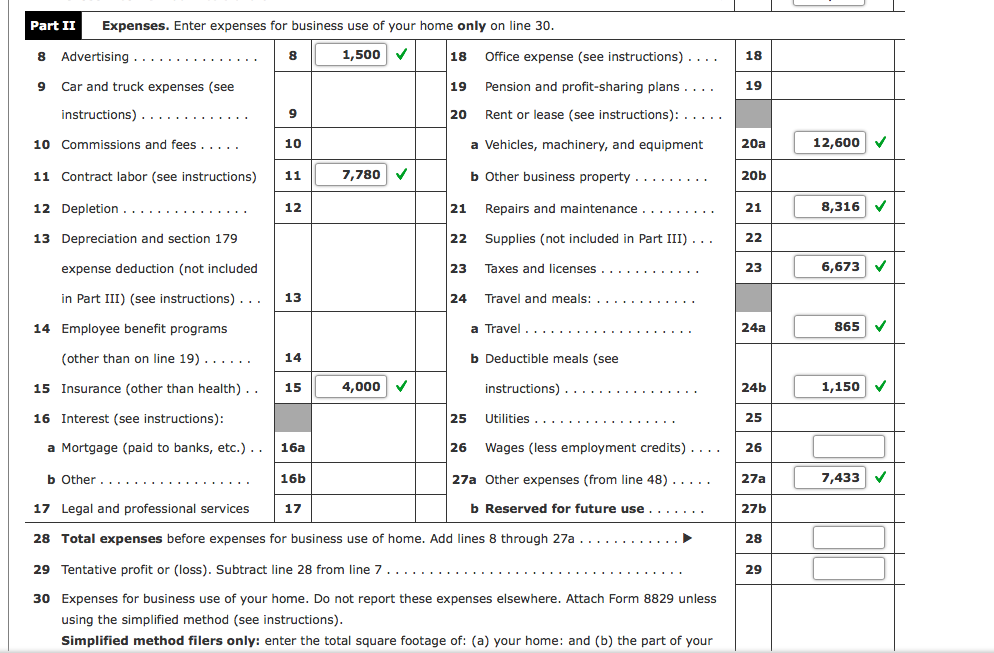

The wages less employees box - I have added the salaries plus taxes and the answer is wrong , I have just put in the salaries and it is wrong , I have subtracted taxes from the salary it is wrong as well . I cannot finish it without completing this form, what am I doing wrong here?

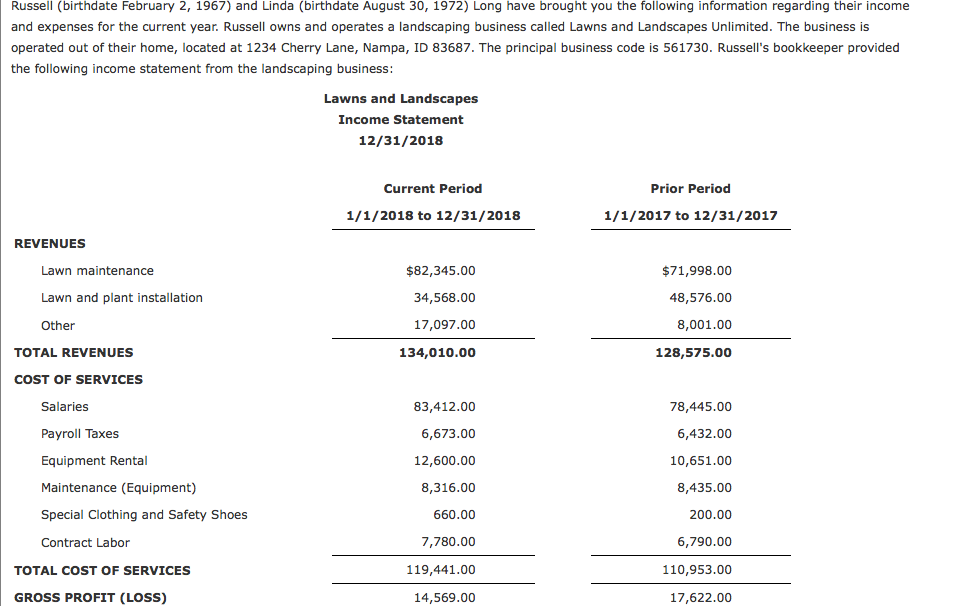

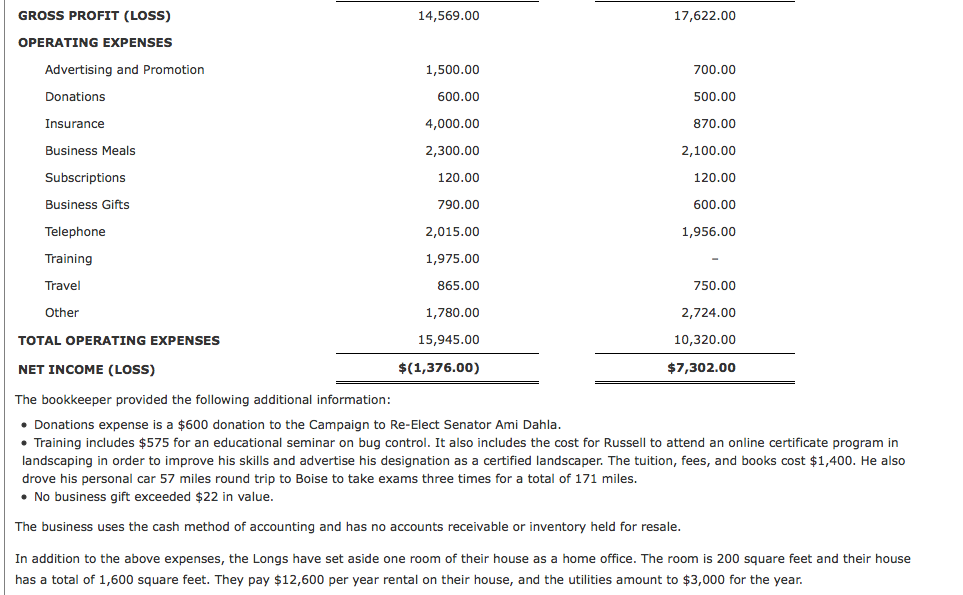

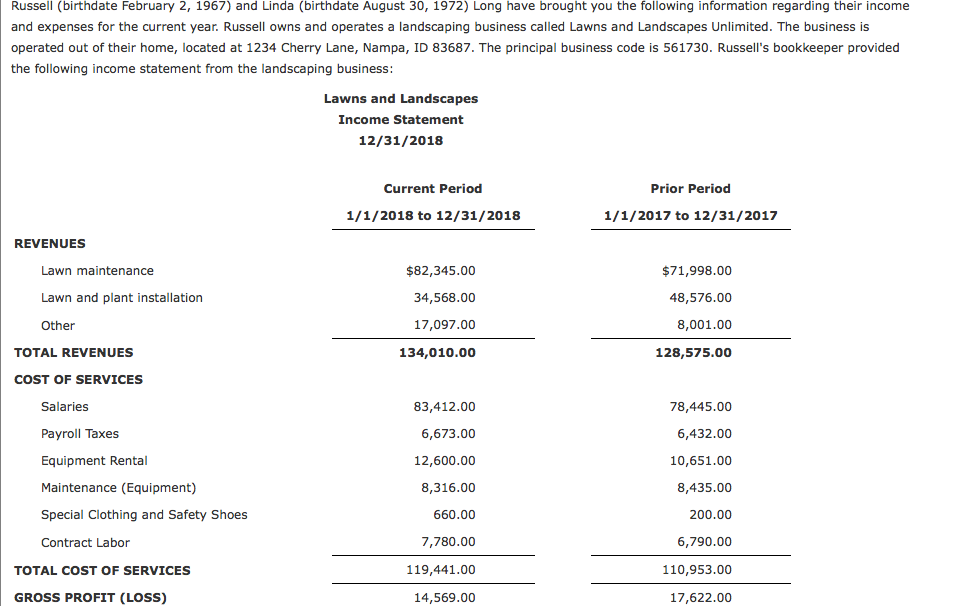

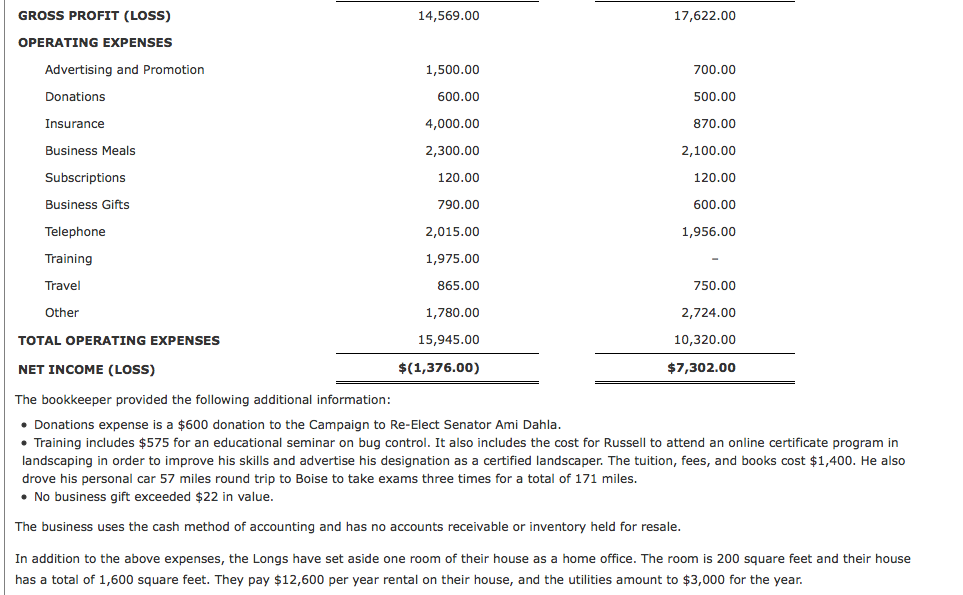

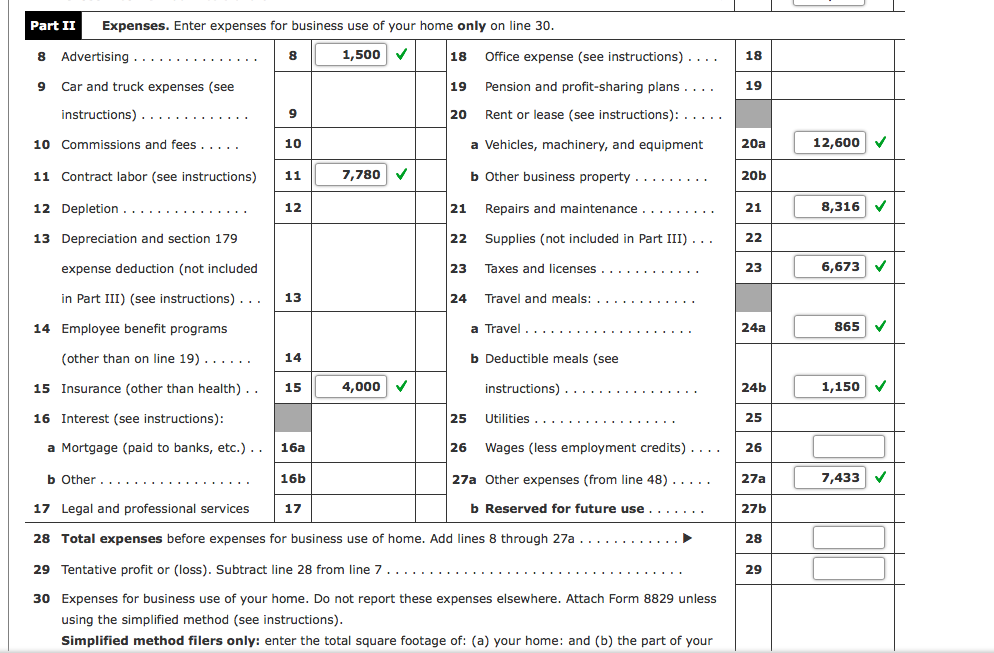

Russell (birthdate February 2, 1967) and Linda (birthdate August 30, 1972) Long have brought you the following information regarding their income and expenses for the current year. Russell owns and operates a landscaping business called Lawns and Landscapes Unlimited. The business is operated out of their home, located at 1234 Cherry Lane, Nampa, ID 83687. The principal business code is 561730. Russell's bookkeeper provided the following income statement from the landscaping business: Lawns and Landscapes Income Statement 12/31/2018 Current Period Prior Period 1/1/2017 to 12/31/2017 1/1/2018 to 12/31/2018 REVENUES Lawn maintenance $71,998.00 $82,345.00 34,568.00 Lawn and plant installation 48,576.00 Other 17,097.00 8,001.00 134,010.00 128,575.00 TOTAL REVENUES COST OF SERVICES Salaries 78,445.00 83,412.00 6,673.00 Payroll Taxes Equipment Rental Maintenance (Equipment) 6,432.00 10,651.00 12,600.00 8,316.00 8,435.00 Special Clothing and Safety Shoes 200.00 660.00 7,780.00 6,790.00 Contract Labor TOTAL COST OF SERVICES GROSS PROFIT (LOSS) 119,441.00 110,953.00 14,569.00 17,622.00 14,569.00 17,622.00 GROSS PROFIT (LOSS) OPERATING EXPENSES Advertising and Promotion 1,500.00 700.00 