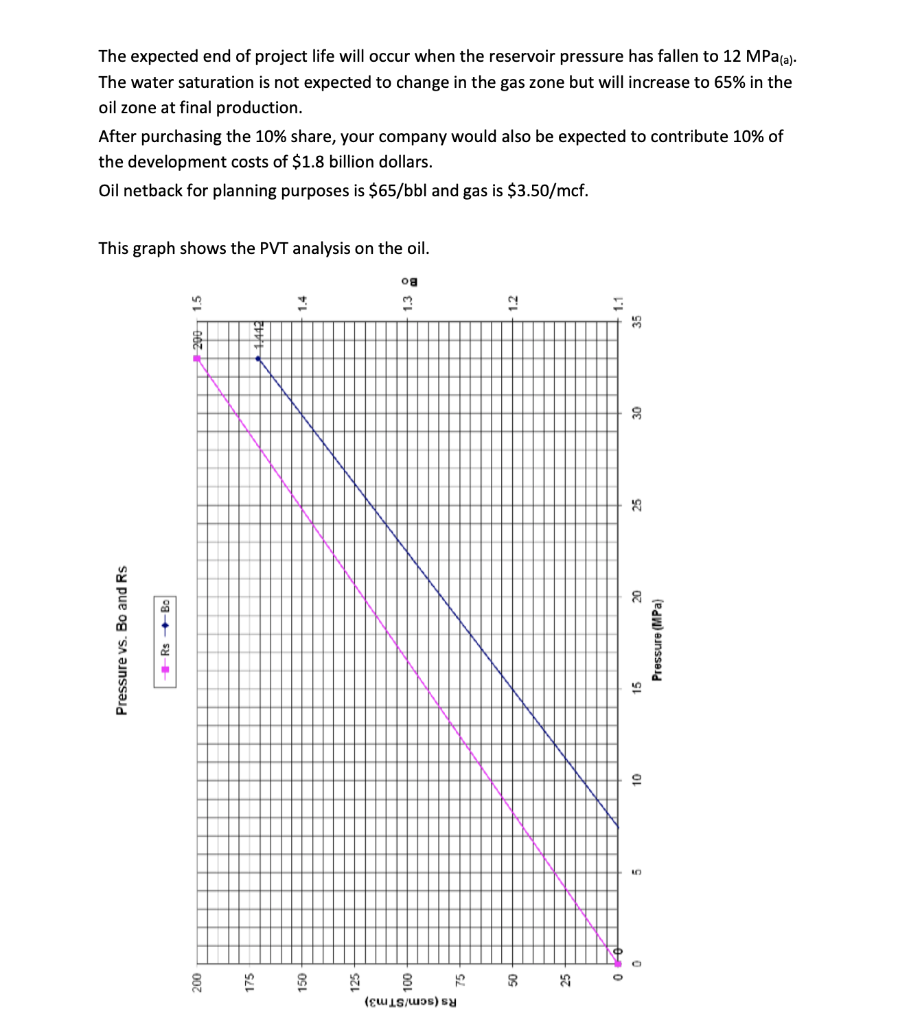

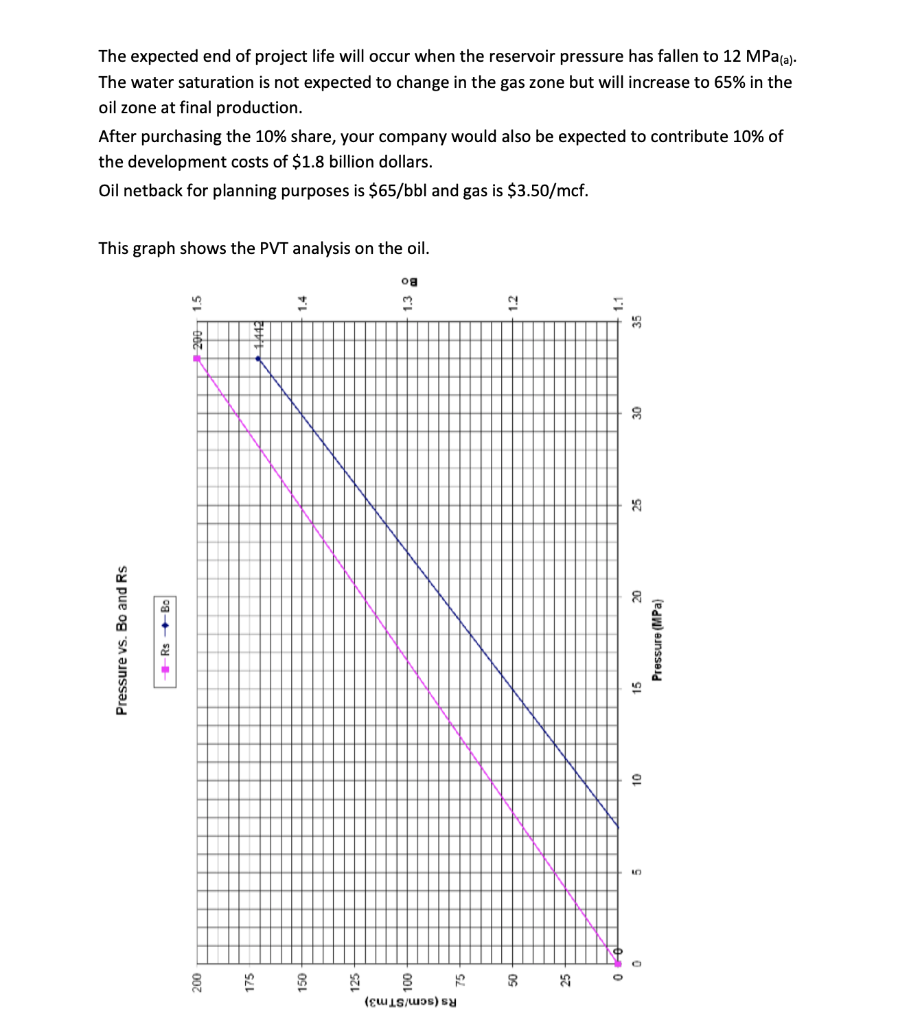

The VP of New Ventures has asked you to have a look at a couple of opportunities to determine which one makes more money for the company. You need to determine the recoverable reserves from two very different reservoirs and make a recommendation to her on which one to invest in. Consider "profit" and more importantly, "Return on Investment". SHALE GAS PLAY This play is located in a relatively remote part of NE BC and would require a lot of infrastructure and expensive drilling. It is rights on 10 sections of land containing a shale formation approximately 80m thick with 4.5% porosity, very tight permeability and an initial water saturation of 18%. Water saturation is expected to remain constant as there is no way for water to move into this rock (too tight). Unfortunately, the recovery factor for this type of reservoir is only expected to be about 10%. You will need to burn 5% of the produced gas for fuel (this is called "shrinkage"). The gas is sweet and dry with a MM of 19.6 kg/kmol. Res pressure and temp are 28 MPalabs) and 65 C respectively. Capital costs for this project are expected to be: 40 horizontal wells (downspaced) at $2 million each for drilling and completion. The infrastructure (roads, pipelines and compression) is about $35 million. This land is being offered at $50 million. Your company is using a gas netback of $4.00/mcf for planning purposes. PURCHASE WORKING INTEREST - OFFSHORE MALAYSIA This play is a reservoir that has been explored and delineated by a Joint Venture of 4 partners. One of the partners is offering up a 10% share at a cost of $300 million. The reservoir is 2500 ha with gas pay of 8m and a net oil pay of 16m. The porosity of the formation is 18% and the water saturation varies from 21% average in the gas zone to 26% in the oil zone. Reservoir temperature is 102C. The offshore location is close enough to land to warrant a separate gas and oil pipeline, so the gas will be produced and sold. The gas has a MM of 23 kg/kmol and contains 8% CO2 which will be removed on shore before sales. The expected end of project life will occur when the reservoir pressure has fallen to 12 MPa(a). The water saturation is not expected to change in the gas zone but will increase to 65% in the oil zone at final production. After purchasing the 10% share, your company would also be expected to contribute 10% of the development costs of $1.8 billion dollars. Oil netback for planning purposes is $65/bbl and gas is $3.50/mcf. This graph shows the PVT analysis on the oil. 1.38 1.5 1.4 1.2 8 Pressure vs. Bo and Rs Rs +Be Pressure (MPa) 10 175 150 125 (EWLS/os) The VP of New Ventures has asked you to have a look at a couple of opportunities to determine which one makes more money for the company. You need to determine the recoverable reserves from two very different reservoirs and make a recommendation to her on which one to invest in. Consider "profit" and more importantly, "Return on Investment". SHALE GAS PLAY This play is located in a relatively remote part of NE BC and would require a lot of infrastructure and expensive drilling. It is rights on 10 sections of land containing a shale formation approximately 80m thick with 4.5% porosity, very tight permeability and an initial water saturation of 18%. Water saturation is expected to remain constant as there is no way for water to move into this rock (too tight). Unfortunately, the recovery factor for this type of reservoir is only expected to be about 10%. You will need to burn 5% of the produced gas for fuel (this is called "shrinkage"). The gas is sweet and dry with a MM of 19.6 kg/kmol. Res pressure and temp are 28 MPalabs) and 65 C respectively. Capital costs for this project are expected to be: 40 horizontal wells (downspaced) at $2 million each for drilling and completion. The infrastructure (roads, pipelines and compression) is about $35 million. This land is being offered at $50 million. Your company is using a gas netback of $4.00/mcf for planning purposes. PURCHASE WORKING INTEREST - OFFSHORE MALAYSIA This play is a reservoir that has been explored and delineated by a Joint Venture of 4 partners. One of the partners is offering up a 10% share at a cost of $300 million. The reservoir is 2500 ha with gas pay of 8m and a net oil pay of 16m. The porosity of the formation is 18% and the water saturation varies from 21% average in the gas zone to 26% in the oil zone. Reservoir temperature is 102C. The offshore location is close enough to land to warrant a separate gas and oil pipeline, so the gas will be produced and sold. The gas has a MM of 23 kg/kmol and contains 8% CO2 which will be removed on shore before sales. The expected end of project life will occur when the reservoir pressure has fallen to 12 MPa(a). The water saturation is not expected to change in the gas zone but will increase to 65% in the oil zone at final production. After purchasing the 10% share, your company would also be expected to contribute 10% of the development costs of $1.8 billion dollars. Oil netback for planning purposes is $65/bbl and gas is $3.50/mcf. This graph shows the PVT analysis on the oil. 1.38 1.5 1.4 1.2 8 Pressure vs. Bo and Rs Rs +Be Pressure (MPa) 10 175 150 125 (EWLS/os)