Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The US current income tax structure is a marginal tax system, with 7 brackets. The brackets are Part of: your taxable but less income

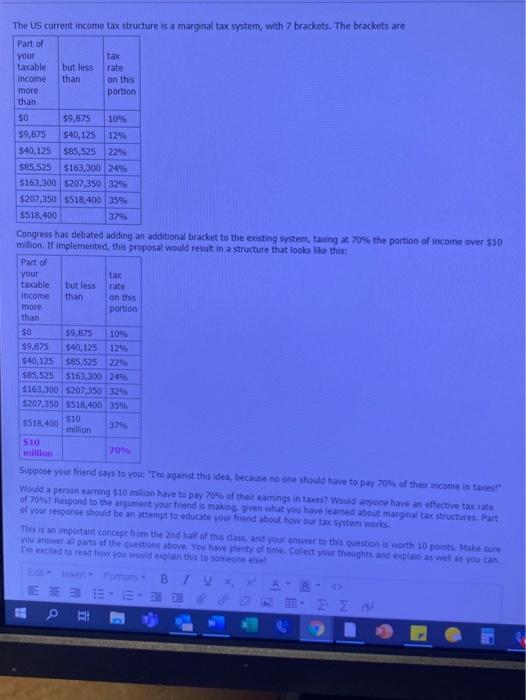

The US current income tax structure is a marginal tax system, with 7 brackets. The brackets are Part of: your taxable but less income than more than $0 $9,875 10% $9,875 $40,125 12% $40,125 $85,525 22% $85,525 $163,300 24% $163,300 $207,350 32% $207,350 $518,400 35% $518,400 37% Congress has debated adding an additional bracket to the existing system, taxing at 70% the portion of income over $10 million. If implemented, this proposal would result in a structure that looks like this: Part of your taxable income more than 50 tax rate on this portion but less than $10 million $9,875 10% $9,875 $40,125 125 $40,125 $85,525 22% $85,525 $163,300 24% $163,300 $207,350 32% $207,350 $518,400 35% $518,400 tax rate on thus portion $10 million Edit- EE 0 37% 70% Suppose your friend says to you: "Tm against this idea, because no one should have to pay 70% of their income in taxes!" Would a person earning $10 million have to pay 70% of their earings in taxes? Would anyone have an effective tax rate of 70%? Respond to the argument your friend is making, given what you have learned about marginal tax structures. Part of your response should be an attempt to educate your friend about how our tax system works. This is an important concept from the 2nd half of this dass, and your answer to this question is worth 10 points. Make sure you answer all parts of the questions above. You have plenty of time. Collect your thoughts and explain as well as you can. I'm excited to read how you would explain this to someone else! Insert Formats B (>

Step by Step Solution

There are 3 Steps involved in it

Step: 1

If Congress has added taxing at 70 of the portion of the Income over 10 Million in existing Tax brac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started