Question

The Warm as Toast Company installs furnaces and fireplaces in homes and businesses. Each furnace and fireplace carries a four-year warranty. During 2016, the company

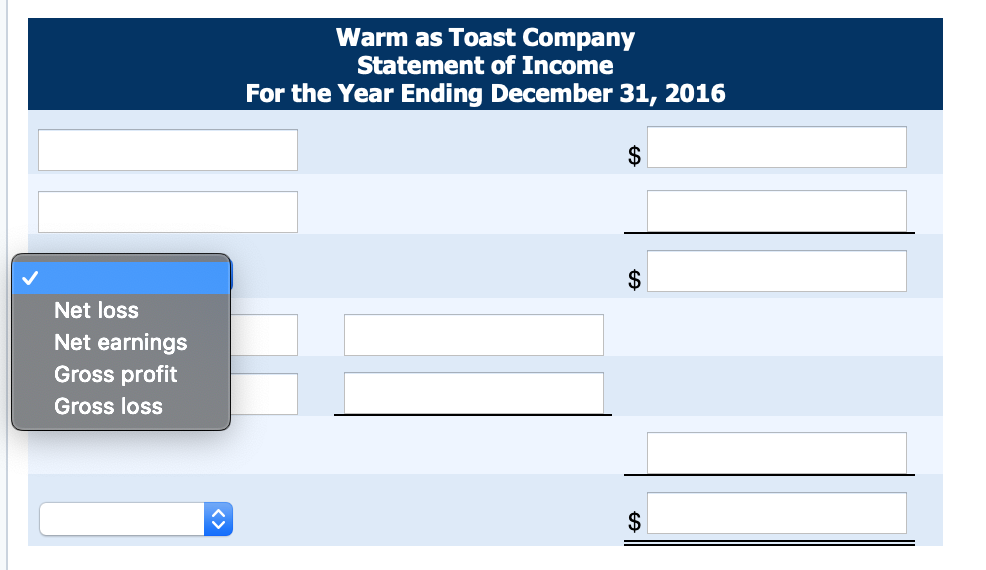

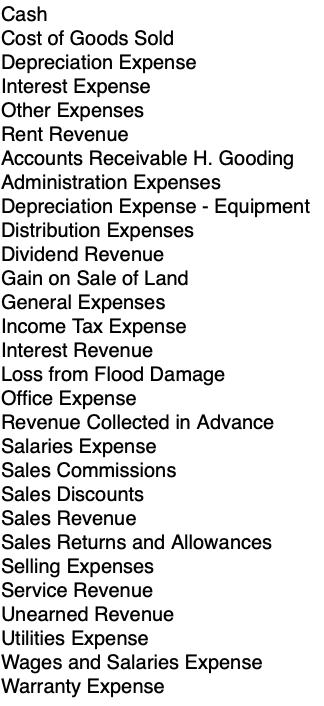

The Warm as Toast Company installs furnaces and fireplaces in homes and businesses. Each furnace and fireplace carries a four-year warranty. During 2016, the company had sales of $835,000. Customers paid half of the sales price when they arranged for an installation and the other half when the furnace or fireplace was installed. At year end, $75,600 of the sales amount represented amounts paid for furnaces or fireplaces that were not yet installed and for which the second half of the payment had not yet been received. The cost associated with the sales was $407,400 for the furnaces and fireplaces that had been installed that year. An additional cost of $198,000 was incurred for the labour associated with the installation. The accountant estimated that total future warranty costs associated with the installed items would likely be $46,800 over the next five years. "Prepare as much of the statement of income for The Warm as Toast Company for 2016 as you can, showing the proper amount of sales, cost of goods sold, gross profit, and any other amounts that can be included." Given table:  List of accounts:

List of accounts:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started