Question

The Wall Street Journal (Lippman, John, The Producers: 'The Terminator' Is Back, March 8, 2002, A1) reported that Warner Brothers agreed to pay $50 million

The Wall Street Journal (Lippman, John, "The Producers: 'The Terminator' Is Back," March 8, 2002, A1) reported that Warner Brothers agreed to pay $50 million for its U.S. distribution rights, plus an additional $50 million in marketing costs, so that it could release Terminator 3 (T-3) in the summer of 2003. It paid this large sum because it did not want another studio to release T-3 on the same weekend in 2003 that Warner released its movie Matrix 2. Suppose that Warner had not purchased the distribution

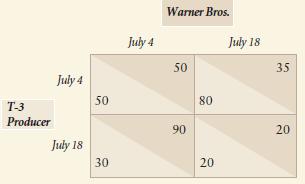

rights to T-3 and that the film's producer retained the rights. Warner would have had to decide whether to release Matrix 2 on the July 4 weekend or on the July 18 weekend. Simultaneously, T-3's producer would have had to decide which of those two weekends to release its film. The payoff matrix (in millions of dollars) of the simultaneous-moves game would have been

a. What is the Nash equilibrium to this simultaneous moves game?

b. Which release dates would have maximized the sum of the profits? Explain.

c. What is the greatest price Warner would have been willing to pay to purchase the distribution rights to T-3? What is the lowest price that T-3's producer would have been willing to accept to sell the rights? Are there mutually beneficial prices at which the trade takes place?

d. If Warner purchased the distribution rights of T-3, when should it have released the film and when should it have released Matrix 2? Explain.

Warner Bros. July 4 July 18 50 35 July 4 50 80 T-3 Producer 90 20 July 18 30 20

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started