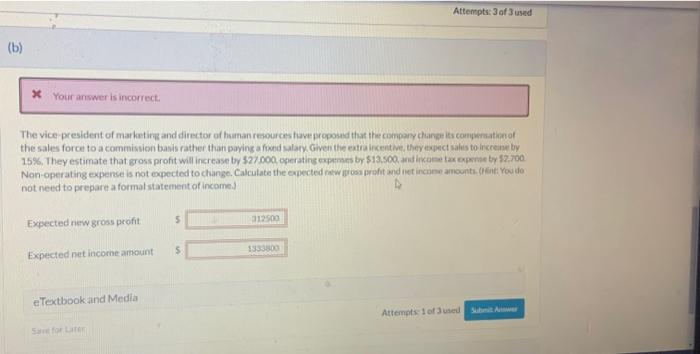

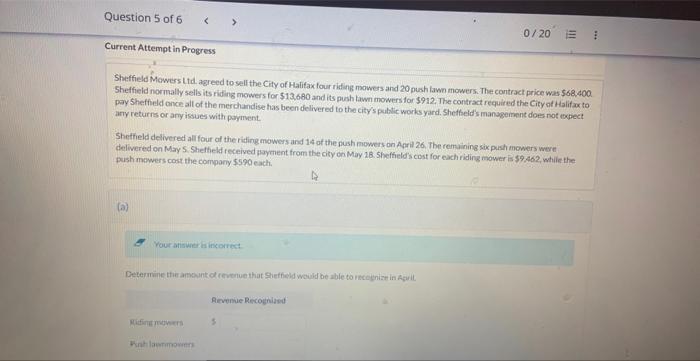

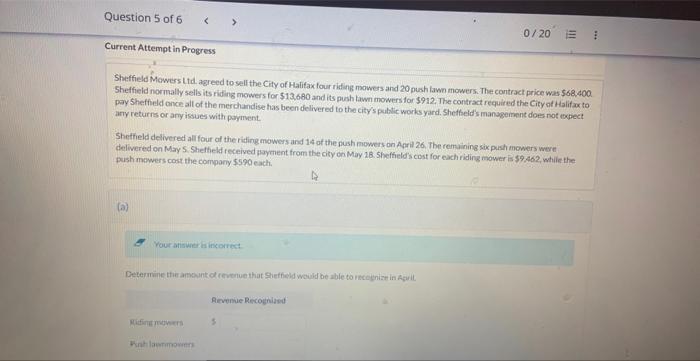

The vice-president of marketing and director of hainan rezources have propohd that the compary chanese its congeroation of the sales force to a commission basis rather than paying a fowd salarx Given the extra incentive they expect sales to increne by 15\%. They estimate that gross profit will increase by $27000, operating eqpenses by $13.500, and inarae tax cxprese by {2. 200 . Non-operating expense is not eppected to change. Calculate the expected natw grosu profit ind net incume anounti-(Hat: Youdo not need to prepare a formal statement ot income.) Expected new gross profit. Expected net incorne amount Sheffield Mowers Ltd agreed to self the City of Halifax four riding mowers and 20 push lawn mowers. The contract price was 562.400. Sheffield normally sells its riding mowers for $13680 and its push lawn mowers for $912. The contract required the City at ialif ax to pay Sheffied once all of the merchandise has been delivered to the city's pubtic works yard. Shetheld's man ugement does not uxpect any returns or any issues with poyment. Shetheld delivered all four af the riting mowers and 14 of the push mowers on April 26. The remaining six push mowers were delivered on May 5 . Shetheld received payment from the city on May 28 . 5 heffelds cost for each riding mower is $9.462, while the pushmawers cont the compory 5590 each, (a) L. Your answeriningorrect. Determine the amoynt of cevenuethat Sheffeld would be able to inceynize in Aguil. The vice-president of marketing and director of hainan rezources have propohd that the compary chanese its congeroation of the sales force to a commission basis rather than paying a fowd salarx Given the extra incentive they expect sales to increne by 15\%. They estimate that gross profit will increase by $27000, operating eqpenses by $13.500, and inarae tax cxprese by {2. 200 . Non-operating expense is not eppected to change. Calculate the expected natw grosu profit ind net incume anounti-(Hat: Youdo not need to prepare a formal statement ot income.) Expected new gross profit. Expected net incorne amount Sheffield Mowers Ltd agreed to self the City of Halifax four riding mowers and 20 push lawn mowers. The contract price was 562.400. Sheffield normally sells its riding mowers for $13680 and its push lawn mowers for $912. The contract required the City at ialif ax to pay Sheffied once all of the merchandise has been delivered to the city's pubtic works yard. Shetheld's man ugement does not uxpect any returns or any issues with poyment. Shetheld delivered all four af the riting mowers and 14 of the push mowers on April 26. The remaining six push mowers were delivered on May 5 . Shetheld received payment from the city on May 28 . 5 heffelds cost for each riding mower is $9.462, while the pushmawers cont the compory 5590 each, (a) L. Your answeriningorrect. Determine the amoynt of cevenuethat Sheffeld would be able to inceynize in Aguil