Donations 600.00 500.00 Insurance 4,000.00 870.00 Business Meals 2,100.00 2,300.00 120.00 Subscriptions 120.00 Business Gifts 790.00 600.00 Telephone 2,015.00 1,956.00 Training 1,975.00 Travel 865.00 750.00 1,780.00 2,724.00 Other TOTAL OPERATING EXPENSES 15,945.00 10,320.00 NET INCOME (LOSS) $(1,376.00) $7,302.00 The bookkeeper provided the following additional information: Donations expense is a $600 donation to the Campaign to Re-Elect Senator Ami Dahla. Training includes $575 for an educational seminar on bug control. It also includes the cost for Russell to attend an online certificate program in landscaping in order to improve his skills and advertise his designation as a certified landscaper. The tuition, fees, and books cost $1,400. He also drove his personal car 57 miles round trip to Boise to take exams three times for a total of 171 miles. No business gift exceeded $22 in value. The business uses the cash method of accounting and has no accounts receivable or inventory held for resale. In addition to the above expenses, the Longs have set aside one room of their house as a home office. The room is 200 square feet and their house has a total of 1,600 square feet. They pay $12,600 per year rental on their house, and the utilities amount to $3,000 for the year. Part II Expenses. Enter expenses for business use of your home only on line 30. 8 Advertising ....... 1,500 18 Office expense (see instructions).... 9 Car and truck expenses (see 19 Pension and profit-sharing plans .... 18 instructions)............. Rent or lease see instructions): ..... 10 Commissions and fees ...... a Vehicles, machinery, and equipment 20a 12,600 11 Contract labor (see instructions) 11 7,780 b Other business property ......... 