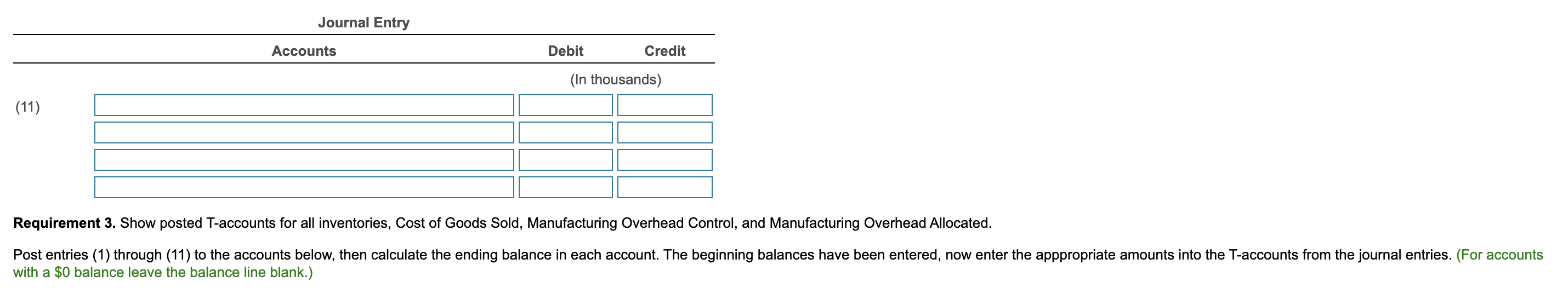

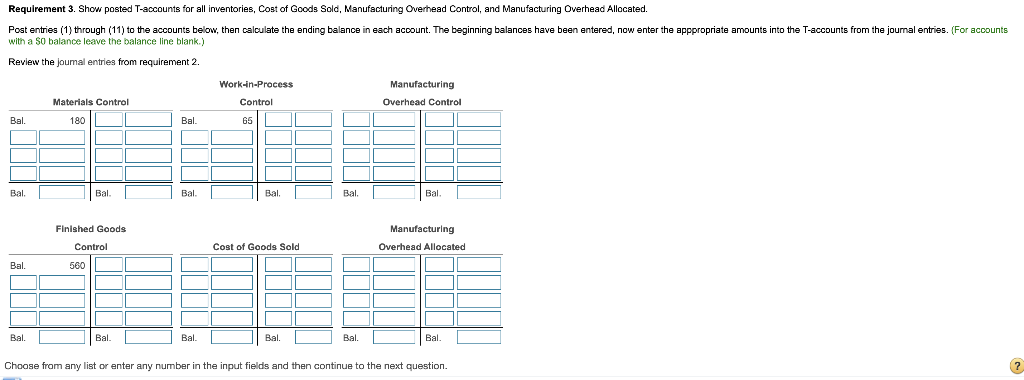

Requirement 3. Show posted T-accounts for all inventories, Cost of Goods Sold, Manufacturing Overhead Control, and Manufacturing Overhead Allocated.

Post entries (1) through (11) to the accounts below, then calculate the ending balance in each account. The beginning balances have been entered, now enter the apppropriate amounts into the T-accounts from the journal entries. (For accounts with a $0 balance leave the balance line blank.)

Review the journal entries from requirement 2.

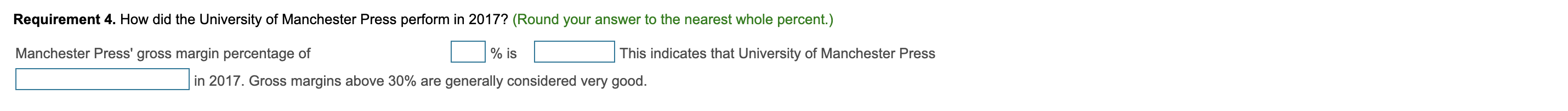

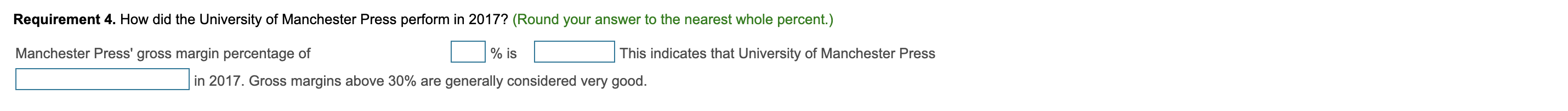

Requirement 4. How did the University of ManchesterManchester Press perform in2017? (Round your answer to the nearest whole percent.)

