Answered step by step

Verified Expert Solution

Question

1 Approved Answer

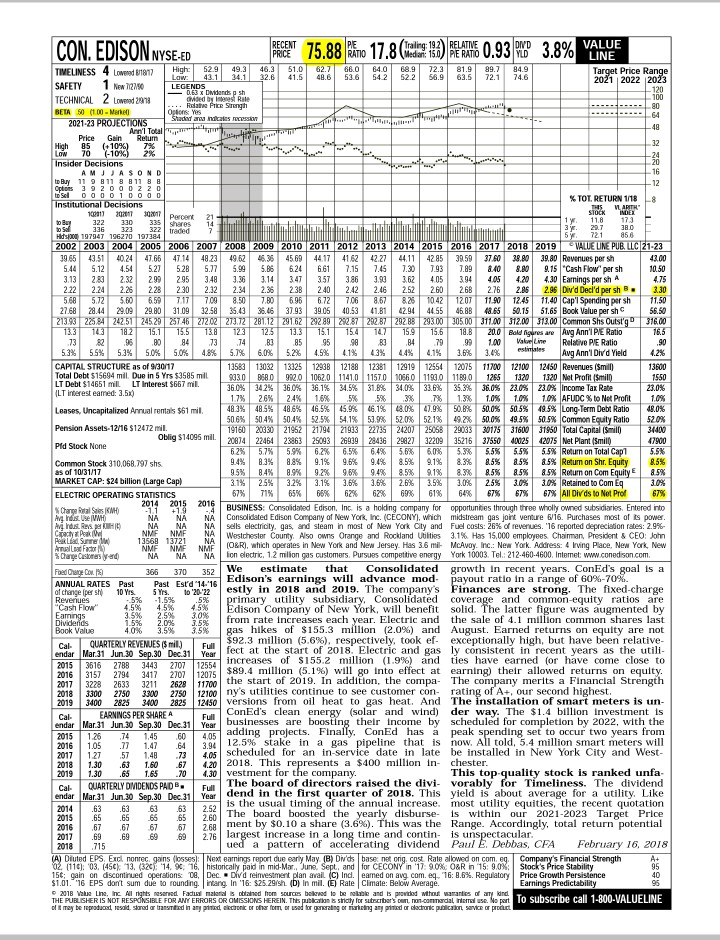

the Value Line report is attached (the second picture) The purpose of this exercise is to calculate the intrinsic value in 2018 for a share

the Value Line report is attached (the second picture)

The purpose of this exercise is to calculate the intrinsic value in 2018 for a share of stock in ConEd using the two-stage DDM seen in class. Thus, go to Value Line here and get the most updated report on ConEd (February 2018) (a) Use linear interpolation to calculate the projected dividends per share for the years 2019, 2020, 2021, and 2022. Use those four projected dividends and the projected price of ConEd in year 2022 to calculate the intrinsic value for a share of stock in ConEd. Assume that the risk-free interest rate in long-term T-bonds is 3% and that the expected market risk premium is 8% (b) According to your fundamental analysis on ConEd above, is ConEd underpriced or overpriced, and if so, by how much? (c) Describe the nature of investments that ConEd will be involved in. (d) Is ConEd a cash cow? Defend your answer The purpose of this exercise is to calculate the intrinsic value in 2018 for a share of stock in ConEd using the two-stage DDM seen in class. Thus, go to Value Line here and get the most updated report on ConEd (February 2018) (a) Use linear interpolation to calculate the projected dividends per share for the years 2019, 2020, 2021, and 2022. Use those four projected dividends and the projected price of ConEd in year 2022 to calculate the intrinsic value for a share of stock in ConEd. Assume that the risk-free interest rate in long-term T-bonds is 3% and that the expected market risk premium is 8% (b) According to your fundamental analysis on ConEd above, is ConEd underpriced or overpriced, and if so, by how much? (c) Describe the nature of investments that ConEd will be involved in. (d) Is ConEd a cash cow? Defend yourStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started