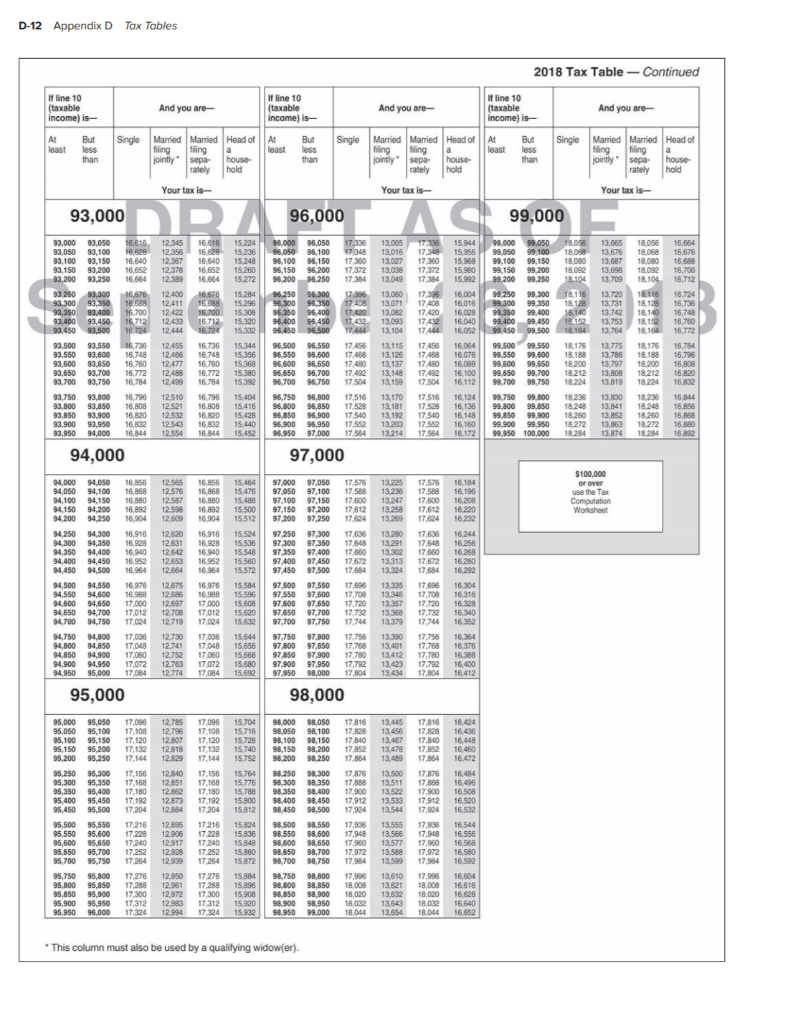

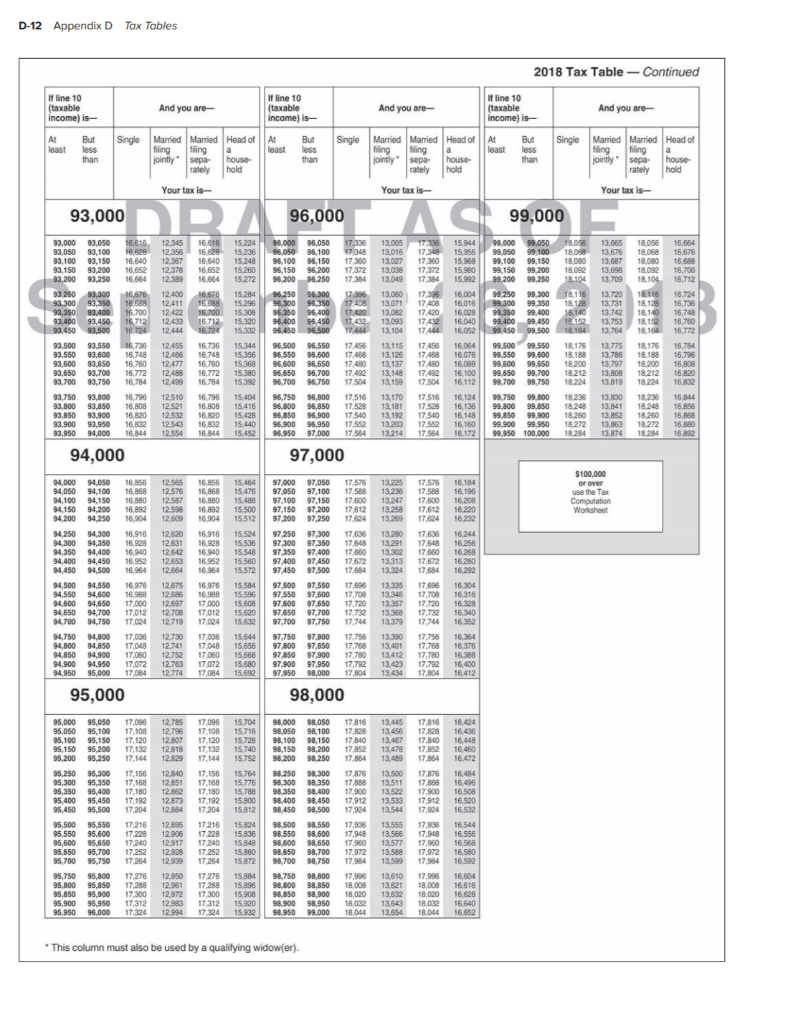

The W-2 income of Sandra, a single taxpayer, was $94,776. Determine Sandra's tax liability. Use the appropriate Tax Tables.2018

