Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The variable component can be computed as shown below: Sales Units Observed Costs COGS Shipping Salaries & Commissions High activity June Low activity - April

The variable component can be computed as shown below:

|

| Sales Units | Observed Costs | ||

| COGS | Shipping | Salaries & Commissions | ||

| High activity June |

|

|

|

|

| Low activity - April |

|

|

|

|

| Difference |

|

|

|

|

Compute the variable cost below:

Calculate the Fixed portion of the mixed cost:

Prepare the income statement.

| Central Valley Company | ||

| Contribution Income Statement | ||

| For the month ended September 30 | ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

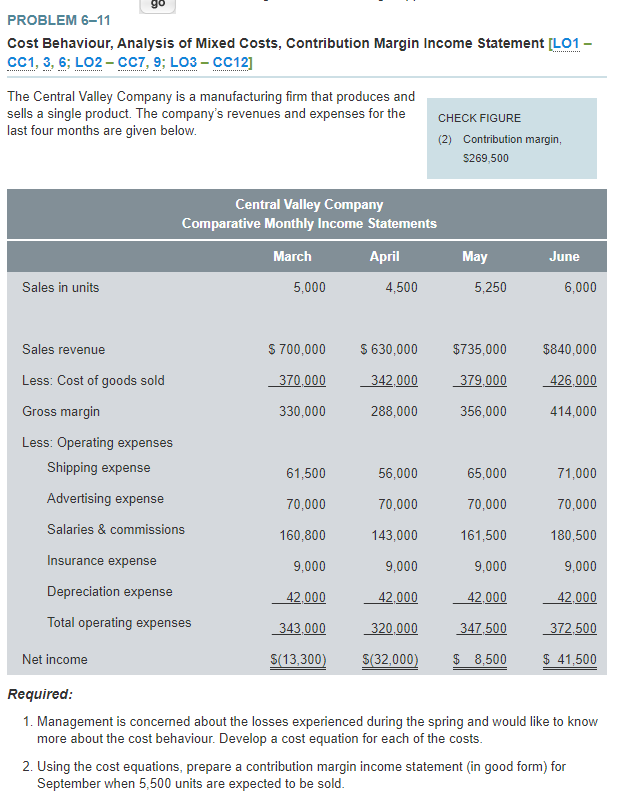

go PROBLEM 611 Cost Behaviour, Analysis of Mixed Costs, Contribution Margin Income Statement [L01 - CC1, 3, 6; LO2- CC7, 9; LO3- CC12] The Central Valley Company is a manufacturing firm that produces and sells a single product. The company's revenues and expenses for the last four months are given below. CHECK FIGURE (2) Contribution margin, $269,500 Central Valley Company Comparative Monthly Income Statements March April May June Sales in units 5,000 4,500 5,250 6,000 Sales revenue S 700,000 S 630,000 $735,000 $840,000 Less: Cost of goods sold 370.000 342.000 379.000 426.000 Gross margin 330,000 288,000 356,000 414,000 Less: Operating expenses Shipping expense 61,500 56,000 65,000 71,000 70,000 70,000 70,000 70,000 Advertising expense Salaries & commissions 160,800 143,000 161,500 180,500 Insurance expense 9,000 9,000 9,000 9,000 42.000 42.000 42.000 42.000 Depreciation expense Total operating expenses 343.000 320,000 347.500 372.500 Net income S(13,300) $(32,000) $ 8,500 $ 41,500 Required: 1. Management is concerned about the losses experienced during the spring and would like to know more about the cost behaviour. Develop a cost equation for each of the costs. 2. Using the cost equations, prepare a contribution margin income statement (in good form) for September when 5,500 units are expected to be sold

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started