20b 12 Depletion .......... Repairs and maintenance ......... 8,316 22 Supplies (not included in Part III) ... 13 Depreciation and section 179 expense deduction (not included in Part III) (see instructions) ... 23 Taxes and licenses ......... 6,673 13 24 Travel and meals: .... 14 Employee benefit programs a Travel .... 865 (other than on line 19)...... b Deductible meals (see 15 Insurance (other than health)... 4,000 instructions) ......... 24b 1,150 16 Interest (see instructions): 25 Utilities ................. 25 a Mortgage (paid to banks, etc.).. 16a 26 Wages (less employment credits).... 26 b Other ........ 16b 27a Other expenses (from line 48)..... 7,433 17 Legal and professional services 17 b Reserved for future use ....... 28 Total expenses before expenses for business use of home. Add lines 8 through 27a ............ 29 Tentative profit or (loss). Subtract line 28 from line 7...... 30 Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 unless using the simplified method (see instructions). Simplified method filers only: enter the total square footage of: (a) your home: and (b) the part of your Russell (birthdate February 2, 1967) and Linda (birthdate August 30, 1972) Long have brought you the following information regarding their income and expenses for the current year. Russell owns and operates a landscaping business called Lawns and Landscapes Unlimited. The business is operated out of their home, located at 1234 Cherry Lane, Nampa, ID 83687. The principal business code is 561730. Russell's bookkeeper provided the following income statement from the landscaping business: Lawns and Landscapes Income Statement 12/31/2018 Current Period Prior Period 1/1/2017 to 12/31/2017 1/1/2018 