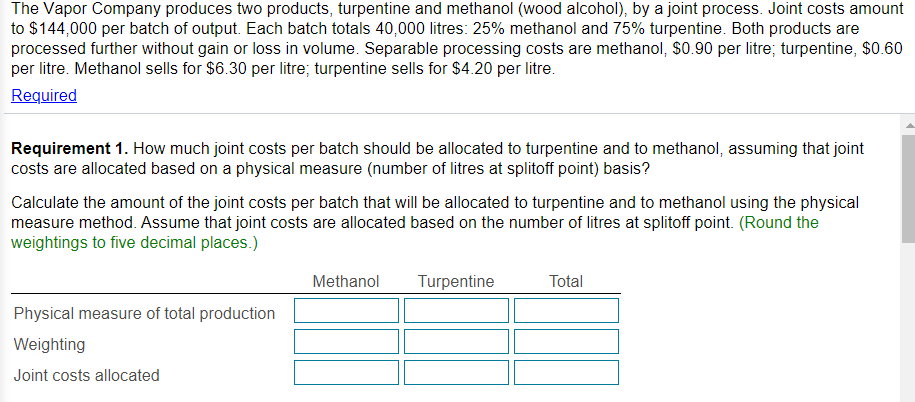

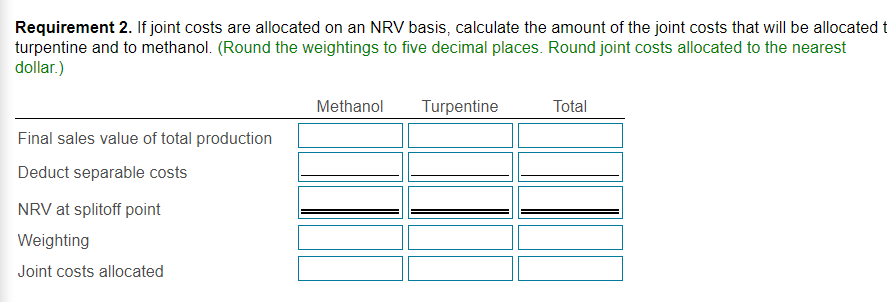

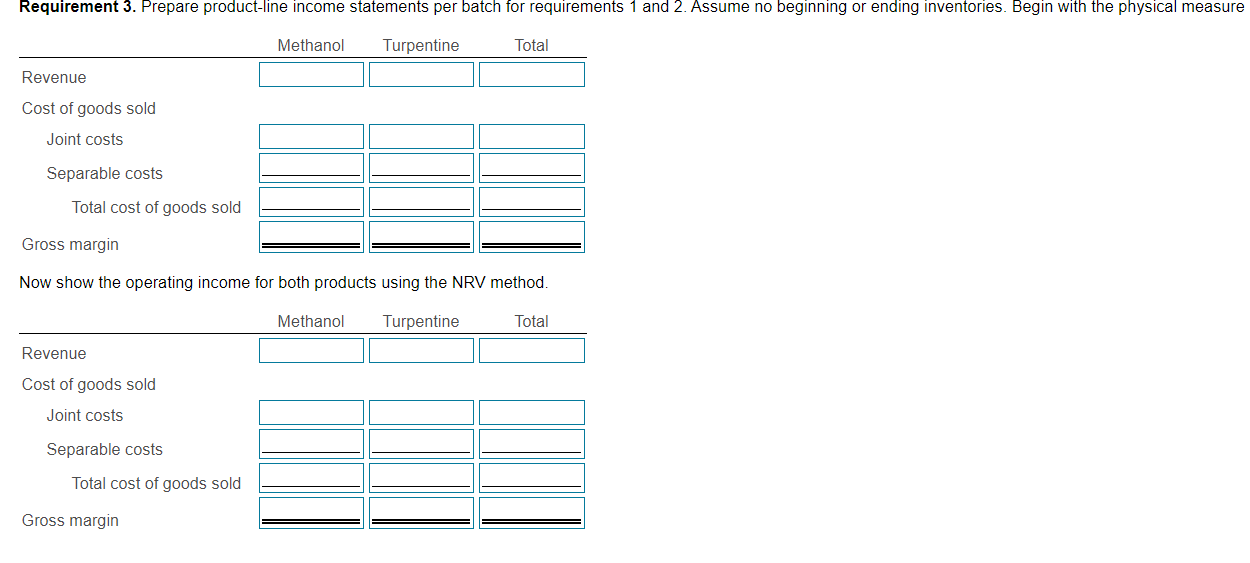

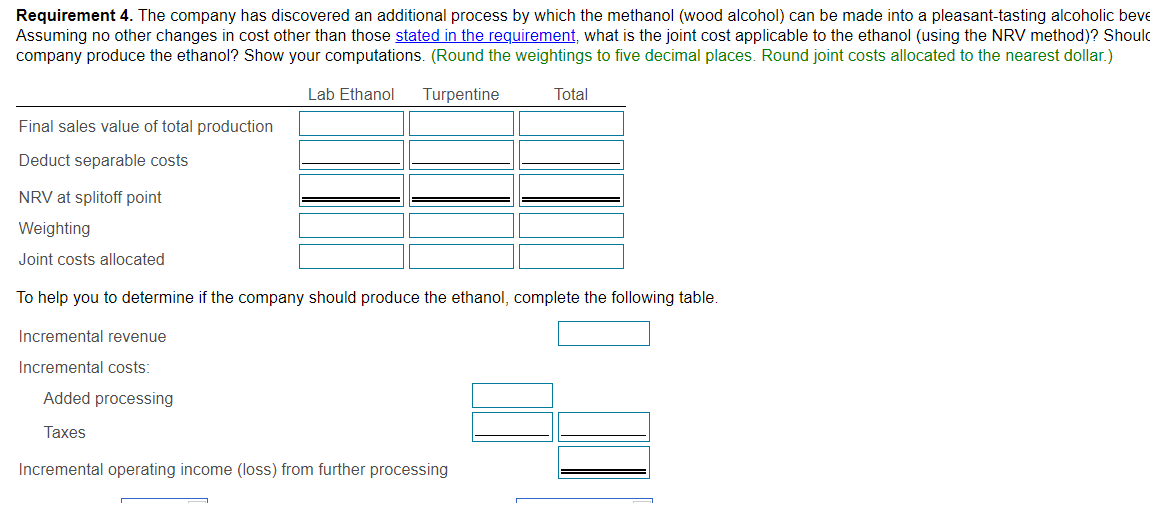

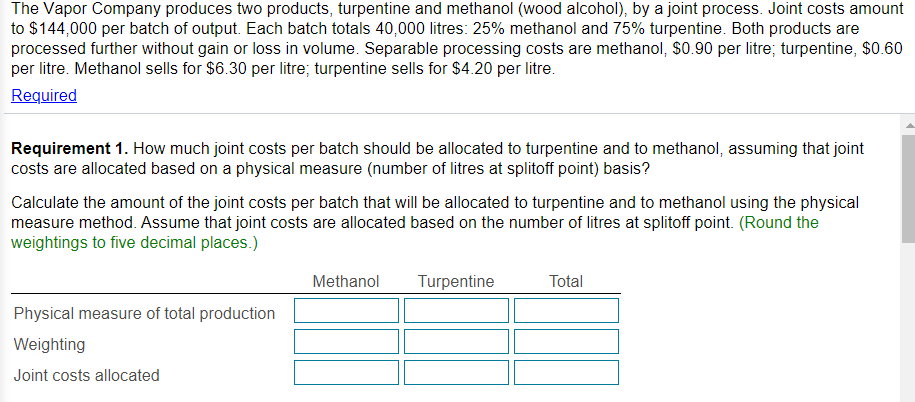

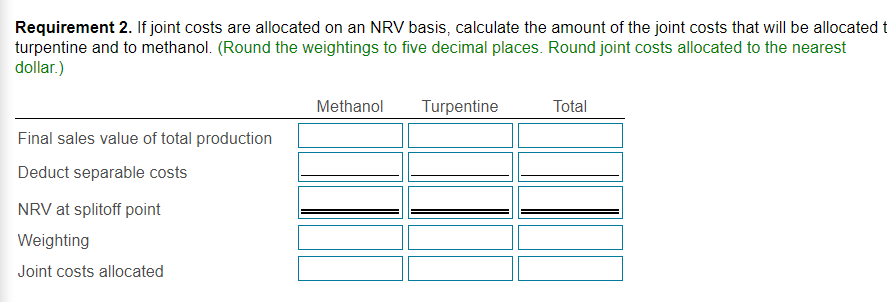

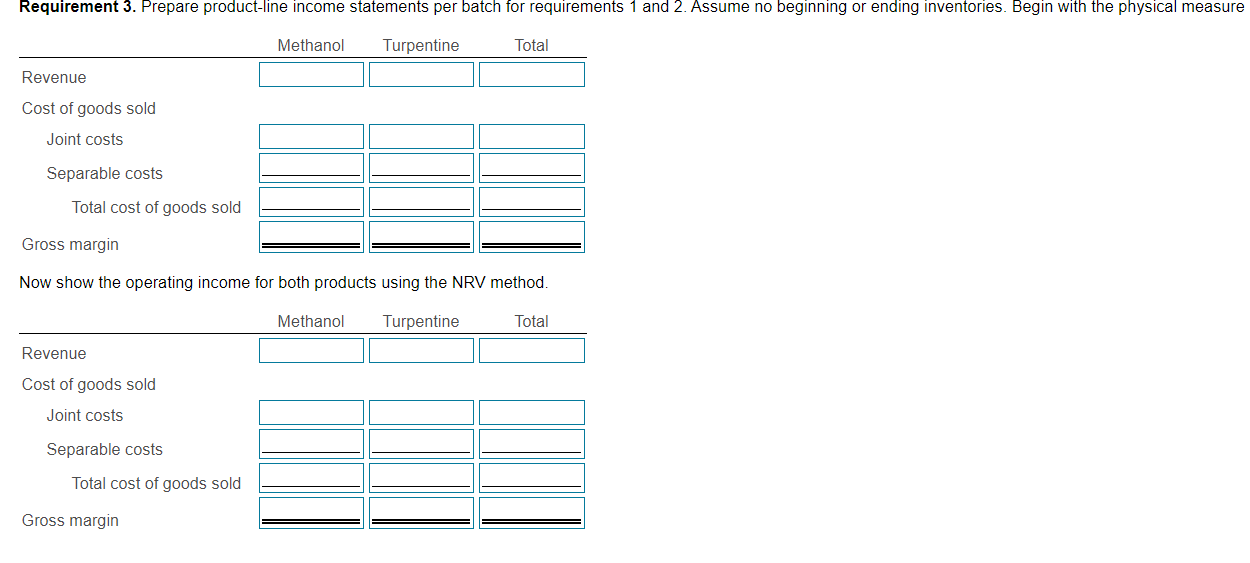

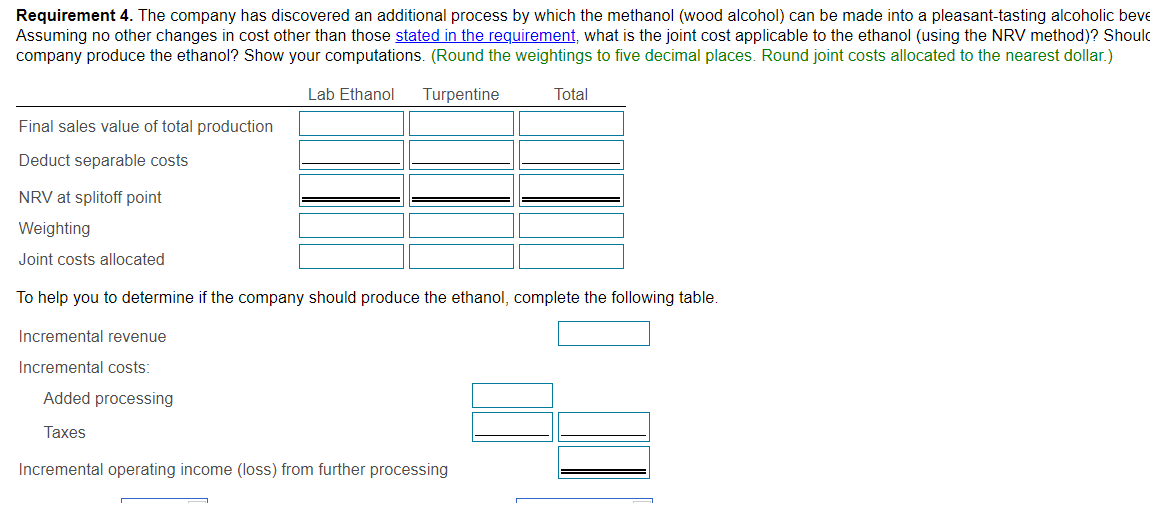

The Vapor Company produces two products, turpentine and methanol (wood alcohol), by a joint process. Joint costs amount to $144,000 per batch of output. Each batch totals 40,000 litres: 25% methanol and 75% turpentine. Both products are processed further without gain or loss in volume. Separable processing costs are methanol, $0.90 per litre; turpentine, $0.60 per litre. Methanol sells for $6.30 per litre; turpentine sells for $4.20 per litre. Required Requirement 1. How much joint costs per batch should be allocated to turpentine and to methanol, assuming that joint costs are allocated based on a physical measure (number of litres at splitoff point) basis? Calculate the amount