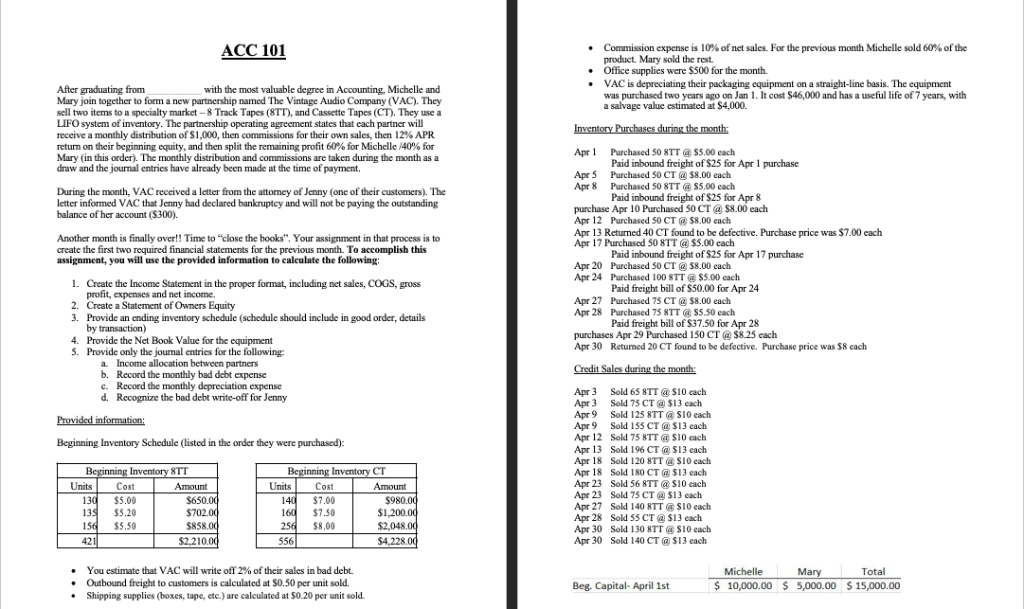

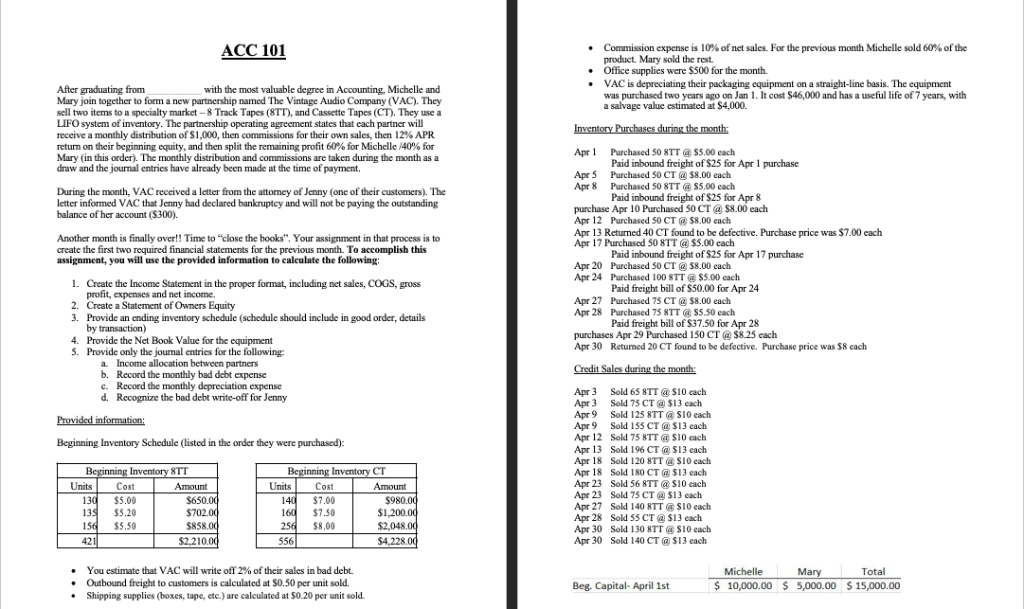

The Vintage Audio Company (VAC). They sell two items to a specialty market 8 Track Tapes (8TT), and Cassette Tapes (CT). They use a LIFO system of inventory. The partnership operating agreement states that each partner will receive a monthly distribution of $1,000, then commissions for their own sales, then 12% APR return on their beginning equity, and then split the remaining profit 60% for Michelle /40% for Mary (in this order). The monthly distribution and commissions are taken during the month as a draw and the journal entries have already been made at the time of payment.