The W-2 income of Sandra, a single taxpayer, was $94,776. Determine Sandra's tax liability. Use the appropriate Tax Tables.2018

D-12 Appendix D Tax Tables 2018 Tax Table - Continued If line 10 (taxable income) is And you are- If line 10 (taxable income) is- And you are At least But less than Single Married Married Head of filing filing a jointly sepa house- rately hold At least But less than If line 10 And you are (taxable Income) is- Single Married Married Head of At But filing filing a least less jointly sepa- house- than rately hold Single Married Married Head of filing filing a jointly sepa house- rately hold Your tax is- Your taxis Your taxis 93 DR 96,000 99,000 93,000 93,050 93,050 16.628 93,100 93,150 16.640 93,150 93,200 16,652 $3,200 93.250 16.664 93,250 93,300 16,670 93,300 93.350 16.088 93,350 93,400 16.700 93,400 93,450 16,712 93.450 93,500 16.724 93,500 93,550 16.736 93,550 93.600 16.748 93,600 93,650 16.760 93,650 93,700 16.772 93,700 93,750 16,784 93,750 93,800 16.790 93,800 93,850 16.808 93,850 93.900 16.820 93,900 93.950 16,832 93,950 94.000 16.844 12345 16676 12,356 16.628 12.367 16.640 12,378 16,652 12.389 16,664 12.400 16,676 12.411 16.088 12.422 16.700 12 403 16.712 12.444 16.724 12.455 16.736 12466 16.748 12.477 16.750 12.488 16.772 12.499 16.784 12.510 16.790 12.521 16.808 12.52 16.820 12.543 16.832 12.554 16.844 15224 15.236 15.248 15,260 15.272 15.284 15.296 15.300 15,320 15.302 15.344 15.356 15.368 15.380 15.392 95000 96,050 96,050 96,100 94.100 96,150 96,150 96,200 96.200 96,250 95.250 96.300 96,300 96,350 96,350 96,400 96.400 96.450 96.450 96,500 96,500 96,550 96,550 95,600 96,600 96,650 96.650 96,700 96,700 96,750 96.750 96,800 96,800 96,850 96.850 96,900 96.900 96,950 96.950 97,000 17335 13,005 17,336 17348 13.016 17,318 17,360 13.027 17,360 17,372 13.038 17,372 17,384 13.049 17,384 17.396 13.060 17,396 17.08 13.071 17.408 17.20 13.082 17.420 17.432 13.090 17.432 13,104 17.444 17.456 13.115 17,456 17.458 13.126 17.468 17.480 13.137 17.480 17.492 13,148 17,492 17 504 13.159 17,504 17,516 13,170 17,516 17.528 13.181 17,528 17.540 13.192 17.540 17.552 13.203 17,552 17.564 13 214 17.564 15.94499.000 99.050 18056 15.956 99,050 99,100 18.088 15.968 99,100 99,150 18.080 15.980 99,150 99,200 18.092 15.992 99,200 99.250 18.104 16,004 99 250 99 300 18.116 16.016 99.300 99,350 18.128 16.028 99,350 99.400 18.140 16.040 98.400 99.450 184152 16.052 99.450 99.500 18.164 16064 99.500 99,550 18.178 16.078 99.550 99.500 18.188 16.088 99,600 99,650 18.200 16.100 99.550 99.700 18.212 16.112 99,700 99.750 18.224 16.124 99.750 99,800 18.236 16.136 99.800 99.850 18.248 16.148 99.850 99.900 18.250 16.160 99.900 99.950 18.272 16.172 99.950 100.000 18.254 13,665 13,676 13,687 13,698 13.700 13.720 13,731 13.742 13759 13,764 13.775 13.786 13,797 13,808 13,819 18.056 18,068 18.080 18.092 18.104 18.116 18128 18.100 18.12 18.164 18.170 18.188 18.200 18.212 18.224 16,664 16,676 16,688 16,700 16,712 16,724 16,736 16,70 16,780 16.772 16,784 16,796 16,808 16.820 16,832 18. 