to 12/31/2018 REVENUES Lawn maintenance $71,998.00 $82,345.00 34,568.00 Lawn and plant installation 48,576.00 Other 17,097.00 8,001.00 134,010.00 128,575.00 TOTAL REVENUES COST OF SERVICES Salaries 78,445.00 83,412.00 6,673.00 Payroll Taxes Equipment Rental Maintenance (Equipment) 6,432.00 10,651.00 12,600.00 8,316.00 8,435.00 Special Clothing and Safety Shoes 200.00 660.00 7,780.00 6,790.00 Contract Labor TOTAL COST OF SERVICES GROSS PROFIT (LOSS) 119,441.00 110,953.00 14,569.00 17,622.00 14,569.00 17,622.00 GROSS PROFIT (LOSS) OPERATING EXPENSES Advertising and Promotion 1,500.00 700.00 Donations 600.00 500.00 Insurance 4,000.00 870.00 Business Meals 2,100.00 2,300.00 120.00 Subscriptions 120.00 Business Gifts 790.00 600.00 Telephone 2,015.00 1,956.00 Training 1,975.00 Travel 865.00 750.00 1,780.00 2,724.00 Other TOTAL OPERATING EXPENSES 15,945.00 10,320.00 NET INCOME (LOSS) $(1,376.00) $7,302.00 The bookkeeper provided the following additional information: Donations expense is a $600 donation to the Campaign to Re-Elect Senator Ami Dahla. Training includes $575 for an educational seminar on bug control. It also includes the cost for Russell to attend an online certificate program in landscaping in order to improve his skills and advertise his designation as a certified landscaper. The tuition, fees, and books cost $1,400. He also drove his personal car 57 miles round trip to Boise to take exams three times for a total of 171 miles. No business gift exceeded $22 in value. The business uses the cash method of accounting and has no accounts receivable or inventory held for resale. In addition to the above expenses, the Longs have set aside one room of their house as a home office. The room is 200 square feet and their house has a total of 1,600 square feet. They pay $12,600 per year rental on their house, and the utilities amount to $3,000 for the year. Part II Expenses. Enter expenses for business use of your home only on line 30. 