The Vinny Cartier Company issued bonds at $1,000 per bond. The bonds had a 30-year life when issued, with semiannual payments at the then annual rate of 13 percent. This return was in line with required returns by bondholders at that point, as described below:

| | | |

| Real rate of return | 4 | % |

| Inflation premium | 5 | |

| Risk premium | 4 | |

| | | |

| Total return | 13 | % |

| | | |

| |

Assume that ten years later the inflation premium is 3 percent, the risk premium has declined to 2 percent and both are appropriately reflected in the required return (or yield to maturity) of the bonds. The bonds have 20 years remaining until maturity.

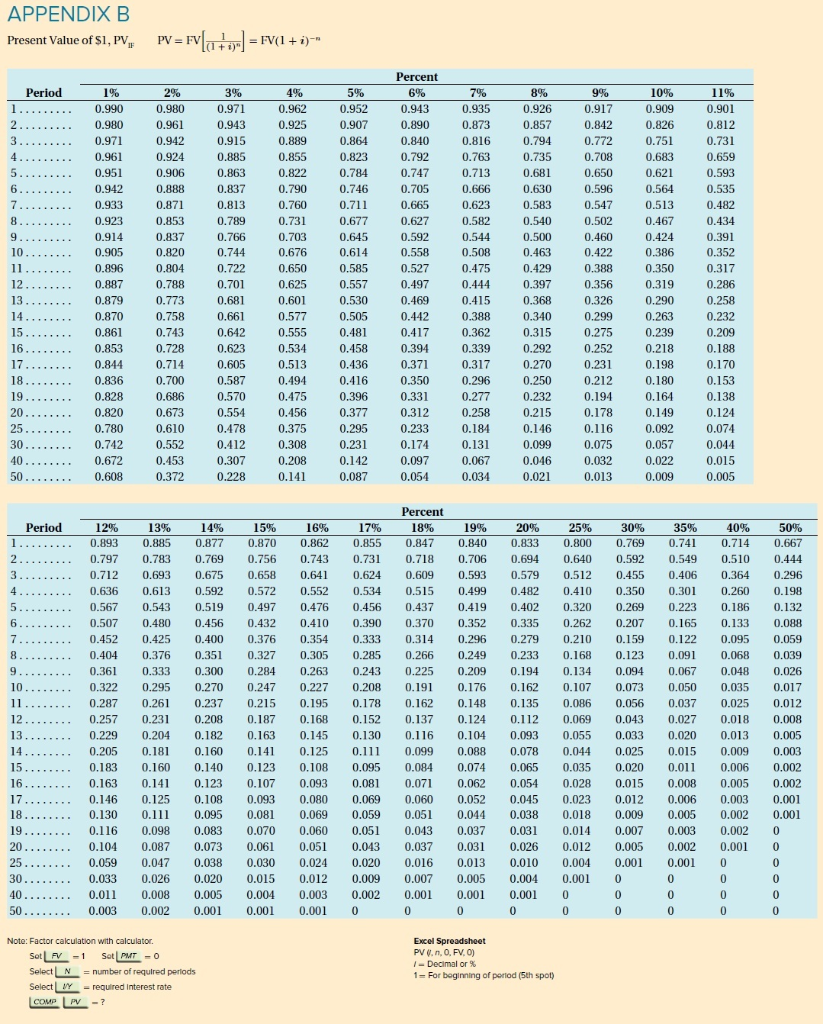

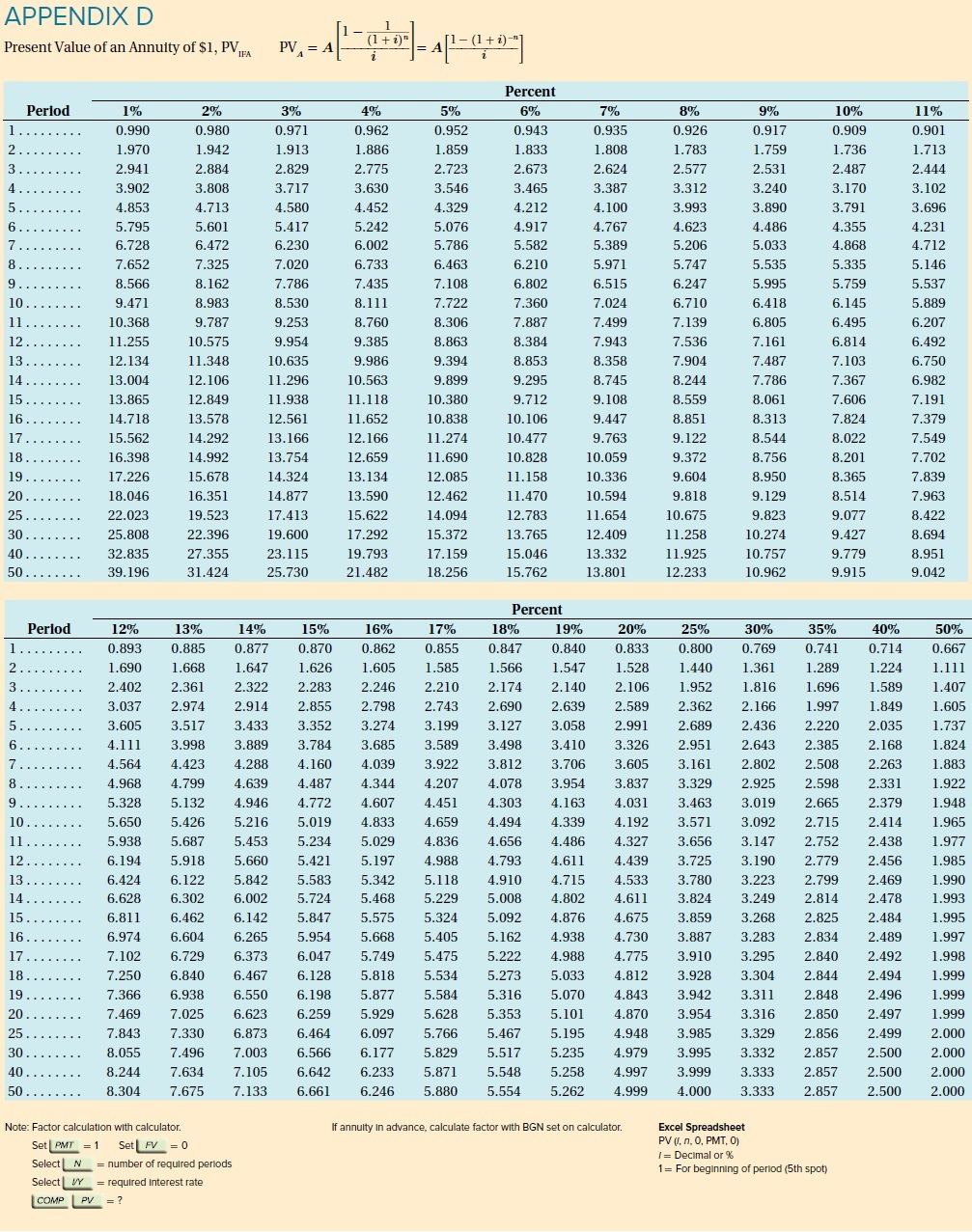

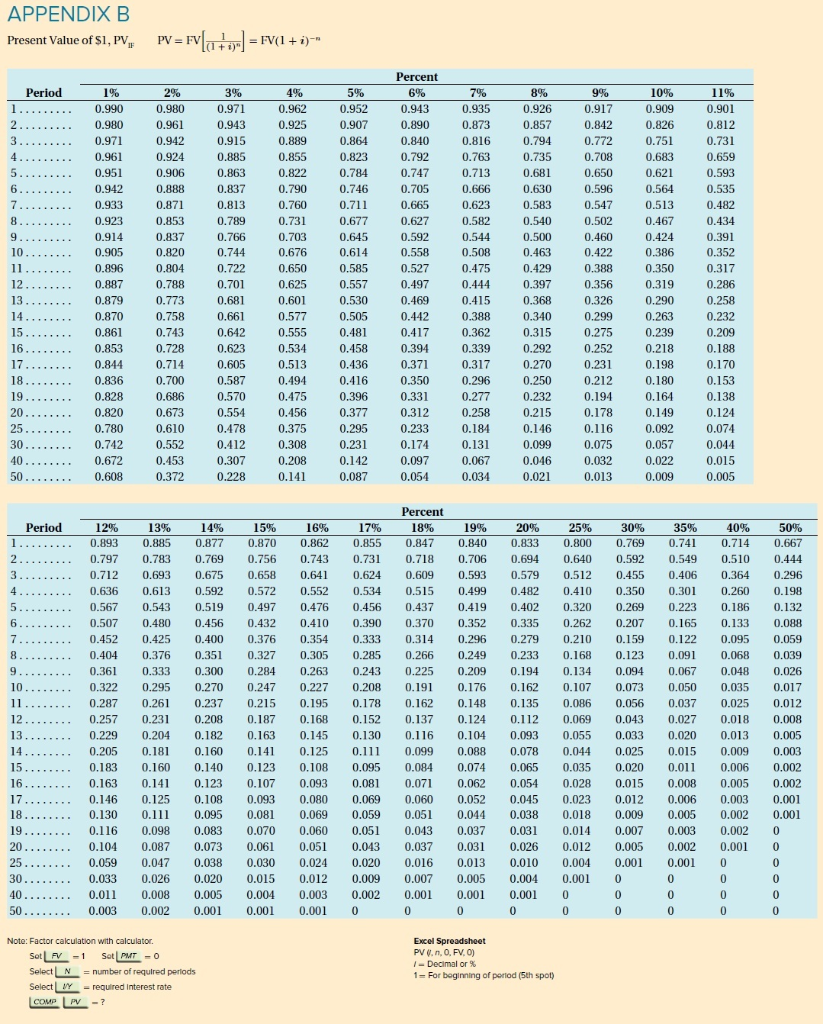

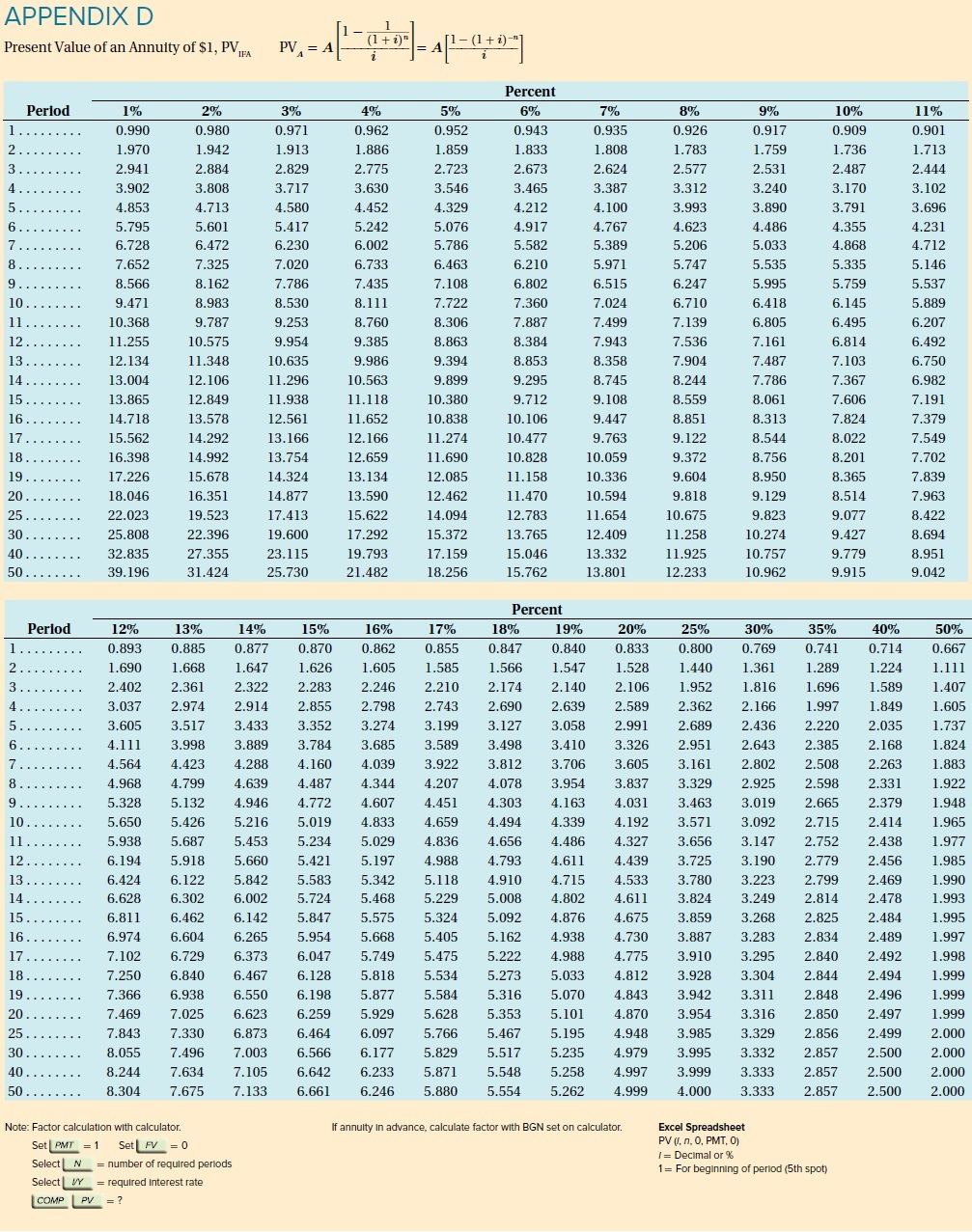

Compute the new price of the bond. Use Appendix B and Appendix D. (Round "PV Factor" to 3 decimal places. Do not round intermediate calculation. Round the final answer to 2 decimal places.)

