Question

The Vaughn Theater, owned by Meg Vargo, will begin operations in March. The Vaughn will be unique in that it will show only triple features

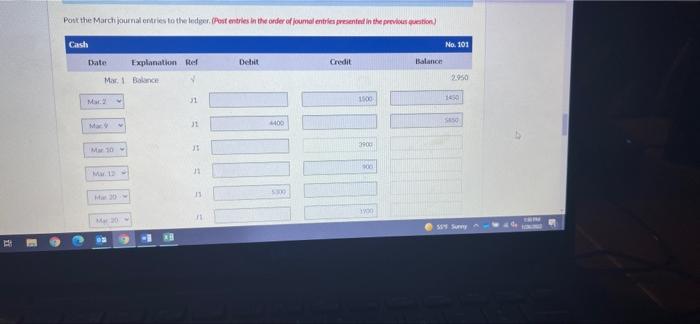

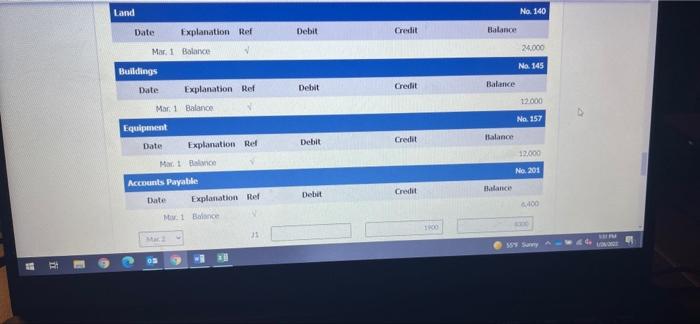

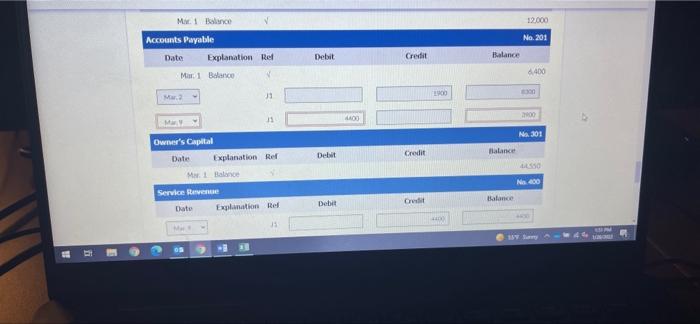

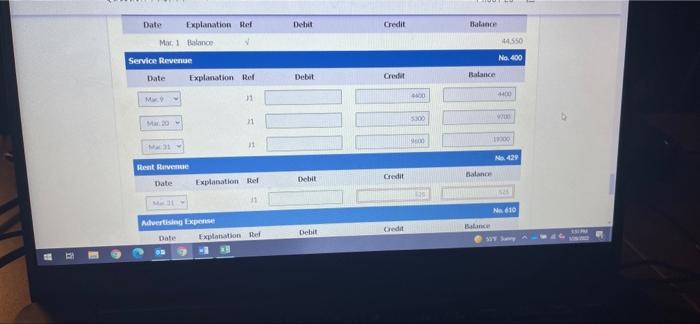

The Vaughn Theater, owned by Meg Vargo, will begin operations in March. The Vaughn will be unique in that it will show only triple features of sequential theme movies. As of March 1, the ledger of Vaughn showed: Cash No. 101 $2,950, No. 140 Land $24,000, No. 145 Buildings (concession stand, projection room, ticket booth, and screen) $12,000, No. 157 Equipment $12,000, No. 201 Accounts Payable $6,400, and No. 301 Owners Capital $44,550. During the month of March, the following events and transactions occurred.

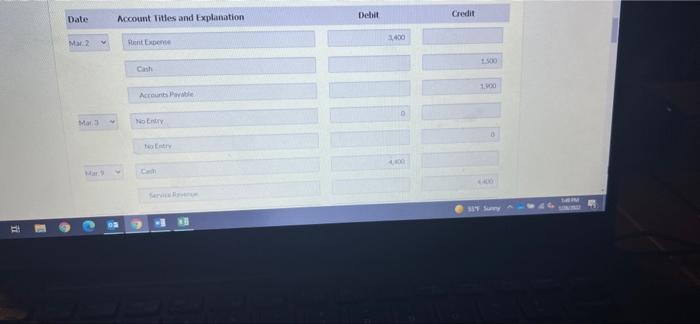

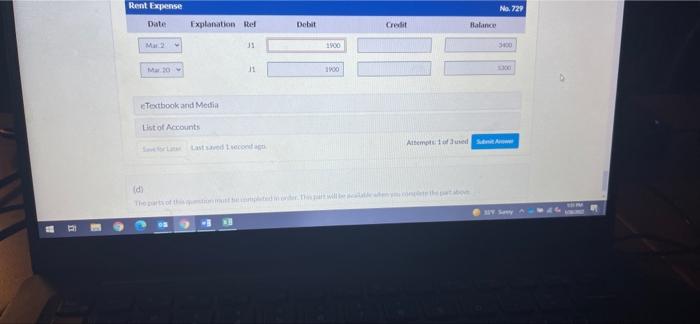

March 1: Rented the three Indiana Jones movies to be shown for the first 3 weeks of March. The film rental was $3,400; $1,500 was paid in cash and $1,900 will be paid on March 10 Jones movies to be shown for the first 3 weeks of March. The film rental was $3,400; $1,500 was paid in cash and $1,900 will be paid on March 10.