8 Advertising ....... 1,500 18 Office expense (see instructions).... 9 Car and truck expenses (see 19 Pension and profit-sharing plans .... 18 instructions)............. Rent or lease see instructions): ..... 10 Commissions and fees ...... a Vehicles, machinery, and equipment 20a 12,600 11 Contract labor (see instructions) 11 7,780 b Other business property ......... 20b 12 Depletion .......... Repairs and maintenance ......... 8,316 22 Supplies (not included in Part III) ... 13 Depreciation and section 179 expense deduction (not included in Part III) (see instructions) ... 23 Taxes and licenses ......... 6,673 13 24 Travel and meals: .... 14 Employee benefit programs a Travel .... 865 (other than on line 19)...... b Deductible meals (see 15 Insurance (other than health)... 4,000 instructions) ......... 24b 1,150 16 Interest (see instructions): 25 Utilities ................. 25 a Mortgage (paid to banks, etc.).. 16a 26 Wages (less employment credits).... 26 b Other ........ 16b 27a Other expenses (from line 48)..... 7,433 17 Legal and professional services 17 b Reserved for future use ....... 28 Total expenses before expenses for business use of home. Add lines 8 through 27a ............ 29 Tentative profit or (loss). Subtract line 28 from line 7...... 30 Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 unless using the simplified method (see instructions). Simplified method filers only: enter the total square footage of: (a) your home: and (b) the part of your