Answered step by step

Verified Expert Solution

Question

1 Approved Answer

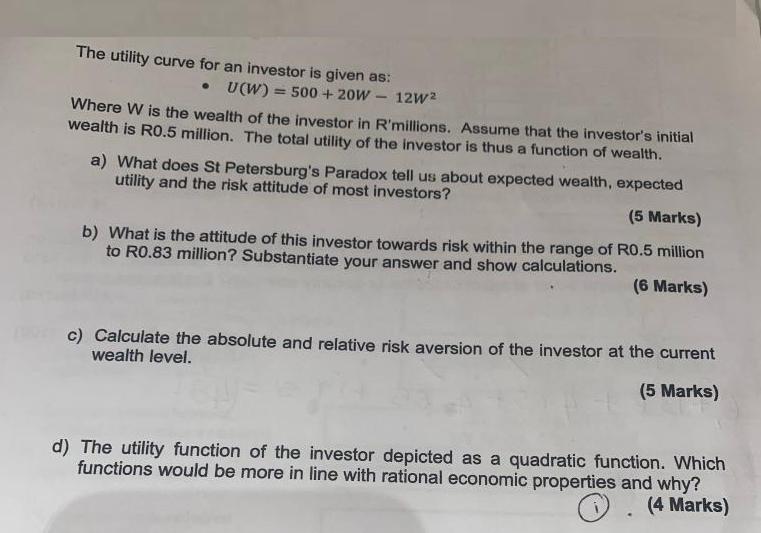

The utility curve for an investor is given as: U(W) = 500+20W - 12W Where W is the wealth of the investor in R'millions.

The utility curve for an investor is given as: U(W) = 500+20W - 12W Where W is the wealth of the investor in R'millions. Assume that the investor's initial wealth is R0.5 million. The total utility of the investor is thus a function of wealth. a) What does St Petersburg's Paradox tell us about expected wealth, expected utility and the risk attitude of most investors? (5 Marks) b) What is the attitude of this investor towards risk within the range of R0.5 million to R0.83 million? Substantiate your answer and show calculations. (6 Marks) c) Calculate the absolute and relative risk aversion of the investor at the current wealth level. (5 Marks) d) The utility function of the investor depicted as a quadratic function. Which functions would be more in line with rational economic properties and why? (4 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a St Petersburg Paradox suggests that individuals should be willing to pay an infinite amount for a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started