ACC 101 Commission expense is 10% of net sales. For the previous month Michelle sold 60% of the product. Mary sold the rest. * .Office supplies were $500 for the month. .VAC is depreciating their packaging equipment on a straight-line basis. The equipment After graduating from Mary join together to form a new partnership named The Vintage Audio Company (VAC). They sell two items to a specialty market8 Track Tapes (8TT), and Cassette Tapes (CT). They use a LIFO system of inventory. The partnership operating agreement states that each partner will receive a monthly distribution of $1,000, then commissions for their own sales, then 12% APR retum on their beginning equity, and then split the remaining profit 60% for Michelle 40% for Mary (in this order). The monthly distribution and commissions are taken during the month as a draw and the journal entries have already been made at the time of payment. with the most valuable degree in Accounting, Michelle and was purchased two years ago on Jan 1. It cost $46,000 and has a useful life of 7 years, with a salvage value estimated at $4,000. Apr1 Purchased 50 8TTS5.00 each Paid inbound freight of $25 for Apr 1 purchase Apr5 Purchased S0 CT$8.00 each Apr8 Purchased 50 8TT S5.00 each During the month, VAC received a letter from the attorney of Jenny (one of their customers). The letter informed VAC that Jenny had declared bankruptcy and will not be paying the outstanding balance of her account ($300). Paid inbound freight of $25 for Apr8 purchase Apr 10 Purchased 50 CT @ $8.00 each Apr 12 Purchased 50 CT@ $8.00 each Apr 13 Returned 40 CT found to be defective. Purchase price was $7.00 each Apr 17 Purchased 50 8TT$S.00 each Another month is finally over!! Time to "close the books". Your assignment in that process is to create the first two required financial statements for the previous month. To accomplish this assignment, you will use the provided information to calculate the following Paid inbound freight of $25 for Apr 17 purchase Paid freight bill of $50.00 for Apr 24 Paid freight bill of $37.50 for Apr 28 Apr 20 Purchased S0 CT $8.00 each Apr 24 Purchased 100 STT$5.00 each 1. Create the Income Statement in the proper format, including net sales, COGS, gross profit, expenses and net income. 2. Create a Statement of Owners Equity 3. Provide an ending inventory schedule (schedule should include in good order, details Apr 27 Purchased 75 CT$8.00 each Apr 28 Purchased 75 8TT S5.50 each 4. 5. by transaction) Provide the Net Book Value for the equipment Provide only the journal entries for the following purchases Apr 29 Purchased 150 CT @$825 each Apr 30 Returmed 20 CT found to be defective. Purchase price was $8 each a. b. c. d. Income allocation between partners Record the monthly bad debt expense Record the monthly depreciation expense Recognize the bad debt write-off for Jenny Apr 3 Sold 65 8TT S10 each Apr 3 Sold 75 CT $13 each Apr9 Sold 125 8TT @ S10 each Apr9 Sold 1SS CT $13 each Apr 12 Sold 75 8TTS10 each Apr 13 Sold 196 CT $13 each Apr 18 Sold 120 8TT S10 each Apr 18 Sold 180 CT @ $13 each Apr 23 Sold 56 8TT S10 each Apr 23 Sold 75 CT $13 each Apr 27 Sold 140 8TT S10 each Apr 28 Sold 55 CT@ $13 each Apr 30 Sold 130 8TT S10 each Apr 30 Sold 140 CT $13 each Beginning Inventory Schedule (listed in the order they were purchased): STT Be CT UnitsCost $5.00 3 S5.20 $5.50 UnitsCost $7.00 $7.50 $8.00 Amount Amount $980 $1,200 $2,048 $4,228 $650 421 $2,210 556 You estimate that VAC will write off 2% ofther sales in bad debt. Outbound freight to customers is calculated at $0.50 per unit sold .Shipping supplies (boxes, tape, etc.) are calculated at $0.20 per unit sold. Michelle 10,000.00 Ma Total Beg. Capital- April 1st 5,000.00 $ 15,000.00