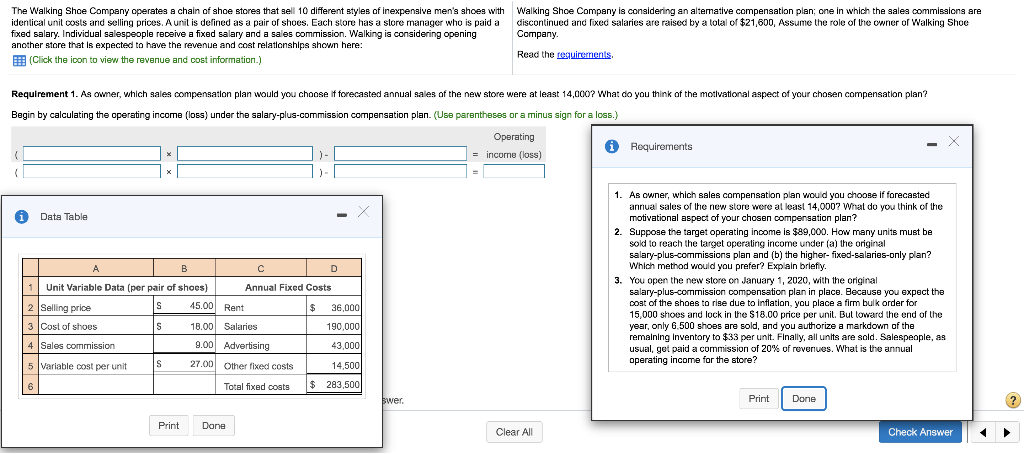

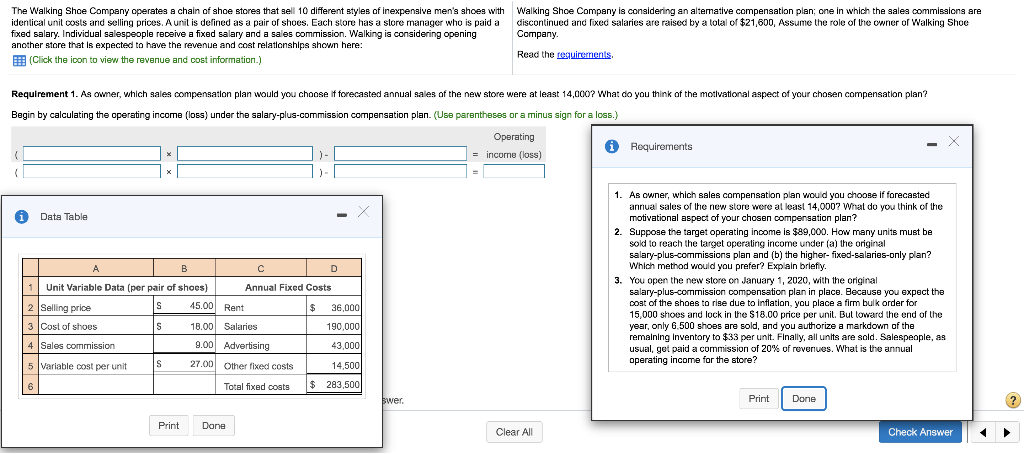

The Walking Shoe Company operates a chain of shoe stores that sell 10 different styles of inexpensive men's shoes with Walking Shoe Company is considering an altemative compensation plan; one in which the sales commissions are identical unit costs and selling prices. A unit is defined as a pair of shoes. Each store has a store manager who is paid a discontinued and fixed salaries are raised by a lolal of $21,600, Assume the role of the owner of Walking Shoe fixed salary. Individual salespeople receive a fixed salary and a sales commission. Walking is considering opening Company another store that is expected to have the revenue and cost relationships shown here: Read the requirements (Click the icon to view the revenue and cost information.) Requirement 1. As owner, which sales compensation plan would you choose if forecasted annual sales of the new store were at least 14,000? What do you think of the motivational aspect of your chosen compensation plan? Begin by calculating the operating income (loss) under the salary-plus-commission compensation plan. (Use parentheses or a minus sign for a loss. Operating Requirements ( ) - = incorne (loss) x X Data Table A B D 1. As owner, which sales compensation plan would you choose if forecasted annual sales of the new store were at least 14,000? Whal do you think of the motivational aspect of your chosen compensation plan? 2. Suppose the target operating income is $89,000. How many units must be sold to reach the target operating income under (a) the original salary-plus-commissions plan and (b) the higher-fixed-salaries-only plan? Which method would you prefer? Explain briefly. 3. You open the new store on January 1, 2020, with the original salary-plus-commission compensation plan in place. Because you expect the coat of the shoes to rise due to inflation, you place a firm bulk order for 15,000 shoes and lock in the $18.00 price per unit. But toward the end of the year, only 6.500 shoes are sold, and you authorize a markdown of the remaining Inventory to $33 per unit. Finally, all units are sold. Salespeople, as usual, get paid a commission of 20% of revenues. What is the annual operating income for the store? 45.00 Rent 1 Unit Variable Data (per pair of shoes) Annual Fixed Costs 2 Selling price S $ 36,000 3 Cost of shoes S 18.00 Salaries 190.000 4 Sales commission 9.00 Advertising 43,000 5 Variable cost per unit S 27.00 Other fixed costs 14,500 6 Total fixed costs $ 283,500 swer Print Done ? Print Dane Clear All Check