New price of the bond $

APPENDIX B Present Value of $1,PV) PV = Fvlat = FV(1 + i)- Period 9% 0.917 0.842 0.772 0.708 1% 0.990 0.980 0.971 0.961 0.951 0.942 0.933 0.923 0.914 0.905 0.896 0.887 0.879 0.870 0.861 0.853 0.844 0.836 0.828 0.820 0.780 0.742 0.672 0.608 2% 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 0.804 0.788 0.773 0.758 0.743 0.728 0.714 0.700 0.686 0.673 0.610 0.552 0.453 0.372 3% 0.971 0.943 0.915 0.885 0.863 0.837 0.813 0.789 0.766 0.744 0.722 0.701 0.681 0.661 0.642 0.623 0.605 0.587 0.570 0.554 0.478 0.412 0.307 0.228 4% 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.650 0.625 0.601 0.577 0.555 0.534 0.513 0.494 0.475 0.456 0.375 0.308 0.208 0.141 5% 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.645 0.614 0.585 0.557 0.530 0.505 0.481 0.458 0.436 0.416 0.396 0.377 0.295 0.231 0.142 0.087 Percent 6% 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 0.527 0.497 0.469 0.442 0.417 0.394 0.371 0.350 0.331 0.312 0.233 0.174 0.097 0.054 7% 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 0.475 0.444 0.415 0.388 0.362 0.339 0.317 0.296 0.277 0.258 0.184 0.131 0.067 0.034 8% 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 0.146 0.099 0.046 0.021 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0.164 0.149 0.092 0.057 0.022 0.009 0.650 0.596 0.547 0.502 0.460 0.422 0.388 0.356 0.326 0.299 0.275 0.252 0.231 0.212 0.194 0.178 0.116 0.075 0.032 0.013 11% 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0.209 0.188 0.170 0.153 0.138 0.124 0.074 0.044 0.015 0.005 ..... .... ........ Period 0 ... 10. ....... 12% 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0.104 0.059 0.033 0.011 0.003 0 13% 0.885 0.783 0.693 0.613 0.543 0.480 0.425 0.376 0.333 0.295 0.261 0.231 0.204 0.181 0.160 0.141 0.125 0.111 0.098 0.087 0.047 0.026 0.008 0.002 14% 0.877 0.769 0.675 0.592 519 0.456 0.400 0.351 0.300 0.270 0.237 0.208 0.182 0.160 0.140 0.123 0.108 0.095 0.083 0.073 0.038 0.020 0.005 0.001 15% 0.870 0.756 0.658 0.572 0.497 0.432 0.376 0.327 0.284 0.247 0.215 0.187 0.163 0.141 0.123 0.107 0.093 0.081 0.070 0.061 0.030 0.015 0.004 0.001 16% 0.862 0.743 0.641 0.552 0.476 0.410 0.354 0.305 0.263 0.227 0.195 0.168 0.145 0.125 0.108 0.093 0.080 0.069 0.060 0.051 0.024 0.012 0.003 0.001 0 Percent 17% 18% 0.855 0.847 0.731 0.718 0.624 0.609 0.534 0.515 0.456 0.437 0.390 0.370 0.333 0.314 0.285 0.266 0.243 0.225 0.208 0.191 0.178 0.162 0.152 0.137 0.130 0.116 0.111 0.099 0.095 0.084 0.081 0.071 0.069 0.060 0.059 0.051 0.051 0.043 0.043 0.037 0.0200.016 0.0090.007 0.002 0.001 0 19% 20% 0.840 0.833 0.706 0.694 0.593 0.579 0.499 0.482 0.419 0.402 0.352 0.335 0.296 0.279 