Answered step by step

Verified Expert Solution

Question

1 Approved Answer

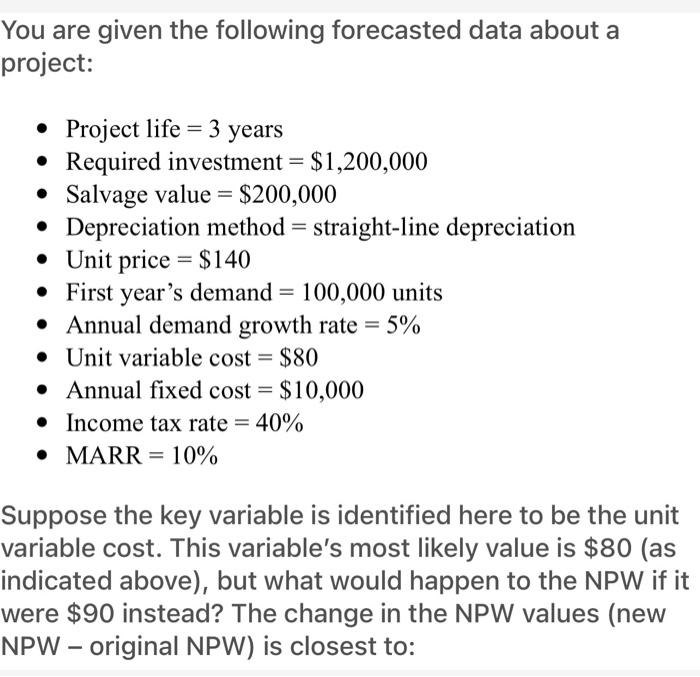

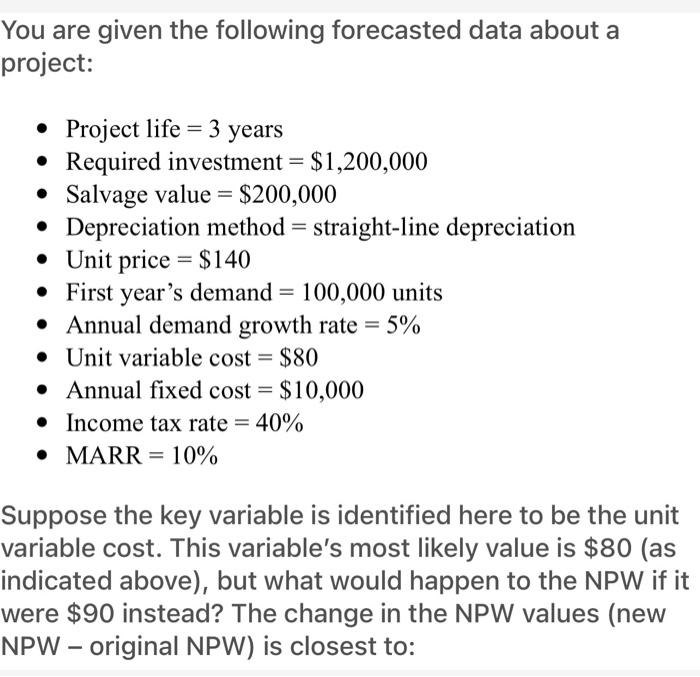

The variable change here is Unit Variable cost to 90$ You are given the following forecasted data about a project: Project life = 3 years

The variable change here is Unit Variable cost to 90$

You are given the following forecasted data about a project: Project life = 3 years Required investment = $1,200,000 Salvage value = $200,000 Depreciation method = straight-line depreciation Unit price = $140 First year's demand = 100,000 units Annual demand growth rate = 5% Unit variable cost = $80 Annual fixed cost = $10,000 Income tax rate = 40% MARR = 10% = Suppose the key variable is identified here to be the unit variable cost. This variable's most likely value is $80 (as indicated above), but what would happen to the NPW if it were $90 instead? The change in the NPW values (new NPW - original NPW) is closest to

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started