230 18.248 15.404 15.416 15.428 15.440 15.452 13,830 13,841 13 852 13,863 13.874 18.200 16,844 16,856 16.800 16,880 16.892 18.272 18.284 94,000 97,000 12.568 12.570 12.587 12.50 12.500 16.184 16.190 16.208 16.220 16.232 $100,000 or over use the Tax Computation Worksheet 17.576 17,588 17,600 17,612 17.624 17.68 17.648 17.650 17,672 17.68 13.225 13.236 13.247 13.258 13.269 13.280 13.291 13.302 13.313 13.324 17.576 17.588 17,600 17,612 17,624 17.635 17,648 17.680 17,672 17,684 12,620 12.631 12,542 12.653 12.654 16.244 16.258 16.268 16.280 16.292 94,000 94.050 16,856 94,050 94,100 16.868 94,100 94,150 16,880 94,150 94.200 16,892 94,200 94.250 16.904 94,250 94.300 16.916 94,300 94,350 16.928 94,350 94,400 16.940 94,400 94,450 16.952 94,450 94,500 16.964 94,500 4,550 16.978 94,550 94,600 16.988 94,500 94,650 17.000 94,650 94,700 17.012 94,700 94.750 17.024 94,750 94,800 17.036 94,800 94,850 17,048 94,850 94,900 17,060 94,900 94.950 17,072 94,950 95,000 17084 16,856 16.868 16.880 16,892 16.904 16.916 16.928 16.940 16.952 16.964 16.976 16.988 17.000 17012 17.024 17.036 17.048 17060 17,072 17.084 15.464 15.476 15.488 15.500 15,512 15.524 15.536 15.548 15.560 15.572 15,584 15.596 15.608 15.620 15.632 15.544 15.656 15.668 15.680 15.692 97.000 97,050 97,050 97,100 97,100 97.150 97,150 97,200 97.200 97.250 97.250 97,300 97,300 97,350 97,350 97,400 97,400 97.450 97,450 97,500 97.500 97,550 97.550 97,600 97.600 97,650 97,650 97,700 97.700 97.750 97,750 97,800 97.800 97850 97,850 97,900 97.900 97.950 97,950 98,000 16 304 16 316 16.328 16.340 16,352 12.675 12.586 12.697 12.708 12,719 12.730 12,741 12.752 12.783 12,774 17.595 13.335 17.708 13.345 17.720 13.357 17,732 13.368 17.744 13.379 17,756 13.390 17.768 13,401 17,780 13,412 17.792 13.423 17 804 13.434 17.696 17,708 17.720 17.732 17,744 17.756 17,758 17,780 17.792 17,804 16,364 16,376 16.388 16.400 16.412 95,000 98,000 15.704 15.716 15.728 15,740 15.752 12.785 12.796 12.807 12.818 12.829 12.340 12,851 12.862 12,873 12.884 17.096 17.108 17.120 17.132 17.144 17.156 17.168 17.180 17.192 17.204 17,816 17.820 17.840 17.852 17.864 17,876 17.80 17.900 17912 17.924 13.445 13.456 13.467 13.478 13.489 13.500 13,511 13.522 13.583 13.544 16.424 16.436 16.448 16.460 16.472 16.484 16.495 15.764 15.776 15.788 15.800 15.812 95,000 95,050 17,096 95,050 95,100 17,108 95.100 95,150 17.120 95,150 95,200 17,132 95,200 95.250 17,144 95.250 95,300 17.156 95,300 95.350 17,168 95,350 95.400 17.180 95,400 95.450 17,192 95,450 95,500 17,204 95,500 95,550 17.216 95,550 95,600 17.228 95,600 95,650 17.240 95,650 95,700 17.252 95,700 95,750 17.264 95,750 95,800 17.278 95,800 95.850 17.288 95,850 95.900 17.300 95.900 95,950 17.312 95.950 96.000 17.324 98.000 98,050 98.050 98,100 98,100 98,150 98,150 98,200 98.200 98.250 98.250 98,300 98.300 98.350 98,350 98,400 98,400 98,450 98.450 98.500 98.500 98.550 98,550 98,600 98.600 98,650 98.650 98.700 98,700 98,750 98.750 98,800 98.800 98,850 98.850 98,900 98.900 98,950 98.950 99,000 17,816 17,828 17,840 17.852 17.864 17.876 17,888 17.900 17.912 17.924 17.956 17.948 17,960 17.972 17,984 17,996 18,008 18,020 18.032 18.044 12.896 12.906 12,917 12.928 12.909 12.950 12.961 12.972 12.980 12.994 17210 17 228 17240 17.252 17.264 17 278 17 288 17300 17.312 17324 15.824 15,836 15,848 15.860 15.872 15 884 15.896 15.908 15.920 15.932 17.935 13.555 17.948 13.566 17.960 13.577 17.972 13.588 17.984 13.599 17.99 13.610 18.000 13.521 18,020 13.632 18.032 13.643 18.044 13.654 16.508 16.520 16,532 16.544 16.556 16.568 16.580 1992 16,592 16.804 16.616 16.628 16.540 16.652 * This column must also be used by a qualifying widow(er)

The W-2 income of Sandra, a single taxpayer, was $94,776. Determine Sandra's tax liability. Use the appropriate Tax Tables.2018

The W-2 income of Sandra, a single taxpayer, was $94,776. Determine Sandra's tax liability. Use the appropriate Tax Tables.2018