0.2490.233 0.209 0.194 .176 0.162 0.148 0.135 0.124 0.112 0.104 0.093 0.088 0.078 0.074 0.065 0.062 0.054 0.052 0.045 0.044 0.038 0.037 0.031 0.031 0.026 0.013 0.010 0.005 0.004 0.001 0.001 0 0 25% 0.800 0.640 0.512 0.410 0.320 0.262 0.210 0.168 0.134 0.107 0.086 0.069 0.055 0.044 0.035 0.028 0.023 0.018 0.014 0.012 0.004 0.0010 0 0 30% 0.769 0.592 0.455 0.350 0.269 0.207 0.159 0.123 0.094 0.073 0.056 0.043 0.033 0.025 0.020 0.015 0.012 0.009 0.007 0.005 0.001 35% 0.741 0.549 0.406 0.301 .223 0.165 0.122 0.091 0.067 0.050 0.037 0.027 0.020 0.015 0.011 0.008 0.006 0.005 0.003 0.002 0.0010 40% 0.714 0.510 0.364 0.260 0.186 0.133 0.095 0.068 0.048 0.035 0.025 0.018 0.013 0.009 0.006 0.005 0.003 0.002 0.002 0.001 50% 0.667 0.444 0.296 0.198 0.132 0.088 0.059 0.039 0.026 0.017 0.012 0.008 0.005 0.003 0.002 0.002 0.001 0.001 0 0 0 50........ 0 0 Note: Factor calculation with calculator. Set FV -1 Set PMT - 0 Select N = number of required periods Select 1Y = required interest rate COMP PV - ? Excel Spreadsheet PV 4., FV) 1 - Decimal or % 1= For beginning of period (5th spot) APPENDIX D Present Value of an Annuity of $1, PVA - PVA Period 4% 0.962 1.886 2.775 8% 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 1% 0.990 1.970 2.941 3.902 4.853 5.795 6.728 7.652 8.566 9.471 10.368 11.255 12.134 13.004 13.865 14.718 15.562 16.398 17.226 18.046 22.023 25.808 32.835 39.196 2% 0.980 1.942 2.884 3.808 4.713 5.601 6.472 7.325 8.162 8.983 9.787 10.575 11.348 12.106 12.849 13.578 14.292 14.992 15.678 16.351 19.523 22.396 27.355 31.424 3% 0.971 1.913 2.829 3.717 4.580 5.417 6.230 7.020 7.786 8.530 9.253 9.954 10.635 11.296 11.938 12.561 13.166 13.754 14.324 14.877 17.413 19.600 23.115 25.730 5% 0.952 1.859 2.723 3.546 4.329 5.076 5.786 6.463 7.108 7.722 8.306 8.863 9.394 9.899 10.380 10.838 11.274 11.690 12.085 12.462 14.094 15.372 17.159 18.256 3.630 4.452 5.242 6.002 6.733 7.435 8.111 8.760 9.385 9.986 10.563 11.118 11.652 12.166 12.659 13.134 13.590 15.622 17.292 19.793 21.482 Percent 6% 0.943 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360 7.887 8.384 8.853 9.295 9.712 10.106 10.477 10.828 11.158 11.470 12.783 13.765 15.046 1 5.762 7% 0.935 1.808 2.624 3.387 4.100 4.767 5.389 5.971 6.515 7.024 7.499 7.943 8.358 8.745 9.108 9.447 9.763 10.059 10.336 10.594 11.654 12.409 13.332 13.801 7.536 9% 0.917 1.759 2.531 3.240 3.890 4.486 5.033 5.535 5.995 6.418 6.805 7.161 7.487 7.786 8.061 8.313 8.544 8.756 8.950 9.129 9.823 10.274 10.757 10.962 10% 0.909 1.736 2.487 3.170 3.791 4.355 4.868 5.335 5.759 6.145 6.495 6.814 7.103 7.367 7.606 7.824 8.022 8.201 8.365 8.514 9.077 9.427 9.779 9.915 11% 0.901 1.713 2.444 3.102 3.696 4.231 4.712 5.146 5.537 5.889 6.207 6.492 6.750 6.982 7.191 7.379 7.549 7.702 7.839 7.963 8.422 8.694 8.951 9.042 7.904 8.244 8.559 8.851 9.122 9.372 9.604 9.818 10.675 11.258 11.925 12.233 40........ 