Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The uptown investment club has $50,000 to invest in the equity market. Chandler advocates investing the funds in Monica's restaurant with a beta of 1.5

The uptown investment club has $50,000 to invest in the equity market. Chandler advocates investing the funds in Monica's restaurant with a beta of 1.5 and an expected return of 16.2%. Ross advocates investing the funds in Rachel's clothing store with a beta of 1.1 and expected return of 14.7%. The club is split 50/50 on the two stocks. You are the deciding vote, and you cannot pick a split of $25,000. Before you vote, you look up the current risk free rate (4%) which stock do you select?

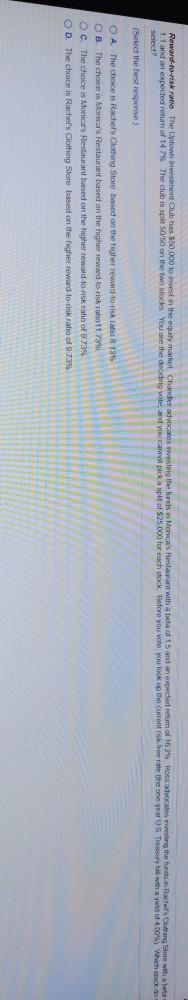

Reward-to-risk ratio The Uptown trivestent Club has 550,000 toestan the equity market. Chandler advocates rivesting the funds in Monica's Restaurant with a buta of 15 and expected retum of 1625 11 and art expected retum of 14 79 The club is spots on the two stocks. You are the dooding vote, and you cannot be a spital 25.000 for each stock before you vote, you look up the current risk free rate the one years Tryb with a lot 4. Which oko Reseaductes over the tunnel Clotne store will be Select (Select the best response A The choice is Rachers Clothing Store based on the higher rward-to-tiska 8 13 B. The choice is Manca's Restaurant based on the higher reward-to-risk ratio 11 734 Oc The choice is Monica's Restaurant based on the higher reward to risk ratio of 973% D. The choice is Rachel's Clothing Store based on the higher reward to risk ralio of 97.39 O A. The choice is Rachel's Clothing Store based on the higher reward-to-risk ratio 8.13% OB. The choice is Monica's Restaurant based on the higher reward-to-risk ratio 11.73% OC. The choice is Monica's Restaurant based on the higher reward-to-risk ratio of 9.73% OD The choice is Rachel's Clothing Store based on the higher reward-to-risk ratio of 9.73%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started