| Manchester Press' gross margin percentage of | | % is | | This indicates that University of Manchester Press |

| | in 2017. Gross margins above 30% are generally considered very good. |

The University of Manchester Press is wholly owned by the university. It performs the bulk of its work for other university departments, which pay as though the press were an outside business enterprise. The press also publishes and maintains a stock of books for general sale. The press usos normal posting to cost each job. Its job-costing system has two direct.costalerius direct materials and direct manufacturing labor and one indirect.gospoolimanufacturing overhead allocated on the basis of direct manufacturing labor costs). The following data (in thousands) pertain to 2017: (Click the icon to view the data.) Data Table Read the requirements Requirement 1. Identify the components of the overview diagram of the job-costing system at the University A Indirect Cost Pool B Manufacturing Overhead A } o} C D Cost Allocation Base Direct Manufacturing Labor Cost E} E Cost Object: Print Job F Manufacturing Overhead G Direct Costs H Direct Costs 1 Direct Materials J Direct Manufacturing Labor Direct materials and supplies purchased on credit 830 Direct materials used 720 Indirect materials issued to various production departments 160 Direct manufacturing labor 1,320 Indirect manufacturing labor incurred by various production departments Depreciation on building and manufacturing equipment Miscellaneous manufacturing overhead incurred by various production departments (ordinarily would be detailed as repairs, photocopying, utilities, etc.) Manufacturing overhead allocated at 160% of direct manufacturing labor costs Cost of goods manufactured 4.100 Revenues 8.800 Cost of goods sold (before adjustment for under-or overallocated manufacturing overhead) 4,050 Inventories, December 31, 2016 (not 2017): Materials Control 180 Work-in-Process Control Finished Goods Control "The term manufacturing overhead is not used uniformly. Other forms that are often encountered in printing companies include job overhead and shop overhead. Requirement 2. Prepare journal entries to summarize the 2017 transactions. As your final entry, dispose of each entry may be omitted.(Record debits first, then credits. Exclude explanations from any journal entries.) Direct materials and supplies purchased on credit, $830 Journal Entry Print Done Choose from any list or enter any number in the input fields and then continue to the next question. Requirement 2. Prepare journal entries to summarize the 2017 transactions. As your final entry, dispose of the year-end under-or overallocated manufacturing overhead as a write-off to Cost of Goods Sold. Number your entries. Explanations for each entry may be omitted.(Record debits first, then credits. Exclude explanations from any joumal entries.) Direct materials and supplies purchased on credit, $830 Journal Entry Accounts Debit Credit (In thousands) Record the direct materials used, $720. Joumal Entry Accounts Debit Credit (In thousands) Record the indirect materials used. S160. Choose from any list or enter any number in the input fields and then continue to the next question. Journal Entry Accounts Debit Credit (In thousands) (3) D Record the cost of the direct and indirect labor used in production, $1,320 and $950, respectively. (Combine the entries to record direct and indirect labor into one entry.) Journal Entry Accounts Debit Credit (In thousands) (4) Record the entry for depreciation, $430. Journal Entry Accounts Debit Credit (In thousands) Record the miscellaneous manufacturing overhead costs, $530. Journal Entry Accounts Debit Credit (In thousands) Record the allocation of the manufacturing overhead. Journal Entry Accounts Debit Credit (In thousands) Record the cost of goods manufactured, $4,100. Journal Entry Accounts Debit Credit (In thousands) Record the revenues, $8,800. Journal Entry Accounts Debit Credit (In thousands) (9) L Record the cost of goods sold, $4,050. Journal Entry Accounts Debit Credit (In thousands) Dispose of the year-end under- or overallocated manufacturing overhead. Journal Entry Accounts Debit Credit (In thousands) (11) Requirement 3. Show posted T-accounts for all inventories, Cost of Goods Sold, Manufacturing Overhead Control, and Manufacturing Overhead Allocated. Post entries (1) through (11) to the accounts below, then calculate the ending balance in each account. The beginning balances have been entered, now enter the apppropriate amounts into the T-accounts from the journal entries. (For accounts with a $0 balance leave the balance line blank.) Requirement 3. Show posted T-accounts for all inventories, Cost of Goods Sold, Manufacturing Overhead Control, and Manufacturing Overhead Allocated. Post entries (1) through (11) to the accounts below, then calculate the ending balance in each account. The beginning balances have been entered, now enter the apppropriate amounts into the T-accounts from the journal entries. (For accounts with a so balance leave the balance line blank.) Review the joumal entries from requirement 2. Work-in-Process Control Manufacturing Overhead Control Materials Control Bal. Bal. Bal. Bal. Bal. Bal. Bal. Finished Goods Control 560 Manufacturing Overhead Allocated Cost of Goods Sold Bal. Bal. Bal. Bal. Bal. Bal. Bal. Choose from any list or enter any number in the input fields and then continue to the next question. Requirement 4. How did the University of Manchester Press perform in 2017? (Round your answer to the nearest whole percent.) Manchester Press' gross margin percentage of nis indicates that University of Manchester Press in 2017. Gross margins above 30% are generally considered very good

The University of

The University of