50........ Period 12% 0.893 1.690 2.402 2......... 3.037 2 2 13% 14% 15% 0.885 0.877 0.870 1.668 1.647 1 .626 2.361 2.322 2.283 2.974 2.914 2.855 3.517 3.433 3.352 3.998 3.889 3.784 4.423 4.288 4.160 4.799 4.639 4 .487 5.132 4.946 4.772 5.426 5.2165.019 5.687 5.453 5.234 5.918 5.660 5.421 6.122 5.842 6.302 6.002 5.724 6.462 6.142 5.847 6.604 6.265 5.954 6.7296.373 6.047 6.840 6.467 6.128 6.938 6.550 6.198 7.025 6.623 6.259 7.330 6.873 6.464 7.496 7.003 6.566 7.634 7.105 6.642 7.675 7.133 6.661 3.605 4.111 4.564 4.968 5.328 5.650 5.938 6.194 6.424 6.628 6.811 6.974 7.102 7.250 7.366 7.469 7.843 8.055 8.244 8.304 16% 0.862 1.605 2.246 2.798 3.274 3.685 4.039 4.344 4.607 4.833 5.029 5.197 5.342 5.468 5.575 5.668 5.749 5.818 5.877 5.929 6.097 6.177 6.233 6.246 17% 0.855 1.585 2.210 2.743 3.199 3.589 3.922 4.207 4.451 4.659 4.836 4.988 5.118 5.229 5.324 5.405 5.475 5.534 5.584 5.628 5.766 5.829 5.871 5.880 Percent 18% 19% 20% 25% 0.847 0.840 0.833 0.800 1.566 1.547 1.528 1.440 2.174 2.140 2.106 1.952 2.690 2.639 2.589 2.362 3.127 3.058 2.991 2.689 3.498 3.410 3.326 2.951 3.812 3.706 3.605 3.161 4.078 3.954 3.837 3.329 4.303 4.163 4.031 3.463 4.494 4.3394.1923.571 4.656 4.486 4.327 3.656 4.793 4.611 4.439 3.725 4.910 4.715 4.533 3.780 5.008 4.802 4.611 3.824 5.092 4.876 4.675 3.859 5.162 4.938 4.730 3.887 5.222 4.988 4.775 3.910 5.273 5.033 4.812 3.928 5.316 5.070 4.843 3.942 5.353 5.101 4.870 3.954 5.467 5.195 4.948 3.985 .517 5.235 4.979 3.995 5.548 5.258 4.997 3.999 5.554 5.262 4.999 4.000 30% 0.769 1.361 1.816 2.166 2.436 2.643 2.802 2.925 3.019 3.092 3.147 3.190 3.223 3.249 3.268 3.283 3.295 3.304 3.311 3.316 3.329 3.332 3.333 3.333 35% 0.741 1.289 1.696 1.997 2.220 .385 .508 2.598 2.665 2.715 2.752 2.779 2.799 2.814 2.825 2.834 2.840 2.844 2.848 2.850 2.856 2.857 2.857 2.857 40% 0.714 1.224 1.589 1.849 2.035 2.168 2.263 2.331 2.379 2.414 2.438 2.456 2.469 2.478 2.484 2.489 2.492 2.494 2.496 2.497 2.499 2.500 2.500 2.500 50% 0.667 1.111 1.407 1.605 1.737 1.824 1.883 1.922 1.948 1.965 1.977 1.985 1.990 1.993 1.995 1.997 1.998 1.999 1.999 1.999 2.000 2.000 2.000 2.000 5.583 5 40........ 50........ If annuity in advance, calculate factor with BGN set on calculator. Note: Factor calculation with calculator. Set PMT = 1 Set FV = 0 Select N = number of required periods Select ve = required interest rate COMPPV = ? Excel Spreadsheet PV (I, n. 0, PMT, O) I= Decimal or % 1= For beginning of period (5th spot)