Question

the WACC must also inses its debt ratio, th (EBIT), taxaliona similar comprease. (EBIT), tax rates, and business risks, HD and Company HD's return on

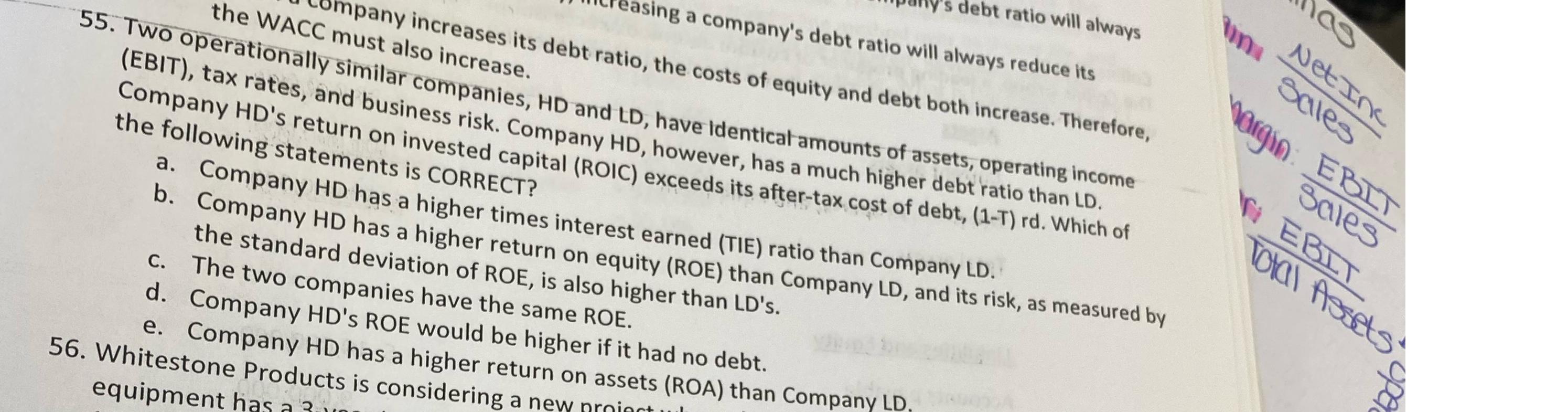

the WACC must also inses its debt ratio, th (EBIT), taxaliona similar comprease.\ (EBIT), tax rates, and business risks, HD and Company HD's return on inves risk. Company HD, have identical amounts of assets, operating income the following statements is CORted capital (ROIC) however, has a much higher debt ratio than LD.\ a. Company HD has is CORRECT?\ b. Company HD has a higher times interest earned the standard devia higher return on equity (ROd (TIE) ratio than Company LD.\ c. The two companiotion of ROE, is also higher than LD's.\ d. Company HD's ROE have the same ROE.\ e. Company HD has a high be higher if it had no debt.\ 56. Whitestone Products is considering return on assets (ROA) than Company LD.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started