March 3: Ordered the Lord of the Rings movies to be shown the last 10 days of March. It will cost $190 per night Rings movies to be shown the last 10 days of March. It will cost $190 per night

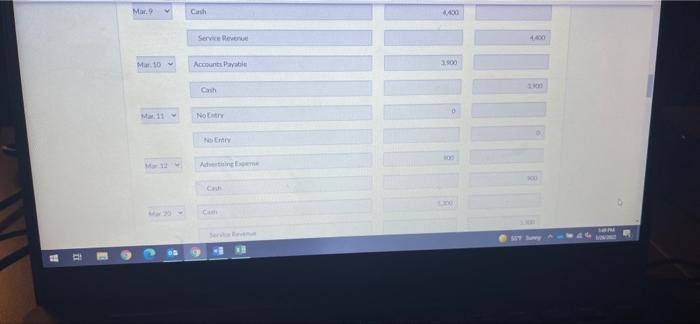

March 9: Received $4,400 cash from admissions.

March 10: Paid balance due on Indiana Jones movies rental and $2,000 on March 1 accounts payable.

March 11: Vaughn Theater contracted with Adam Ladd to operate the concession stand. Ladd is to pay 15% of gross concession receipts, payable monthly, for the rental of the concession stand.

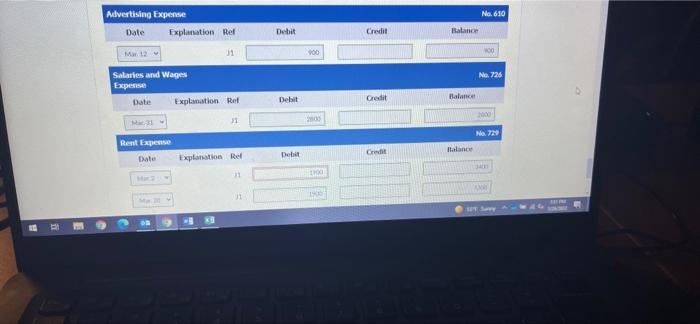

March 12: Paid advertising expenses $900.

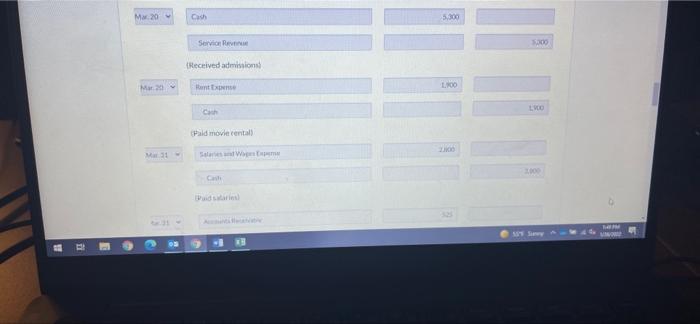

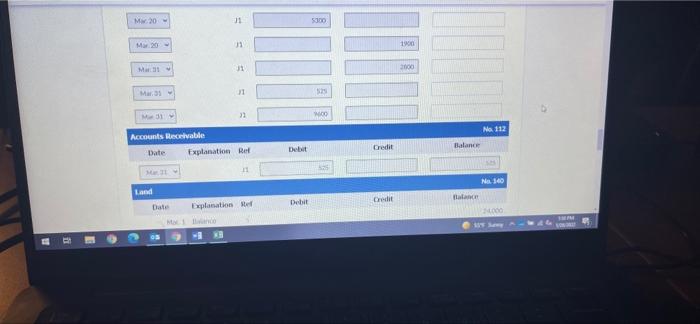

March 20: Received $5,300 cash from customers for admissions.

March 20 : Received the Lord of the Rings movies and paid the rental fee of $1,900.

March 31: Paid salaries of $2,800.

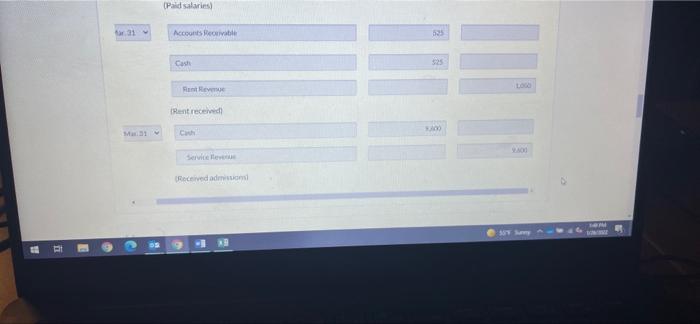

March: 31 Received statement from Adam Ladd showing gross receipts from concessions of $7,000 and the balance due to Vaughn Theater of $1,050 ($7,000 15%) for March. Ladd paid one-half the balance due and will remit the remainder on April 5

March 31 Received $9,600 cash from customers for admissions.

Question: Post the March journal entries to the ledger.

(Post entries in the order of journal entries presented in the previous question.)

Please see pictures below: from previous question 4,

400 cash from

Jones movies rental and $2,000 on March 1 accounts payable.Theater contracted with Adam Ladd to operate the concession stand. Ladd is to pay 15% of gross concession receipts, payable monthly, for the rental of the concession stand.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started