of the joint costs per batch that will be allocated to turpentine and to methanol using the physical measure method. Assume that joint costs are allocated based on the number of litres at splitoff point. (Round the weightings to five decimal places.) Methanol Turpentine Total Physical measure of total production Weighting Joint costs allocated Requirement 2. If joint costs are allocated on an NRV basis, calculate the amount of the joint costs that will be allocated t turpentine and to methanol. (Round the weightings to five decimal places. Round joint costs allocated to the nearest dollar.) Methanol Turpentine Total Final sales value of total production Deduct separable costs NRV at splitoff point Weighting Joint costs allocated Requirement 3. Prepare product-line income statements per batch for requirements 1 and 2. Assume no beginning or ending inventories. Begin with the physical measure Methanol Turpentine Total Revenue Cost of goods sold Joint costs Separable costs Total cost of goods sold Gross margin Now show the operating income for both products using the NRV method. Methanol Turpentine Total Revenue Cost of goods sold Joint costs Separable costs Total cost of goods sold Gross margin Requirement 4. The company has discovered an additional process by which the methanol (wood alcohol) can be made into a pleasant-tasting alcoholic beve Assuming no other changes in cost other than those stated in the requirement, what is the joint cost applicable to the ethanol (using the NRV method)? Should company produce the ethanol? Show your computations. (Round the weightings to five decimal places. Round joint costs allocated to the nearest dollar.) Lab Ethanol Turpentine Total Final sales value of total production Deduct separable costs NRV at splitoff point Weighting Joint costs allocated To help you to determine if the company should produce the ethanol, complete the following table. Incremental revenue Incremental costs: Added processing Taxes Incremental operating income (loss) from further processing